Hoang Anh Gia Lai is making efforts to erase accumulated losses and reduce debt – Photo: BONG MAI

Hoang Anh Gia Lai Joint Stock Company (stock code HAG) has just revealed its business picture for the third quarter of 2024 and the first three quarters of this year, with many notable information.

Profit of hundreds of billions, cash increase

In the third quarter of this year, Hoang Anh Gia Lai earned nearly VND1,500 billion in revenue, a decrease of more than 24% compared to the same period last year. Sales of the two main segments, pig farming and fruit growing (bananas, durians, etc.), both decreased.

However, the gross profit margin – the profitability of the company chaired by Mr. Doan Nguyen Duc (Bau Duc) – improved from 28% to nearly 43% in the last quarter. Not to mention the decrease in cost of goods sold, increase in financial revenue, decrease in financial expenses, etc., the company still had a net profit after tax of more than 350 billion VND.

In the first three quarters of this year, Hoang Anh Gia Lai brought in nearly VND4,200 billion in revenue, down nearly 17% compared to the same period last year. After deducting expenses, the company had a profit after tax of more than VND850 billion (+20%). Completing nearly 65% of the net profit after tax plan set for the whole year.

Although the company is now in a profitable phase again, it still has an accumulated loss of more than 600 billion VND. The company's cash has increased 2.3 times compared to the beginning of the year, reaching nearly 114 billion VND, mainly in bank deposits, with a small amount in cash at the fund.

