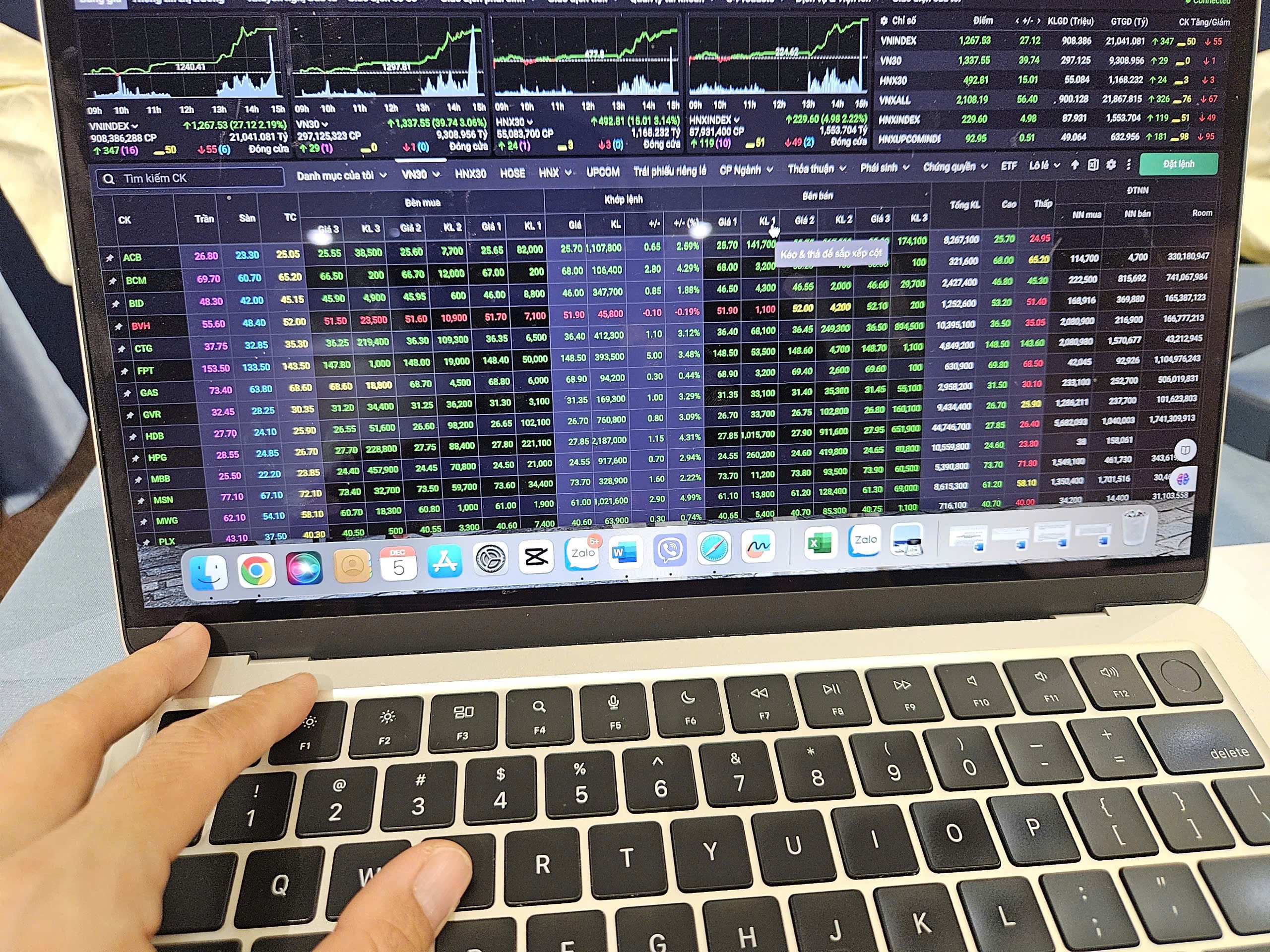

(NLDO) - The VN-Index is under downward pressure after 8 consecutive weeks of increases, with many stocks being sold off.

VN-Index closed the trading session on March 18 in red, stopping at 1,330.97 points, down 5.29 points compared to the previous session; HNX Index increased slightly by 0.26 points to 247.03 points while Upcom decreased by 0.14 points to 100.29 points.

Market liquidity decreased compared to the previous session, when the trading value on the HOSE floor reached more than 19,600 billion VND. Many stocks were in red with 318 stocks decreasing, 160 stocks increasing and 66 stocks closing at the reference level (unchanged compared to the previous session). The market continued to be strongly differentiated with increasing selling pressure in stocks that have had a good growth period recently such as real estate, securities, and banking.

Foreign investors continued to net sell more than 430 billion VND, focusing on some stocks such as FPT (sold more than 330 billion VND), SSI, HPG, CTG, SAB...

Stocks slow after 8 consecutive weeks of gains

FPT shares have continued to decline continuously in recent days. At the end of today's session, FPT shares stopped at 130,000 VND, down sharply from the 156,000 VND mark at the end of January 2025.

Mr. Tran Hoang Son, Director of Market Strategy, VPBank Securities Company (VPBankS), analyzed that the recent price increase of FPT shares in particular and Vietnamese technology stocks in general is closely linked to the trend of technology stocks in the US, especially the group of stocks of technology corporations, led by NVIDIA. In the past two years, FPT shares have increased very strongly, from the beginning of 2023 to now, they have increased by about 50%.

By the end of 2024 and early 2025, the DeepSeek story, especially the valuation of technology stocks in the US and Vietnam at very high levels, has created strong profit-taking pressure.

"FPT shares are also below the MA200 (200-day moving average) for the first time after a period of year-long price increases. This trend is due to the stock valuation being very high after a two-year period of hot growth and foreign investors reducing their holdings after the hot growth period. With the net selling trend of foreign investors, the decline of FPT shares may continue in the short term," said Mr. Son.

Commenting on stocks tomorrow (March 19), SHS Securities Company believes that the market will continue to be under selling pressure, restructuring the portfolio in many codes after a period of price increase over the past 8 weeks. In the short term, the current market is not an attractive price range for disbursement.

"If buying, investors should target stocks with good fundamentals, leading in strategic industries, and outstanding economic growth" - SHS Securities Company stated.

According to Vietnam Construction Securities Company (CSI), the liquidity of matched orders fell below the average of 20 trading sessions for the first time after nearly a month, reflecting a cautious state. It is likely that the market will have a technical adjustment to circulate cash flow, attracting more cash flow before moving towards medium-term goals.

CSI remains cautious, limiting new purchases and patiently waiting for a correction to the support zone of 1,286 - 1,290 points to return to a net buying position of stocks.

Source: https://nld.com.vn/chung-khoan-ngay-mai-19-3-vi-sao-co-phieu-fpt-lao-doc-196250318183217483.htm

![[Photo] National Assembly Chairman Tran Thanh Man attends the Policy Forum on Science, Technology, Innovation and Digital Transformation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/c0aec4d2b3ee45adb4c2a769796be1fd)

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's special meeting on law-making in April](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/8b2071d47adc4c22ac3a9534d12ddc17)

Comment (0)