Overview of silver price today 12/16/2024

Today's silver price at Phu Quy Jewelry Group has dropped sharply, currently fluctuating at 1,123,000 VND/tael for buying and 1,158,000 VND/tael for selling in Hanoi. At the same time, at other transaction points in Hanoi, the silver price was recorded at 938,000 VND/tael (buying) and 972,000 VND/tael (selling). In Ho Chi Minh City, the silver price also fluctuated from 940,000 VND/tael (buying) to 974,000 VND/tael (selling). Regarding the world silver price, the buying and selling prices are still maintained at 777,000 VND/ounce and 782,000 VND/ounce.

Update on silver prices on December 16 in two major markets Hanoi and Ho Chi Minh City

| Silver type | Unit | Hanoi | Ho Chi Minh City | ||

| Buy | Sell | Buy | Sell | ||

| Silver 99.9 | 1 amount | 938,000 | 972,000 | 940,000 | 974,000 |

| 1 kg | 25,017,000 | 25,915,000 | 25,070,000 | 25,967,000 | |

| Silver 99.99 | 1 amount | 946,000 | 980,000 | 947,000 | 982,000 |

| 1 kg | 25,224,000 | 26,128,000 | 25,266,000 | 26,179,000 | |

Update silver price list 16/12 of Phu Quy Gold Investment Joint Stock Company

| Silver type | Unit/VND | Hanoi | |

| Buy | Sell | ||

| Silver bars, Phu Quy 999 silver bars | 1 amount | 1,123,000 | 1,158,000 |

| Phu Quy 999 Silver Bar | 1 kg | 29,946,592 | 30,879,923 |

Update world silver price list on December 16, 2024

| Unit | World silver price today (VND) | |

| Buy | Sell | |

| 1 Ounce | 777,000 | 782,000 |

| 1 only | 93,662 | 94,275 |

| 1 amount | 937,000 | 943,000 |

| 1 kg | 24,977,000 | 25,140,000 |

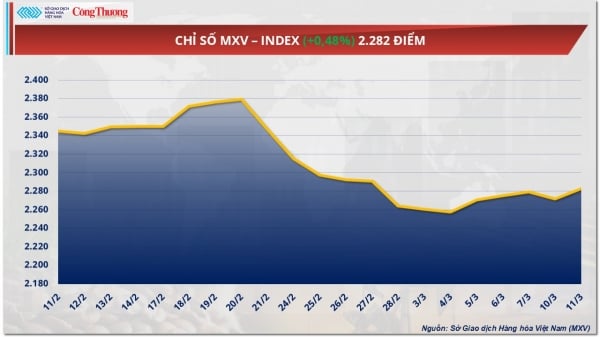

The two main factors believed to be responsible for this situation are the rise of the US dollar and not-so-positive economic indicators from China.

Data from CME FedWatch shows that the probability that the US Federal Reserve (FED) will cut interest rates at its meeting on December 18, 2024 is still quite high, up to 96%. However, the possibility of keeping interest rates unchanged until January 2025 or the end of the first quarter of 2025 has increased sharply, reaching 78.3%. This shows that the FED tends to be cautious in loosening monetary policy.

In addition, the yield on the 10-year US Treasury note continued to rise, reaching its highest level in more than two weeks. Higher bond yields often lead to a stronger US dollar, reducing the attractiveness of other assets such as silver to investors.

China, one of the world's largest silver consumers, is facing a number of challenges. Recent economic data shows that the country's economy is showing signs of slowing growth, raising concerns about future demand for silver, especially in the electronics and solar energy industries.

With these factors, silver prices are expected to continue to face many challenges in the short term. However, analysts also emphasize that the silver market is very sensitive to macroeconomic fluctuations. Any changes in the Fed's monetary policy, geopolitical situation or unexpected economic data can change the current trend.

Source: https://baodaknong.vn/gia-bac-hom-nay-16-12-2024-gia-bac-giam-nhe-do-chiu-tac-dong-tu-dong-usd-237000.html

Comment (0)