Water bill bears tax on fee

At the workshop on providing comments on the Law on Value Added Tax (VAT, amended) on the afternoon of April 16, organized by the Ho Chi Minh City National Assembly Delegation, lawyer Truong Thi Hoa (Ho Chi Minh City Bar Association) proposed amending the regulation in Article 9 "clean water for production and daily life does not include bottled and jarred drinking water and soft drinks subject to a tax rate of 5%. According to Ms. Hoa, clean water for daily life should be subject to a tax rate of 0% because it is an essential need of the people, belonging to the field of social security that needs to be prioritized and especially ensured in accordance with the 2013 Constitution "Citizens have the right to social security".

Many opinions say that clean water for daily use should be removed from the taxable list to meet the essential needs of the people.

Sharing the same view, Lieutenant Colonel Nguyen Minh Tam (Ho Chi Minh City Police) said that it is necessary to remove clean water from the taxable list to meet the essential needs of the people, especially people in rural, remote and mountainous areas who are still facing difficulties in accessing clean water for daily use.

This is not the first time that the story of eliminating the tax on clean water has been proposed by delegates. In October 2023, voters in Lang Son and Hai Duong provinces also reflected that the current situation of people in rural areas having to pay additional VAT on electricity for lighting and domestic water is unreasonable. At the same time, they requested that competent authorities consider and research policies to exempt these taxes for people living in rural areas. However, the Ministry of Finance rejected this proposal by citing the VAT Law under the authority of the National Assembly, collected according to goods and services, regardless of the purpose, subjects using goods and services and the area of consumption of goods and services. In particular, the VAT Law does not have regulations on tax exemption or reduction.

Disagreeing with the explanation of the Ministry of Finance, Dr. Huynh Thanh Dien (Nguyen Tat Thanh University) said that of course tax collection is within the regulations, but voters, representing the voice of the people, proposed to amend the regulations, so the authorities must be responsible for reviewing the regulations to see if they are appropriate or not, and if there are any shortcomings, in order to study and amend them.

Mr. Dien analyzed that water, electricity, and gasoline are essential goods, of which electricity and water are "the most essential of all essentials" in people's daily lives. If they have to bear too many costs, people will be "overwhelmed", especially in the current difficult economic context. In fact, the water bills of households are increasing because clean water is being added with many types of fees, and each fee tends to increase every year.

Dr. Huynh Thanh Dien (Nguyen Tat Thanh University)

For example, according to current regulations, every year, the water supply unit will proactively review the implementation of the clean water price plan and the expected clean water price for the following year. In case the factors of clean water production and business costs fluctuate, causing the clean water price to increase or decrease in the following year, the water supply unit will prepare a clean water price plan dossier and send it to the Department of Finance for appraisal and submission to the Provincial People's Committee for consideration and decision on adjustment.

Since January 1 this year, Saigon Water Corporation (SAWACO) has been collecting fees for drainage and wastewater treatment services for Ho Chi Minh City at a fee of 25% of the clean water price in 2024. This price in 2023 is 20%. This service price was previously called the environmental protection fee. According to the roadmap approved by the Ho Chi Minh City People's Committee, the price for drainage and wastewater treatment services in Ho Chi Minh City in 2022 is 15% of the clean water price, increasing to 20% in 2023, 25% in 2024 and 30% in 2025.

To make it easier to visualize, currently, if a household uses 100,000 VND of clean water each month, it has to pay 5% VAT, equivalent to 5,000 VND; 25% of drainage and wastewater treatment service fee, equivalent to 25,000 VND; Along with that, people will have to pay VAT according to the new regulations in Resolution 110/2023/QH15, which means that this service fee will include VAT at a rate of 8% in the first 6 months of 2024 and increase to 10% in the last 6 months of the year. Notably, clean water for production and daily life is not subject to a 2% VAT reduction according to Decree 44/2023 of the Government (the tax reduction only applies to items subject to a tax rate of 10%).

"An essential item that serves people's daily life carries too many taxes and fees, and is not a priority in stimulus programs, which is completely unreasonable," Dr. Huynh Thanh Dien assessed.

Just target essential goods for taxation?

According to economist Bui Trinh, electricity and water are in the field of ensuring social security for people, so they should not be taxed. Moreover, water not only serves the daily needs of consumers but is also an essential commodity for all production and business sectors. Therefore, reducing taxes not only helps ensure social security for people but also creates opportunities for goods and products consumed on the market to reduce prices accordingly. In a difficult economic context like this, the price of any product that can be reduced is as good as possible.

