DNVN - Today, the USD recorded its strongest increase in the past 10 weeks.

USD exchange rate on international market

The Dollar Index (DXY), which measures the strength of the USD against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), stopped at 103.21 points, up 0.68 points compared to the trading session on October 14, 2024.

The U.S. dollar hit a 10-week high on Thursday amid muted trading, with a multi-week rally sustained by economic data showing a slowdown in the economy, in line with expectations for a modest interest rate cut by the Federal Reserve.

Trading volumes were low, with major markets in Japan and Canada closed on Monday, while the U.S. bond market paused for Indigenous Peoples Day. The greenback rose against the Chinese yuan after China's economic stimulus package announced over the weekend failed to please investors.

The dollar index continued to rise to 103.36, its highest level since August 8. It was recently up 0.2% at 103.23, while the euro fell to a 10-week low below $1.09 and was recently down 0.3% at $1.0902.

The European Central Bank (ECB) is expected to cut interest rates this week, but the Fed's decision remains in focus. According to LSEG estimates, the US interest rate futures market has predicted an 87% chance that the Fed will ease interest rates by 25 basis points at its November meeting, and only a 13% chance that the Fed will keep interest rates unchanged at its target range of 4.75%-5%.

Meanwhile, the Fed cut rates by a sharp 50 basis points at its September policy meeting.

The market expects the Fed to cut another 45 basis points by the end of the year, and another 98.5 basis points in 2025. This is much lower than expected before the Fed's September meeting, when breakthrough non-farm data changed expectations for future rate cuts.

Expectations of slow and small rate cuts from the Fed have helped the dollar maintain its upward momentum in recent weeks, but analysts say the rally may be coming to an end.

Elsewhere, the euro continued to decline and closed down 0.3% to $1.0902 as investors were almost certain that the ECB would cut policy by 25 basis points at its policy meeting this week, amid data pointing to a slowdown in eurozone activity.

The pound fell 0.1% against the dollar, currently at $1.3054.

Against the Japanese yen, the US dollar rose to its highest level since early August, reaching 149.96 yen.

Domestic USD exchange rate

On October 15, 2024, the US dollar continued to rise strongly, reaching a 10-week high, while the euro and the Chinese yuan depreciated.

At the opening of the trading session, the State Bank announced the central exchange rate between the Vietnamese Dong and the USD decreased by 14 VND, currently at 24,161 VND/USD.

Currently, the exchange rate of commercial banks fluctuates between 23,400 - 25,450 VND/USD. The State Bank of Vietnam has also adjusted the USD buying and selling rate to between 23,400 and 25,450 VND/USD.

The USD exchange rate at Vietcombank is currently buying and selling at 24,630 - 25,020 VND. The USD buying and selling price in the banking market is in the range of 24,000 - 25,500 VND/USD.

The euro exchange rate at the State Bank of Vietnam's Transaction Office slightly decreased, currently at 25,070 VND for buying and 27,709 VND for selling.

The Japanese yen exchange rate at the State Bank of Vietnam also decreased slightly, currently listed at 154 VND for buying and 170 VND for selling.

Thanh Mai (t/h)

Source: https://doanhnghiepvn.vn/kinh-te/gia-ngoai-te-ngay-15-10-2024-usd-tang-vot-dat-moc-103-21-diem/20241015084839528

![[Photo] Prime Minister Pham Minh Chinh receives the head of the Republic of Tatarstan, Russian Federation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/7877cb55fc794acdb7925c4cf893c5a1)

![[Photo] Overview of the Workshop "Removing policy shortcomings to promote the role of the private economy in the Vietnamese economy"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/d1c58c1df227467b8b33d9230d4a7342)

