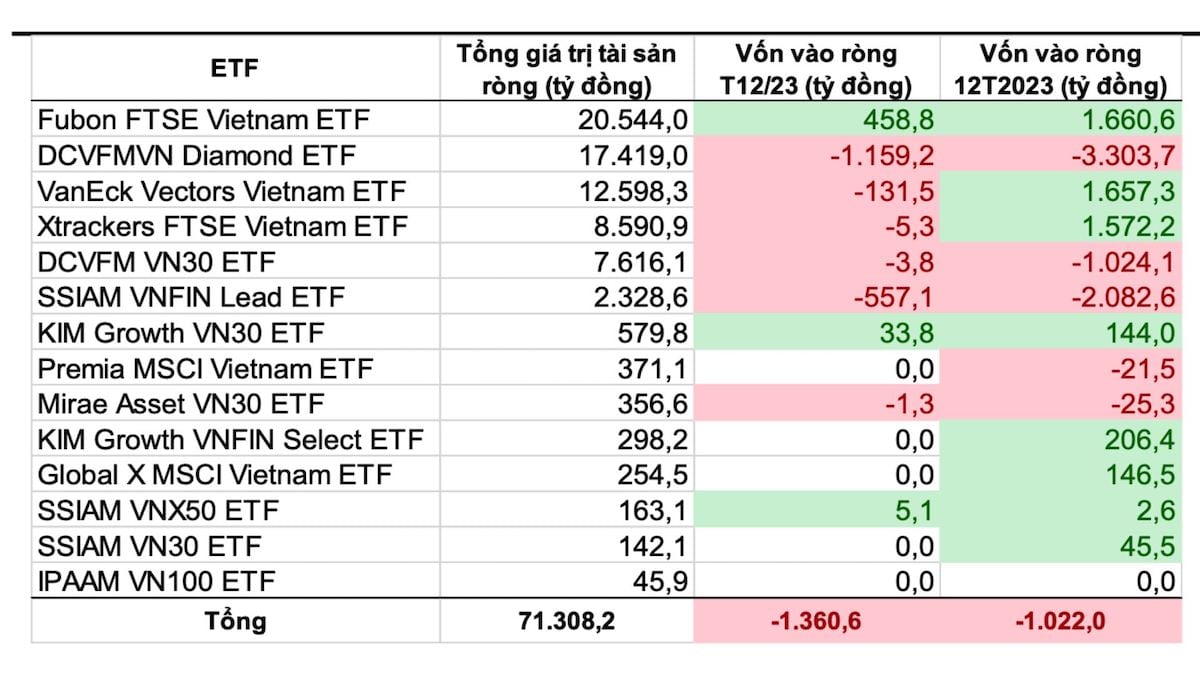

Despite starting with strong net capital inflows in the first months of the year, by the end of 2023, major ETFs in Vietnam recorded a total net capital withdrawal of VND 1,022 billion. According to Mr. Nguyen Ba Khuong - analyst at VNDIRECT Securities Company, in December 2023 alone, the capital withdrawal was nearly VND 1,361 billion. Most of which came from the net withdrawal of the DCVFMVN Diamond ETF (net withdrawal of VND 1,159.2 billion), SSIAM's VNFIN Lead ETF (net withdrawal of VND 557 billion) and the VanEck Vectors Vietnam ETF (net withdrawal of VND 131.5 billion).

On the other hand, Fubon FTSE Vietnam fund and KIM Growth VN30 fund recorded net inflows of VND458.7 billion and VND33.8 billion, respectively.

Going into details, in the past year, Fubon FTSE Vietnam ETF has emerged thanks to its net buying momentum despite foreign investors in general still tirelessly selling net in the Vietnamese stock market. As of the session on January 8, this fund has issued a net of 2 million fund certificates, equivalent to about 0.7 million USD. The issuance volume of Fubon ETF is equivalent to about 18 billion VND and all of it has been disbursed to buy Vietnamese stocks.

In another development, foreign investors increased their net selling activities in December 2023 with a net selling value of more than VND 10,096 billion. This is also the month that recorded the highest net selling value in 2023 by foreign investors, nearly 3 times higher than the net selling value in the previous month. The codes that were sold the most in the last month of the year included VHM, HPG, FUEVFVND, VNM, STB, VCB, VPB. On the other hand, the codes that were bought the most were MWG, VHC, BID, NVL, NKG, CMG.

"Thai investors played a major role in foreign net selling in December 2023. Thailand has issued a new tax law, which will increase tax rates on foreign income from January 1, 2024. Therefore, Thai investors have sold and withdrawn money before 2024 to avoid being subject to this new tax rate," Mr. Khuong explained.

In addition, according to analysts, the reason for the net withdrawal also comes from the interest rate difference between the domestic currency and the USD. As for the DCVFM VNDiamond ETF fund (net withdrawal of nearly VND 3,700 billion), the reason also comes from some stocks that have run out of room for disbursement, listed enterprises are operating inefficiently, and bank stocks are losing their attractiveness...

According to experts from SSI Research, in the medium term, investment flows into the Vietnamese stock market may benefit from the shift of money to developing markets. However, this will usually only appear after the FED starts cutting interest rates. In the short term, the attractiveness of Vietnamese stocks from Thai and Korean investors may be affected by new regulations/plans of the Government of these countries to help boost the domestic stock market.

Source

Comment (0)