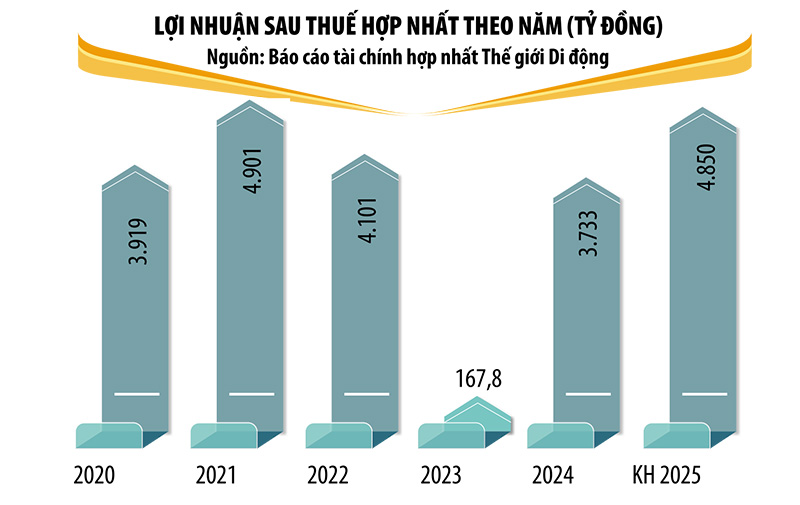

With a target of VND150,000 billion in net revenue and VND4,850 billion in after-tax profit, Mobile World Investment Corporation also set out a significant growth plan for its core chain stores.

Accelerate to regain form

Compared to 2023, the business results of Mobile World Investment Corporation (code MWG) in 2024 had a strong breakthrough. Net revenue from sales and service provision reached VND 134,341 billion, an increase of 13% compared to 2023. Gross profit margin improved, bringing gross profit to VND 27,499 billion, equivalent to 22% growth.

Of which, revenue from mobile phones, computers and electronic devices reached VND91,100 billion, revenue from food and fast-moving consumer goods reached VND41,088 billion, accounting for 67% and 30% of total revenue, respectively. However, the food and fast-moving consumer goods segment had a much higher gross profit margin at 24%, while the electronics segment only reached 18%. As a result, the whole year's after-tax profit reached VND3,733 billion, 22 times higher than the previous year.

Profit in 2024 achieved high growth, but in fact, the reason came from the sharp decline in Mobile World's profit in 2023. Compared to the period 2021 - 2022 (profit was over 4,000 billion VND), the Company has not yet regained its form.

In 2024, Mobile World set a not-so-ambitious target, with a revenue plan of VND125,000 billion and a profit after tax of VND2,400 billion. In just 9 months, the Company exceeded its plan. The profit after tax for the whole year exceeded 55%.

After a year of recovery, Mobile World has set a big target again, with net revenue of VND150,000 billion and after-tax profit of VND4,850 billion, corresponding to a 30% growth in profit. This plan is close to reaching the record profit figure of 2021.

In terms of revenue structure by chain, Dien May Xanh and Bach Hoa Xanh chains are contributing the largest revenue, with 44.3% and 30.6% respectively in 2024. In terms of business products, phones, accessories and other mobile devices bring in 35.1% of revenue, while fresh food and FMCG contribute 30.6%.

Series of plans for chain stores

The Gioi Di Dong has revealed a series of plans for its chain stores. Specifically, with the chain Thegioididong.com (including Topzone) and Dien May Xanh, the Company aims to increase revenue by over VND4,000 billion, despite the unfavorable general market. The Company will not expand offline stores, consider replacement, as well as optimize and focus on revenue growth of old stores.

On the online channel, Mobile World will build a technology and electronics shopping destination with a diverse portfolio, focusing on services. As for the orientation with the Topzone chain, the Company determines that this is a strategic bridge between the Company and Apple to realize the goal of 1 billion USD in revenue from Apple retail at the chains by 2027.

Mobile World has set a rather large target for the Bach Hoa Xanh chain with the vision of becoming the leading food and consumer goods retail chain in Vietnam, with a revenue of 10 billion USD before 2030. In 2025 alone, the goal for this chain is to increase revenue by at least 7,000 billion VND, open 200-400 new stores, of which online revenue will grow by at least 300% compared to 2024. This chain of stores will start making a profit in 2024, but the accumulated loss is currently over 8,651 billion VND.

Other store chains are also expected to grow well by Mobile World, such as the Avakids chain with a revenue target of over 10%, the Erablue chain with a revenue target of over 50%, and the An Khang Pharmacy chain with an expected break-even in the second quarter of 2025. These figures show Mobile World's ambition to increase market share, but the feasibility is still a concern and has received different forecasts from analysts.

SSI Securities Company is quite cautious when considering the target numbers of Mobile World. Regarding the revenue target of 10 billion USD set for the Bach Hoa Xanh chain, SSI assessed that this is quite an ambitious number in the context of the mini-supermarket model and the current modest speed of opening new stores.

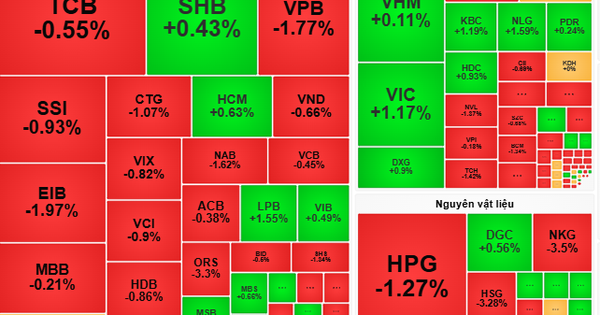

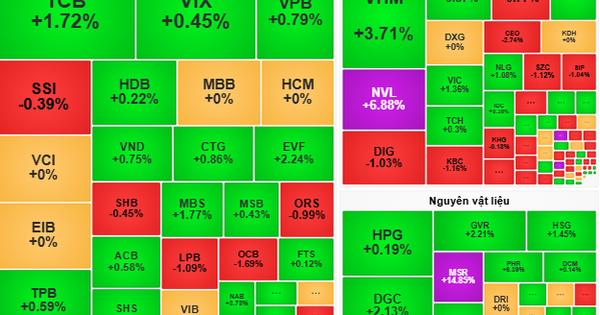

Mobile World's 2025 revenue and profit plan shows that the profit of the technology and electronics product segment will remain the same as last year amid a slow recovery in consumption. SSI believes that despite the slow recovery in consumption, Mobile World has a suitable business model and a phone replacement cycle that is expected to boost profit growth significantly in 2025. However, it may be necessary to adjust the profit estimate for 2025 down due to weaker-than-expected consumption growth.

Meanwhile, Shinhan Securities forecasts Mobile World's revenue and profit to be higher than the company's plan. Specifically, this securities company forecasts Mobile World to reach VND150,628 billion in revenue and VND5,010 billion in after-tax profit. This is a record profit for Mobile World and 3% higher than the plan.

Impact of tightening consumer spending trend

According to PwC’s 2024 consumer survey, Vietnamese consumers are still affected by rising prices for food, energy, housing and other essential items, which significantly impacts their spending. 64% of respondents said they still spend the majority of their spending on food and 48% on healthcare. In contrast, 33% of respondents said they would cut back on spending on luxury items and about 30% would reduce purchases of non-essential items.

Source: https://baodautu.vn/the-gioi-di-dong-tim-loi-di-giai-bai-toan-tang-truong-d250391.html

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)