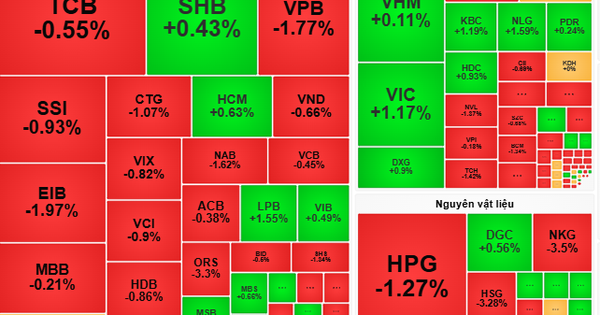

During the trading week from September 9 to 13, the VN-Index fluctuated around the 1,250-1,270 point range, with the 1,250 point support level tested twice. Selling pressure covered the market with 4/5 correction sessions.

Closing the trading week, the VN-Index stopped at 1,251.71 points, down 22.2 points (-1.75%) compared to the previous weekend. The VN30-Index decreased 3.31 points (0.26%), to 1,294.3 points.

On the Hanoi Stock Exchange, at the end of the session on September 13, the HNX-Index stopped at 232.42 points, up 0.51 points (0.22%); the HNX30-Index stopped at 504.13 points after inching up 1.45 points (0.29%).

The VN-Index is in the accumulation phase for the year-end uptrend. Experts say investors should take advantage of this period to increase the proportion of stocks around the 1,250-point support zone, prioritizing industry groups with positive growth stories. Illustrative photo.

Liquidity dropped sharply, with particularly low liquidity in the last two trading sessions of the week. Accumulated to the end of the trading week, the average matched liquidity on the Ho Chi Minh City Stock Exchange reached 497 million shares (-20.69%), equivalent to VND 12,335 billion (-21.16%) in trading value. Foreign investors net sold VND 1,122 billion.

The Vietnamese stock market continued to experience a quiet trading week, reflecting caution ahead of important macro developments including the upcoming interest rate meeting of the US Federal Reserve (Fed) taking place in the middle of next week with the forecast that the Fed will cut interest rates for the first time this year.

In addition, the market is waiting to see the State Bank's reaction after the Fed's interest rate cut and Typhoon Yagi made landfall in the North, disrupting the production and business activities of a number of enterprises.

In this context, experts from Vietnam Construction Securities Joint Stock Company believe that cautious sentiment is growing as the index has not been able to conquer the 1,300 point level in its fourth attempt.

With the current developments, the market is likely to continue to move sideways in a narrow range, looking for a balance point. Investors should limit additional purchases, prioritize observation positions and wait for stocks to return to their accounts when there is profit before continuing to increase the proportion.

“Regarding the long-term trend, we still expect the market to soon break through the 1,300-point threshold in the near future in the context of Vietnam's economy growing beyond expectations and the State Bank showing signs of loosening monetary policy to support economic growth,” experts from Vietnam Construction Securities Joint Stock Company forecast.

Meanwhile, the group of experts from VNDirect Securities Corporation "maintains a positive view on the prospects of the Vietnamese stock market in the final period of the year and the scenario of VN-Index surpassing the 1,300-point mark this year is completely feasible thanks to supporting factors such as the Fed's expected reduction of the operating interest rate by about 0.75% in the final months of the year.

The cooling pressure on exchange rates and inflation has helped the State Bank shift its focus to prioritizing economic growth, increasing money supply and maintaining low interest rates; business results of listed companies continue to improve; new developments in the story of raising market limits.

At the same time, past experience shows that “market tops always appear during active trading periods and market bottoms are formed when market liquidity is low”.

Therefore, the VN-Index is in the accumulation phase for the year-end uptrend and investors should take advantage of this period to increase the proportion of stocks around the 1,250-point support zone, prioritizing industry groups with positive year-end growth stories such as banking, securities, import-export (textiles, seafood, wood products) and industrial park real estate.

An Ha

Source: https://www.congluan.vn/chi-so-vn-index-trong-giai-doan-tich-luy-nha-dau-tu-can-lam-gi-post312469.html

![[Photo] The two Prime Ministers witnessed the signing ceremony of cooperation documents between Vietnam and Singapore.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/294b2d9cbf494db29dbdc47951d8313a)

![[Photo] General Secretary To Lam receives Singaporean Prime Minister Lawrence Wong](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/4bc6a8b08fcc4cb78cf30928f6bd979e)

Comment (0)