MWG shares stir as identity of buyer of 5% of Bach Hoa Xanh's capital revealed

MWG shares reversed from a decrease in price to more than 5.6%, at one point reaching nearly 53,000 VND when the board of directors announced that it had sold 5% of Bach Hoa Xanh's capital and the buyer was CDH Investments.

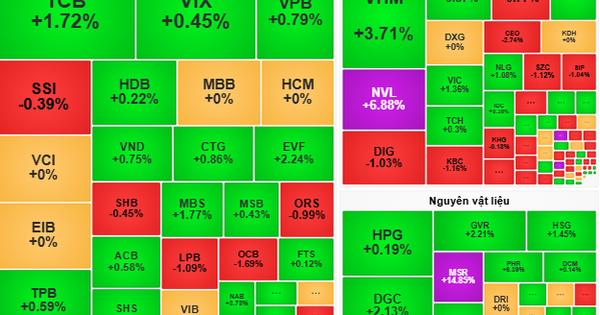

Shares of Mobile World Investment Corporation (stock code: MWG) have gone from being cautious to being excited after the company announced the completion of the Bach Hoa Xanh capital sale. Specifically, this morning, MWG decreased by 0.5% compared to the reference and continued to decrease for two consecutive sessions. However, not long after, this stock reversed to green and gradually widened the increase range to 5.6% compared to the reference to 52,800 VND. This is the highest price range of this stock since the end of September 2023 until now.

This morning, Mobile World announced that its member unit, Bach Hoa Xanh Investment and Technology Joint Stock Company, has completed the transaction of selling individual shares to investors. According to Mobile World's leaders, with Bach Hoa Xanh's positive cash flow and continuously improving business results, especially the goal of starting to have after-tax profits at the company level from 2024, Bach Hoa Xanh does not need to offer up to 20% of its shares as originally planned, but only sells 5%.

Thomas Lanyi, head of CDH Investments Southeast Asia, said the deal marks CDH Investments’ latest commitment to Vietnam and its second transaction with Mobile World. According to Thomas, Vietnam is one of CDH’s priority markets in Southeast Asia and the organization is optimistic about the future of the retail sector there.

“Consumer demand is evolving towards modern retail chains instead of traditional markets and Bach Hoa Xanh is ideally positioned to capture this potential. We thank the Mobile World and Bach Hoa Xanh teams for their trust and are excited to partner for the next phase of profitable growth,” Mr. Thomas Lanyi wrote in the announcement of the partnership.

According to Mobile World, during the transaction process, many potential investors (including reputable financial investors and strategic investors) sought information, met with the company, participated in competitive bidding, conducted a business review and negotiated to purchase shares.

Bach Hoa Xanh selected the partner to receive the transfer of shares based on four criteria. First, this investor is reputable and willing to make a minority equity investment. Second, this investor is willing to offer to buy new common shares (primary shares) through a direct equity transaction with a simple transaction structure.

The transferee must also be willing to offer a valuation that reflects the positive changes in the business results of Bach Hoa Xanh and the long-term potential of Bach Hoa Xanh Investment and Technology Joint Stock Company. The final criterion is that this organization must be willing to support and assist the Board of Directors in realizing long-term development plans, not directly participate in operational activities, and not manage or control Bach Hoa Xanh Investment and Technology Joint Stock Company and its subsidiaries in any form.

Mobile World aims to record revenue of VND125,000 billion this year, up 6% year-on-year, and after-tax profit of VND2,400 billion. Of which, the Bach Hoa Xanh chain is expected to contribute 30% of revenue, achieving double-digit growth, while increasing market share and starting to generate profits.

Source

Comment (0)