In 2025, the National Assembly assigned the Customs sector a revenue estimate of VND 411,000 billion, an increase of 9.6% compared to the 2024 estimate. With the policy of seriously and effectively implementing the directions of the Government and the Ministry of Finance, in 2025, the entire Customs sector is determined to promote the achieved results, be proactive, creative, and strive to collect 10% more than the actual revenue in 2024.

Accordingly, to complete the task, the Customs Department requires units to actively perform key tasks and assign budget collection targets to 20 regional customs branches and Post-clearance Inspection Branches.

The Customs Department assigned specific targets as follows: Customs Sub-Department (CCHQ) of Region I collected 40,720 billion VND; CCHQ of Region II collected 144,000 billion VND; CCHQ of Region III collected 75,600 billion VND (by the end of February, CCHQ of Region III (formerly Hai Phong Customs Department) collected 13,177.1 billion VND, reaching more than 17.4% of the assigned plan); CCHQ of Region IV collected 12,820 billion VND; CCHQ of Region V collected 14,940 billion VND; CCHQ of Region VI collected 9,650 billion VND; CCHQ of Region VII collected 1,622 billion VND; CCHQ of Region VIII collected 20,300 billion VND; CCHQ of Region IX collected 4,380 billion VND; CCHQ of Region X collected 26,000 billion VND;

The revenue of the Customs Department of Region XI was assigned to reach 10,850 billion VND; the revenue of the Customs Department of Region XII was 22,000 billion VND; the revenue of the Customs Department of Region XIII was 3,953 billion VND; the revenue of the Customs Department of Region XIV was 980 billion VND; the revenue of the Customs Department of Region XV was 24,650 billion VND; the revenue of the Customs Department of Region XVI was 24,525 billion VND; the revenue of the Customs Department of Region XVII was 5,500 billion VND; the revenue of the Customs Department of Region XVIII was 22,300 billion VND; the revenue of the Customs Department of Region XIX was 3,455 billion VND; the revenue of the Customs Department of Region XX was 1,255 billion VND; the Post-clearance Inspection Department was 500 billion VND.

The Customs Department requires regional customs units to synchronously deploy common tasks according to their functions and tasks. At the same time, research, propose and deploy solutions to increase revenue and prevent budget loss in accordance with the characteristics and situation of the unit; proactively assess the impact of international integration commitments on revenue collection at their units.

In addition, for units with large revenues from crude oil and gasoline, it is necessary to proactively follow the developments in world oil prices to promptly assess the level of impact; firmly grasp the source of revenue, closely follow the implementation of projects, import-export activities of enterprises operating in the area to promptly report and propose specific solutions. In particular, units need to organize the collection of value-added tax on all small-value imported goods sent via postal services, express delivery and imported goods transacted via e-commerce.

The Customs Department also requires units to strictly implement measures to urge debt collection and settlement, ensuring that the debt amount by December 31, 2025 must be lower than December 31, 2024. In particular, after reorganizing the apparatus, units need to review and finalize data to hand over data and documents related to tax accounting, tax collection and management, and must be responsible for the accuracy of the data. At the same time, focus on reviewing problems (if any), proposing solutions and reporting to functional units for timely handling to avoid interruptions when implementing the new apparatus.

Notably, the Customs Department recommends that regional customs units focus on controlling pricing; classifying and applying tax rates; exempting, reducing, refunding, and not collecting taxes; supervising processed goods, export production, export processing, bonded warehouses, non-extended warehouses, transit goods, temporarily imported and re-exported business goods, goods transported under customs supervision, goods sent via express delivery services, means of transport, etc.

Units also need to strengthen the fight against revenue loss through monitoring, checking customs procedures, post-clearance inspection, specialized inspection, fighting against smuggling and trade fraud. Focus on checking the types, subjects, and conditions for enjoying preferential tax policies; fight against fraud in quantity, type, code, value, origin... resolutely not letting revenue loss occur in the area.

Source: https://baophapluat.vn/cuc-hai-quan-giao-chi-tieu-phan-dau-thu-cho-20-chi-cuc-khu-vuc-post543471.html

![[Photo] Nearly 2,000 people enthusiastically participated in the Olympic Running Day - For the security of the Fatherland](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/33bed26f570a477daf286b68b14474d4)

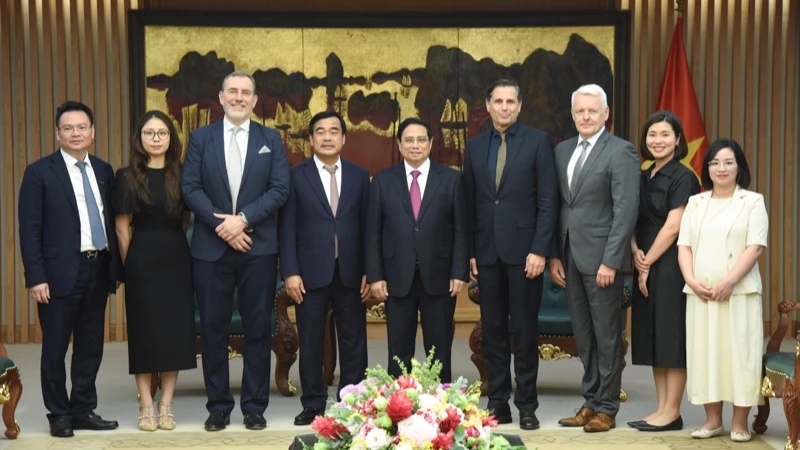

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Skoda Auto Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/298bbec539e346d99329a8c63edd31e5)

Comment (0)