The Red Sea, which connects the Indian Ocean to the Mediterranean via the Suez Canal, is a vital international energy and trade route, carrying 12% of global trade. However, Houthi attacks in the sea have brought the vital trade route between Europe and Asia to a standstill in recent weeks.

Accordingly, global shipping giants such as Maersk, Hapag-Lloyd, CMA and CGM as well as oil giant BP have had to temporarily suspend shipments through this sea area and reroute through the Cape of Good Hope in southern Africa. This has caused each round-trip shipment to take about 10 days longer, while costs have also increased dramatically, significantly affecting the export goods of countries around the world, including Vietnam.

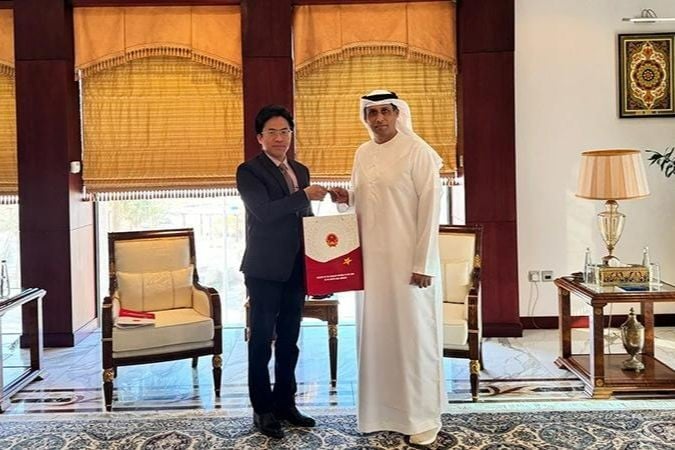

|

| Cashew exports are being strongly impacted by the Red Sea region. Photo: Mai Ca |

According to the reporter of the Industry and Trade Newspaper, at present, businesses with goods exported to Europe, the Middle East... have been severely affected by high shipping rates (the common level reported by businesses is an increase of more than 200% to 300% compared to the end of 2023). As a result, the delivery and production plans of businesses as well as partners have been disrupted, many businesses have had to temporarily suspend exports and renegotiate contracts with partners...

“We are extremely concerned that the security situation in the Red Sea will have a strong impact on business operations. Accordingly, the loss of security in this area has forced shipping lines to change their routes and increase freight rates significantly. In addition, shipping times are also longer than before,” said Mr. Le Duy Hiep, Chairman of the Vietnam Logistics Business Association.

According to Mr. Le Duy Hiep, in the past 3 years, the production and business situation of Vietnamese enterprises has been heavily affected by Covid-19 and has only recently recovered. Now, the impact of inflation and the Red Sea region will slow down the recovery process and directly affect exports.

“We have met with shipping lines to learn about the situation and will negotiate with them on a more reasonable increase, because the current increase is too sudden. As for Vietnamese businesses, we recommend that they find other safer shipping routes with more competitive prices,” said Mr. Le Duy Hiep.

Meanwhile, Mr. Vu Thai Son, Chairman of the Board of Directors of Long Son Group, who is also Chairman of the Cashew Association of Binh Phuoc Province, said that although businesses avoid risks by choosing multiple shipping lines when choosing a carrier, at present, all shipping lines have tripled their prices, so businesses have no other choice because signed orders must be delivered to maintain their reputation with customers. As for new orders, businesses will try to offer new freight rates to reduce losses.

According to Mr. Son, the more worrying thing is that not only the route through the Red Sea area has increased in price, but many other routes (specifically to the West Coast of the United States) have also had their prices doubled.

“While there is no effective solution, we recommend that businesses unite to reduce production costs. To do this, we must join hands to reduce the price of raw cashew imports from Africa because this country is currently the main supplier for Vietnamese businesses,” said Mr. Son.

According to many businesses and industries, currently only a few routes to Japan, South Korea, China, etc. have not had their freight rates increased - these are also markets with large import demands for cashews, textiles, rice, and seafood. Therefore, businesses need to focus more on these markets, while also paying attention to implementing strict standards according to market requirements to retain customers.

“Currently, our exports to Japan are normal and are not affected by shipping costs. This is also the company's main market in 2023, so TCM will maintain and expand this market in the coming time,” said Mr. Tran Nhu Tung, Chairman of the Board of Directors of Thanh Cong Textile - Investment - Trading Joint Stock Company (TCM).

Source link

Comment (0)