Withdrawing social insurance at one time is beneficial in the short term but harmful in the long term. Therefore, the revised Law on Social Insurance has provided 4 options to limit or create conditions for employees to continue participating in social insurance towards having enough time to receive pension.

|

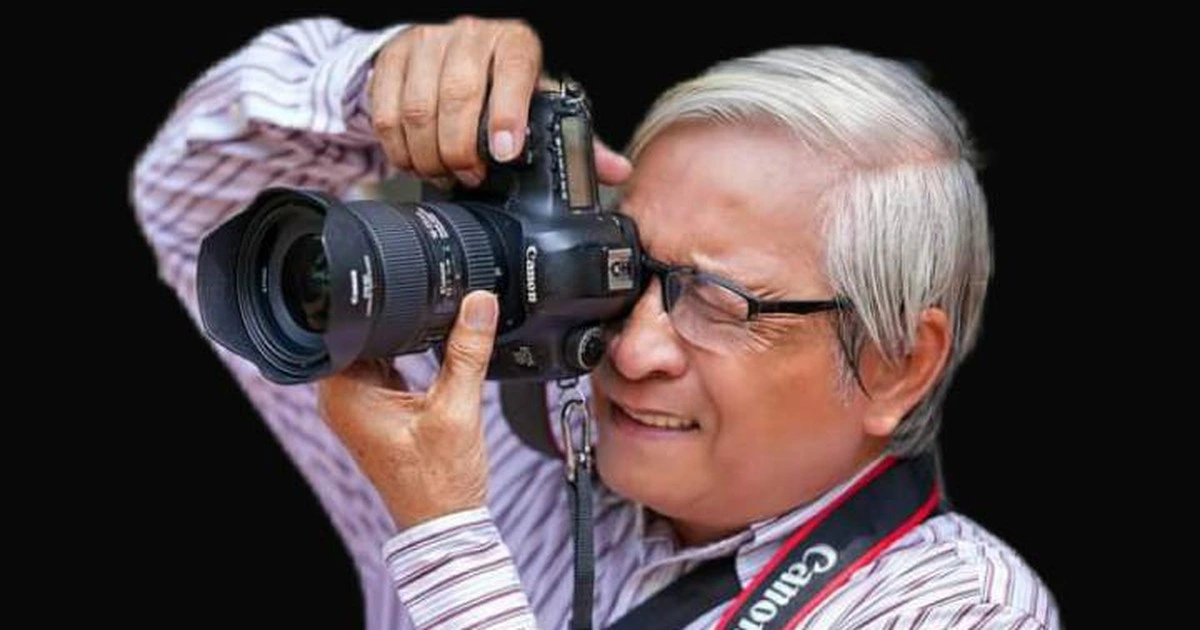

| Employees complete procedures to withdraw social insurance at the Reception and Result Delivery Department of Vung Tau City People's Committee. |

Mr. Le Hong Sinh (born in 1971, residing in Nguyen An Ninh Ward, Vung Tau City) used to work as a security guard for 3 years and 2 months. During that time, the security company paid all social insurance benefits for him. After exactly 1 year of quitting his job, on April 13, Mr. Sinh went to the Reception and Results Department of Vung Tau City to complete the procedures to receive social insurance at one time: "With a period of 3 years and 2 months and a salary of 5.5 million VND, I received about 40 million VND. I will use this money to buy a new motorbike to replace the old one", Mr. Sinh planned.

Ms. Nguyen Thi Khuong (born in 1988, residing in Vung Tau City) has 8 years and 11 months of social insurance contributions while working at a private kindergarten in the area. Currently, Ms. Khuong works as an hourly maid so she does not continue to pay social insurance. "Now that I have enough time after 1 year of quitting my job, I am eligible to complete the procedures to receive social insurance at one time, so I came to complete the procedures to receive the money. With a salary of nearly 2.4 million VND/month, I will receive more than 35 million VND in 8 years of social insurance contributions," Ms. Nguyen Thi Khuong calculated.

Similarly, previously, Ms. Nguyen Thi Ngoc Bich (residing in Phu My Town) was a worker at E-TOP Company Limited (My Xuan Industrial Park, Phu My Town) and had participated in social insurance for 8 years. However, 1 year ago, she had to quit her job because she had to take care of her young child. Therefore, Ms. Ngoc Bich wanted to receive social insurance at one time even though she was advised to lose many benefits when leaving this safety net.

Mr. Nguyen Van Son, Deputy Director of Phu My Town Social Insurance, said that in the first quarter of 2023, Phu My Town Social Insurance processed one-time social insurance benefit applications for 335 people, an increase of 64 compared to the same period in 2022 with an amount of more than 20.2 billion VND. Most people who apply for one-time social insurance withdrawal want to withdraw their social insurance one-time to cover immediate difficulties when applying.

Meanwhile, data from the provincial Social Insurance shows that in the first quarter of 2023, the total number of people with one-time social insurance withdrawal records was 3,715, a decrease of 229 people compared to the same period in 2022. However, the above situation of one-time social insurance withdrawal is very worrying.

Vietnam Social Security warns that the one-time withdrawal of social insurance is posing a challenge to the goal of ensuring social security and this is also the reason for the slow increase in pension coverage. Statistics show that, of the total number of people who receive one-time social insurance, nearly 10% are those who have paid social insurance for 10 years or more.

Therefore, in the current draft of the revised Social Insurance Law, the Ministry of Labor, Invalids and Social Affairs proposes two options for one-time withdrawal of social insurance. In addition to the option of maintaining the current regulations, the option that has received public attention is to withdraw no more than 50% of the total time of contribution to the social insurance fund. In addition, the remaining time of social insurance contribution is reserved for employees to enjoy social insurance benefits when they reach retirement age.

Regarding this, the representative of Vietnam Social Security explained that this plan of only allowing a maximum withdrawal of 50% helps employees have a certain amount of money to solve immediate difficulties and still have the conditions to continue participating in social insurance later to receive a pension.

Thus, with the new regulations in the draft Law on Social Insurance (amended), employees have 4 options when reserving 50% of the payment period. Specifically, if they continue to work and participate in social insurance, they will accumulate until they have 20 years of payment to receive a pension; in case employees reach retirement age but do not have enough years of social insurance payment, they can choose to pay one time for the missing time to receive a pension; choose to receive monthly pension benefits; continue to withdraw social insurance one time when they reach retirement age.

Article and photos: QUANG LE

| When withdrawing social insurance one time, the actual amount will be much lower than the amount contributed to the social insurance fund. Specifically, according to current regulations, the total contribution to the social insurance fund will be 22% of monthly salary, equivalent to more than 2.6 months salary/year. If withdrawing social insurance, the employee will only be paid back 2 months salary for each year of social insurance contribution. When old, the employee will not have a pension and will have to depend on their children and grandchildren. When sick or ill, they will not be entitled to free health insurance, when they die, their family will not be entitled to funeral allowance... If the employee later returns to work and participates in social insurance, the previous payment period will not be counted because they have received social insurance one time. |

Source

Comment (0)