SAWACO delivers water tanker to residents at Ehome S apartment building (Thu Duc City, Ho Chi Minh City) in early April 2024

From the story of VAT on clean water, Mr. Bui Trinh cited many essential goods that are currently subject to many unreasonable taxes and fees. A typical example is gasoline. This is an essential commodity for the whole society, from businesses to people, everyone must use it. In essence, imposing special consumption tax (SCT) on essential goods is incorrect. Besides, the pricing of gasoline in Vietnam is too confusing. The two ministries of Industry and Trade and Finance discuss back and forth but do not go anywhere, causing people to pay a high price for fuel used every day. Not to mention the two oil refineries Dung Quat and Nghi Son have been announced to meet 70 - 75% of the country's gasoline demand, so why are they still calculated based on import prices plus taxes? Or the gasoline distribution system is also having many problems from the import hub to the retail stores, causing the market to be chaotic at times, lacking supply...

"Why can't we remove the special consumption tax on gasoline? The explanation of the Ministry of Finance in the past has not been convincing. People need to be explained more clearly why the country has met 70-75% of demand but still has to buy gasoline at a higher price than the world? The price of the product to consumers is largely made up of taxes. If we remove the special consumption tax on gasoline, the VAT on electricity and water, businesses will operate better, people will spend more, and in the future, revenue will increase, making up for the tax revenue," Mr. Bui Trinh raised the issue and said that the state should expand tax and fee support policies for many items, especially those managed by the state (such as electricity, water, gasoline) to encourage businesses to boost production and promote consumption.

Lawyer Truong Thanh Duc, Director of ANVI Law Firm, also emphasized the view that it is impossible to limit the use of products that are considered mandatory in people's lives and the circulation of goods of enterprises. According to him, the basis for imposing special consumption tax on gasoline to limit environmental pollution is not correct and not fundamentally standard. Because currently Vietnam does not have an alternative solution for this fuel source because renewable energy has not developed strongly.

"I don't understand why people say that gasoline is not an essential commodity and then calculate special consumption tax. Because this tax is only levied on luxury goods or goods that do not encourage consumption such as beer, wine... If we consider the tax collection target for the budget, this tax is not suitable at present, because two domestic oil refineries have provided more than 70% of the supply. Therefore, the management agency must consider amending the special consumption tax policy on gasoline as well as taxes and fees on other essential goods as soon as possible," said lawyer Truong Thanh Duc.

If increasing spending is too difficult, we must reduce revenue to help the economy recover.

While the tax problems have not been resolved, in the recent period, people have witnessed a surge in price increases for many goods. Electricity prices were officially increased by 4.5% in November 2023; followed by road service prices on most highways across the country increasing simultaneously during the New Year holiday; followed by the application of ceiling prices for airline tickets...

Data from the General Statistics Office shows that the consumer price index (CPI) in the first quarter of 2024 increased by 3.77% over the same period in 2023. In addition to the first reason due to the high domestic rice price, the price index of domestic water increased by 10.58% due to increased demand for water; at the same time, some provinces and centrally-run cities increased water prices according to the decision of the Provincial People's Committee. Along with that, the price index of domestic electricity increased by 9.38% due to increased demand for electricity and the adjustment of the average retail electricity price by Vietnam Electricity Group (EVN). The General Statistics Office also forecasts that EVN may continue to increase electricity prices when input materials such as gasoline, oil, and coal are all at high levels, contributing to the increase in CPI in the next period of the year.

Looking at the market overview, Dr. Huynh Thanh Dien assessed: Vietnam's economy has not yet escaped the difficult situation, it is only in the stage of preparing for recovery. This is the time when the state needs to implement many policies to regain growth momentum, typically expanding the fiscal and monetary policies, leaving money for people to increase spending, leaving money for businesses to have capital to do business, expand business activities. The "soul" of the fiscal expansion policy is to increase public spending, reduce revenue, reduce input costs to support businesses to reduce product prices, increase competitiveness. When businesses restore production and business activities, it means creating more jobs, people have more income to spend, thereby helping the market to be vibrant, restoring the economy. When the economy is stable, revenue can be increased to compensate for the budget deficit.

On the other hand, tax is a tool for the Government to regulate the market with the ultimate goal of collecting from the rich and redistributing to the poor through investment programs to develop transport infrastructure, which has a welfare meaning. If we impose heavy taxes on essential goods that cannot be used without electricity, water, gasoline, rice, etc., the goal of regulation will have almost no effect, but on the contrary, it will affect the goal of economic recovery and development.

"In each period, tax and fee policies need to be adjusted appropriately, not rigidly. When people's income decreases and businesses are facing difficulties, it is necessary to consider exempting or reducing taxes and fees to support people and support input costs for businesses. In the past two years, the Government has set a goal of expanding fiscal policy, accepting budget deficits to boost public investment and stimulate the economy, but data shows the opposite result. Every year, the total revenue is bumper, but expenditures have not reached 90% of the plan. Some localities have not even exceeded the 60% threshold. If spending is too difficult, then revenue must be reduced, leaving money for people to do business and produce. Expanding fiscal policy requires more practical actions that directly impact the interests of people and businesses," Dr. Huynh Thanh Dien suggested.

