Assessing the impact of the State Bank of Vietnam (SBV) suspending the implementation of some regulations that cause difficulties for businesses in Circular 06, Agriseco Securities found that this has a positive impact on the psychology of securities investors in the short term, in which the two industries directly affected are real estate and banking.

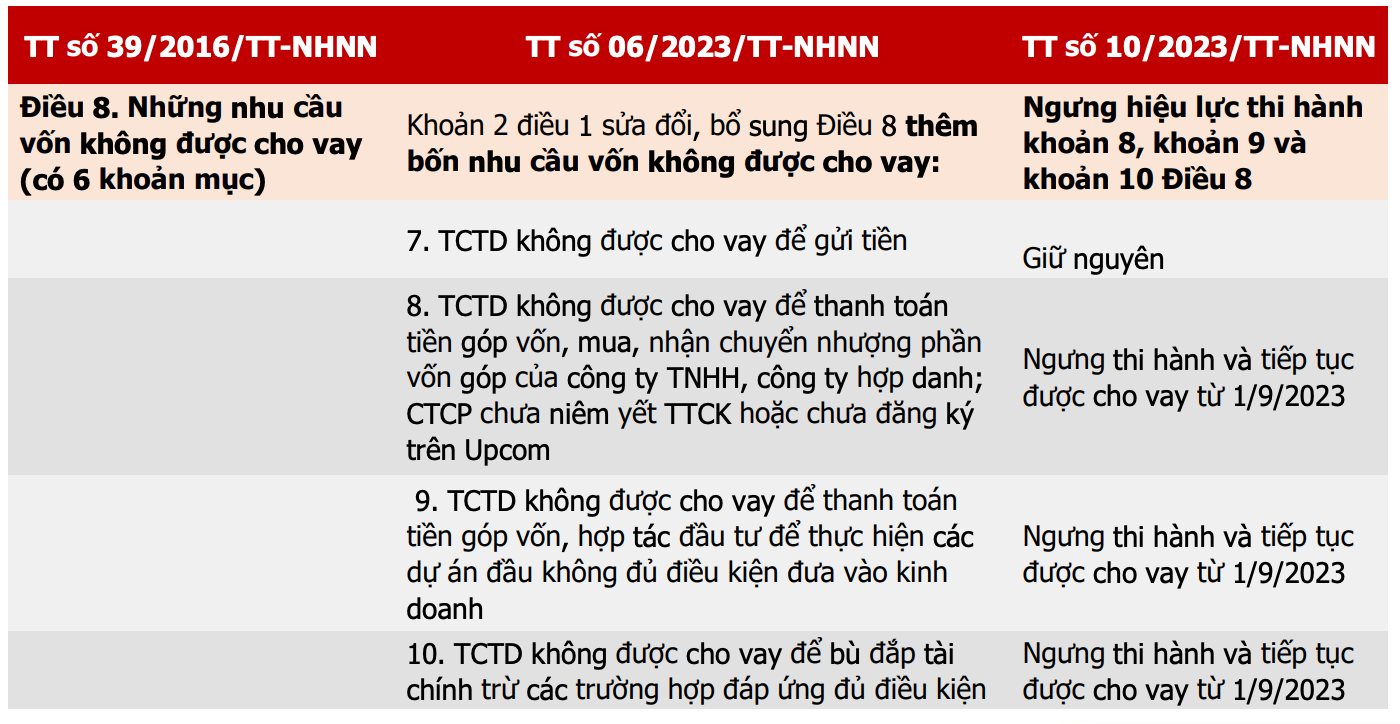

Previously, on August 23, the State Bank of Vietnam issued Circular No. 10/2023 to suspend the implementation of a number of provisions restricting lending as prescribed in Circular No. 06/2023.

The team of experts said that this has positive implications for households and businesses that need to borrow capital and cooperate to contribute capital to finance production and business activities, especially the real estate group. The temporary suspension of implementation will help real estate companies increase their ability to borrow to implement projects and restructure debt in the context of economic difficulties.

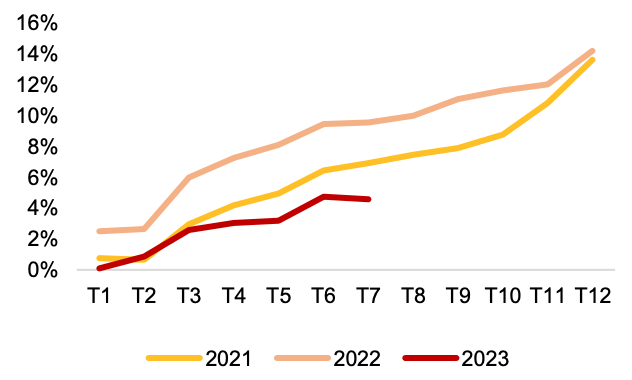

In fact, credit growth in the first seven months of the year increased only 4.56%, with negative growth in July, while the planned credit growth target was 14-15%. This could have a positive impact on credit growth in the coming time and support economic recovery.

Comparison table of circulars regulating credit institution lending activities (Source: SBV, Agriseco Research).

Previously, when Circular No. 06 was issued, it tightened lending conditions to focus cash flow on businesses and projects operating in accordance with regulations.

Therefore, the suspension of some restrictions on lending purposes will have a positive impact on the entire real estate industry, helping businesses increase their access to capital to develop land funds, implement real estate projects and restructure debt.

Residential real estate businesses, especially those facing cash flow difficulties, will benefit more than industrial real estate businesses due to their higher debt ratio and often needing large capital to implement projects from the initial steps.

However, the real estate group needs to pay attention to the risk of bond maturity pressure in the next two quarters and the business results of the residential real estate group in the second half of the year are expected to not recover. In addition, real estate enterprises wishing to borrow credit capital need to prove the potential of the project as well as the plans to repay the debt.

Annual credit growth (Source: SBV, Agriseco Research).

For these groups, in the short term, investors can observe cash flow and gradually disburse in stocks that show signs of attracting money and have not yet increased too much.

As for the group of banks, Agriseco has a neutral assessment and is monitoring this group because the issuance of Circular No. 10 will somewhat positively affect credit growth, but bad debt pressure may increase if banks increase disbursement into projects that are not fully legal or risky.

Investors should also note that the above move will mainly have a positive impact on psychology, while lending between commercial banks and businesses and individuals will depend on market demand.

Regarding the banking group, Agriseco believes that the outlook for the last months of 2023 will be differentiated, maintaining growth momentum in the group of State-owned banks and large commercial banks with high bad debt coverage ratios. The group of banks with high outstanding real estate loans may benefit psychologically in the short term when credit demand from real estate improves .

Source

Comment (0)