With revenue in January 2024 doubling compared to the same period last year, shares of seafood company Vinh Hoan - VHC increased sharply, returning to the high price range of 16 months ago.

Right from the morning session of the first week of February 26, the group of seafood stocks suddenly skyrocketed, attracting strong cash flow, despite the previous red market situation. Notably, VHC expanded its increase by nearly 7%, reaching VND 69,100/share, with 2.8 million units matched, the highest level since the beginning of July 2023.

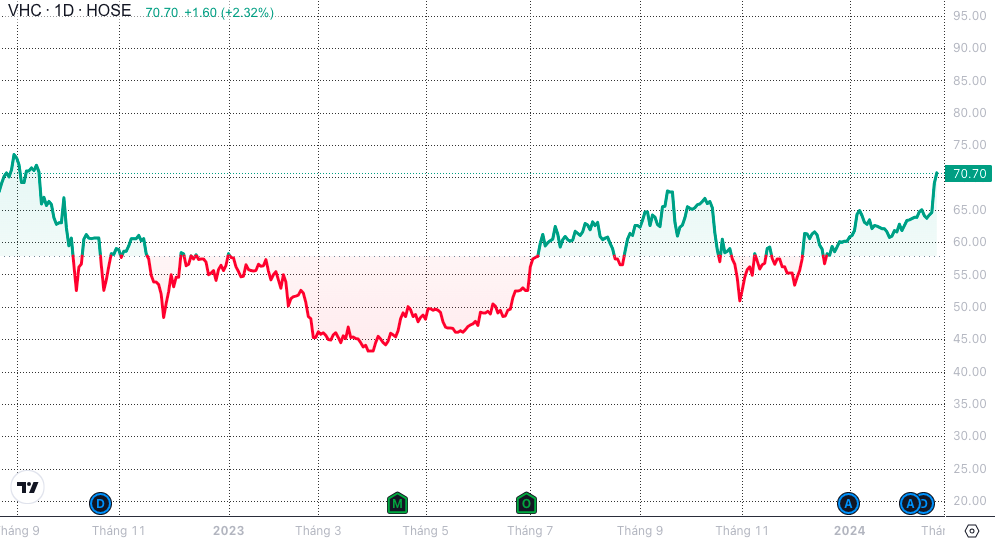

At the end of today's session (February 27), VHC shares of "queen" of pangasius Truong Thi Le Khanh continued to increase to 70,700 VND/share, reaching 70,000 VND/share after 16 months. This is the 4th consecutive session of increase for this enterprise.

It is known that VHC shares were officially listed on the stock market in 2007. After 13 years of listing, VHC reached a record high market price of over VND 90,000/share in early June 2022.

VHC is on the trend of returning to the high price zone of 70,000 VND/share after 16 months (Source: SSI iBoard)

This development was recorded in the context of the seafood industry's export situation in the first months of the year that has been, is, and is forecast to continue to grow.

According to the Ministry of Industry and Trade, Vietnam's seafood exports have shown signs of recovery since the end of 2023 and are likely to increase again in 2024, especially in the second half of 2024. In particular, exports of two key seafood products, shrimp and tra and basa fish, will recover after a sharp decline in 2023.

At VHC, according to the business situation announcement in January 2024, revenue reached 921 billion VND, a sharp increase of 102% compared to the same period last year. Revenue in all markets was high, in which China and domestic markets increased sharply by 259% and 137%. The domestic market - Vietnam is still the market that helps VHC achieve the highest revenue with 325 billion VND.

In terms of products, the pangasius segment contributed nearly half of the total revenue with VND448 billion, up 64% over the same period. The by-products, other products, and shrimp crackers segments also grew strongly, up 226%, 142%, and 78%, respectively.

The business side said that this year the export market will have positive developments. In particular, VHC benefits from the new EU regulation that pollock and cod originating from Russia are subject to a 13.7% tax. This type of seafood that directly competes with Vietnamese pangasius, including products processed in China but originating from Russia, no longer enjoys a 0% tax incentive, which contributes to expanding the room for Vietnamese pangasius exporting businesses to the EU - the world's largest seafood import market.

Furthermore, since the end of December 2023, the US has expanded the ban on importing Russian seafood products, not allowing Russian seafood to enter the US through a third country, opening up opportunities to boost pangasius exports to Vietnam.

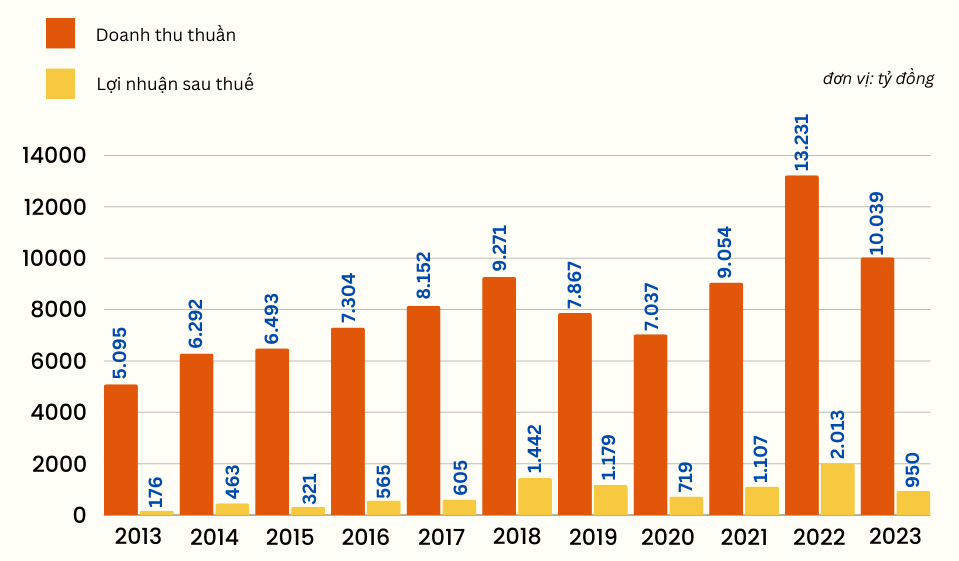

In 2023, VHC achieved VND10,039 billion in net revenue, down 24.1% year-on-year. Profit dropped sharply by nearly 53% to about VND950 billion.

With this result, VHC did not complete the plan for both revenue and profit after tax, specifically, revenue reached 88% and profit reached 95% compared to the plan (VND 11,500 billion in revenue and VND 1,000 billion in profit after tax).

Revenue and profit development at VHC over the past 10 years

Source: Financial Statements

Observing the business situation over the past 10 years at Vinh Hoan, it can be seen that in 2023, revenue and profit have decreased significantly compared to 2022 in the context of the general difficulties of the global economy. However, compared to other years, business results in 2023 are still relatively positive.

By the end of 2023, VHC recorded a slight increase in total assets of nearly VND 300 billion, up to VND 11,806 billion, including: 72.6% equity and 27.4% liabilities.

Inventory portfolio increased to more than VND 3,600 billion, an increase of 28.4% compared to the end of 2022.

Source

Comment (0)