Regional water tax exemption?

In order to properly implement the principles of tax regulation tools to ensure full rights and obligations of the people, Dr. Phan Thi Viet Thu (Ho Chi Minh City Bar Association) said that the state should consider exempting VAT on clean water in each area. For example, in urban areas and large cities where people have abundant clean water, taxes should still be imposed to limit waste. On the contrary, in rural areas, remote areas with limited access to clean water, no tax should be imposed to ensure social security for all people. This ensures the principle of tax collection into the budget and re-spending on public activities.

The Law on Value Added Tax was passed on June 3, 2008 and took effect on January 1, 2009. After 15 years of implementation, some provisions in the law have revealed shortcomings and limitations. According to the Law and Ordinance Development Program for 2024, the draft Law on Value Added Tax (amended) will be submitted to the 15th National Assembly at the upcoming 7th session (May 2024).

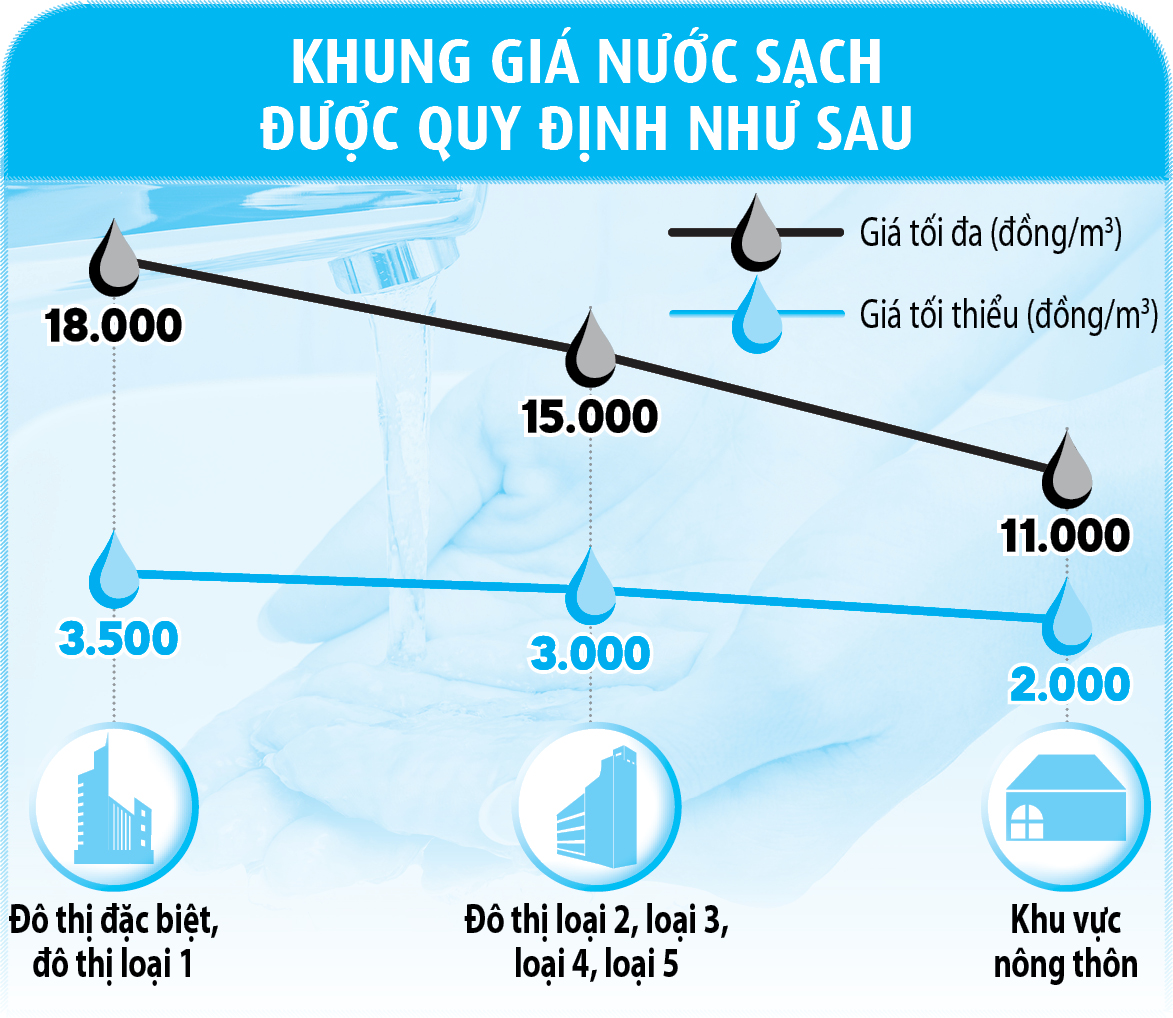

Clean water price frame is regulated

GRAPHICS: BAO NGUYEN

Source link

Comment (0)