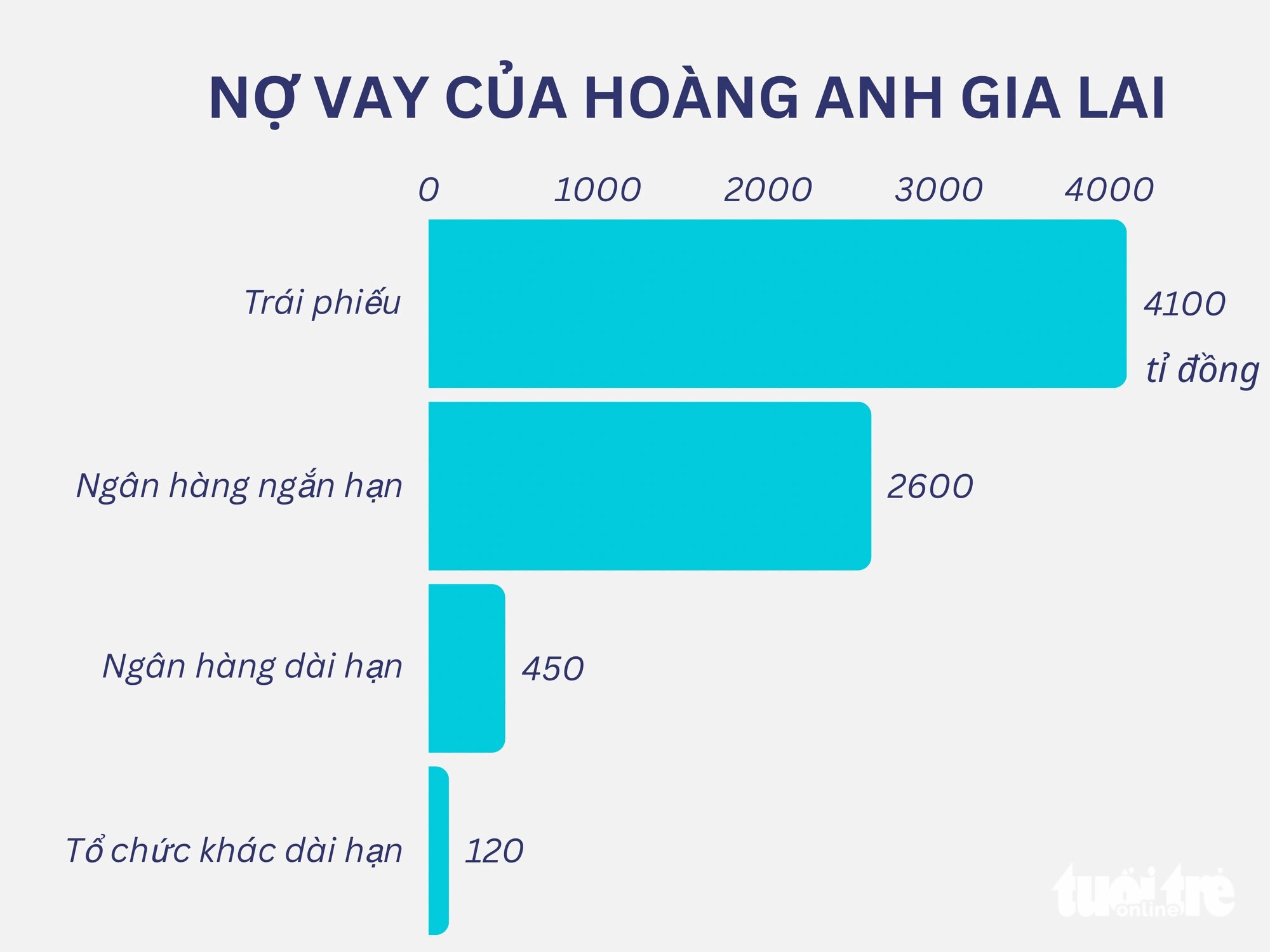

Still have to pay nearly 3,900 billion VND in interest on bank bonds

From the richest billionaire on the stock market, rising like a kite in the wind, Mr. Duc suddenly struggled and was drowning in debt. However, in recent years, Mr. Duc has continuously improved his business strategy, at the same time showing his determination to pay off his debt.

As of the end of the third quarter of 2024, Hoang Anh Gia Lai still had to pay more than 13,500 billion VND in debt, a significant decrease compared to the beginning of the year. Total debt decreased slightly to nearly 7,300 billion VND, mainly short-term debt, the remaining 40% was long-term debt.

Specifically about short-term loans. Banks LPBank, TPBank, Sacombank and HDBank with a total amount of approximately 2,600 billion VND.

At the same time, the enterprise owes more than VND 4,100 billion in bonds, arranged by BIDV Bank and BIDV Securities, due at the end of 2026.

Hoang Anh Gia Lai has a total long-term debt of nearly 450 billion VND at Lao Viet Joint Venture Bank, Sacombank and LPBank. In addition, it also has a long-term loan of more than 120 billion VND at units such as: MISC Binh Duong Trading and Service Company Limited, Phu Quy Gia Lai Agricultural Company Limited and PC General Joint Stock Company.

The company has to pay interest on bank loans and bonds of more than 3,860 billion VND. In addition, it has to pay nearly 22 billion VND in interest on loans to other organizations and individuals.

Consolidated financial statements, as of Q3-2024 – Chart: BONG MAI

Negative operating and investment cash flow, positive financial cash flow

Regarding cash flow, in the first three quarters of 2024, Hoang Anh Gia Lai recorded a negative main business cash flow of more than VND 400 billion, in contrast to the positive level in the same period last year. While investment cash flow was negative by more than VND 260 billion, financial cash flow was positive by nearly VND 740 billion.

At the end of the last quarter, the company's equity reached approximately VND9,000 billion, a significant increase compared to the beginning of the year. Assets increased significantly to nearly VND22,500 billion. This includes short-term receivables (35%), fixed assets (27%), long-term unfinished assets (22%) and other items.

On the stock market, HAG code is currently anchored at 10,600 VND/share, recording a decrease of more than 14% in a quarter and an increase of 38% in the past year.

Developing green, sustainable agriculture

Developing green, sustainable agricultureSource: https://tuoitre.vn/bau-duc-lam-an-co-loi-tro-lai-nhung-tra-no-con-cao-20241018212800191.htm

Comment (0)