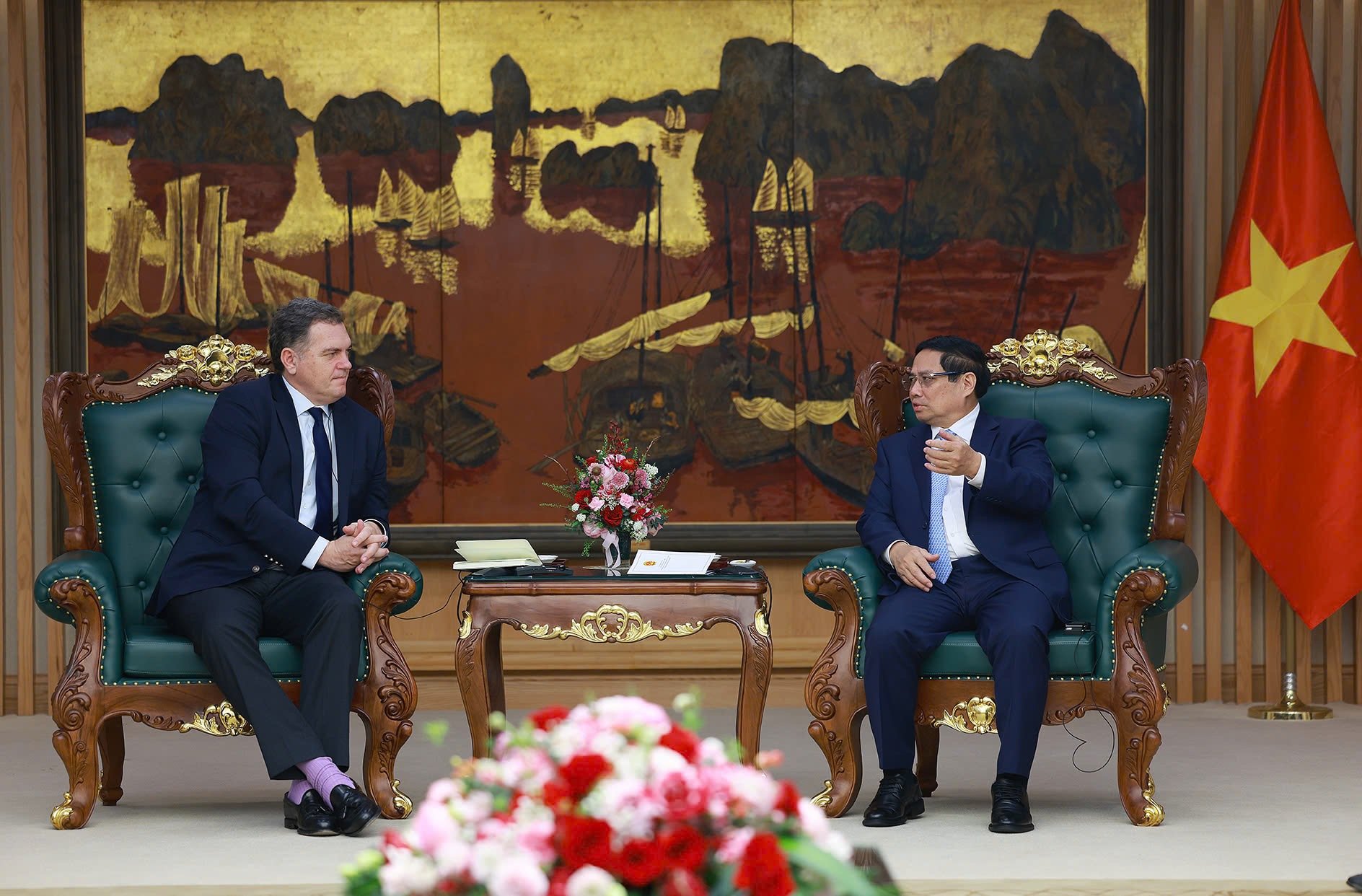

![[Photo] Prime Minister Pham Minh Chinh receives French Minister in charge of Transport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/aa649691f85546d59c3624b1821ab6e2)

![[Photo] Meet the pilots of the Victory Squadron](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/fd30103acbd744b89568ca707378d532)

Comment (0)