Series of high-level leadership changes; VN-Index at risk of correction; Stock investment strategy before the "shake"; Dividend payment schedule.

VN-Index differentiates under profit-taking pressure

VN-Index started the new week at 1,326.15 points, decreased slightly towards the end of the week, and ended the week with the index slightly increasing 0.1% in value.

Liquidity recorded an increase of 8.7% compared to last week, showing that cash flow remained positive, focusing on certain industry groups.

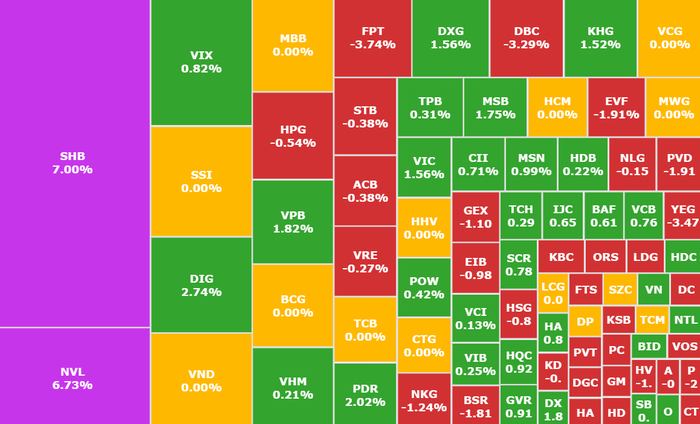

The market last week recorded a strong differentiation between industry groups. In particular, the Real Estate group played a key role in supporting the market. In addition, the Banking group also contributed to the support with the breakthrough of some leading stocks, but there was no strong consensus. Some other industries: Securities, Steel and Technology also had clear differentiation, reflecting that the cash flow circulation was not really strong.

The market turned down due to strong differentiation between industry groups (Source: SSI iBoard)

The increase in points is not commensurate with the explosion in liquidity. Experts believe that this is a sign of an upcoming correction, appearing after 7 consecutive weeks of increase, showing the cautious psychology of investors (NĐT) in the face of profit-taking pressure and unpredictable developments of cash flow.

Notably, foreign investors continued their strong net selling trend with a value of more than VND 1,707 billion, focusing on large-cap stocks, putting pressure on the market.

Viettel family stocks lost 44 trillion in capitalization since the beginning of the year

Marking the 5th consecutive decline, VGI (Viettel Global Investment Corporation - Viettel Global, HOSE) closed at VND 77,200/share, down 3.02% in the past trading week.

With a price of 77,200 VND/share, Viettel Global's current capitalization is about 235,000 billion VND, down more than 44,000 billion VND compared to the beginning of the year.

VGI goes against the market, falling sharply for 5 consecutive sessions (Photo: Internet)

VGI was one of the sought-after stocks in the first half of 2024, increasing from VND 25,800/share in early 2024 to a peak of VND 111,000/share on July 10, equivalent to an increase of 330%.

The reason, according to analysts, is that in the short term, technology stocks may face corrections in the context of high prices and many investors wanting to "take profits".

Regarding business results, in 2024, Viettel Global recorded revenue of VND 35,363 billion, an increase of more than 25% compared to 2023. Profit after tax reached VND 7,187 billion, nearly 4.4 times higher than the previous year and erased all accumulated losses.

Series of high-level leadership changes

On the eve of the "season" of General Meeting of Shareholders and announcement of business results for the first quarter of 2025, many businesses simultaneously announced changes in senior leadership.

Specifically, Vicasa - VNSteel Steel Joint Stock Company (VCA, HOSE) received a resignation letter from Mr. Nguyen Xuan Son from the position of Chairman of the Board of Directors of VCA for the 2023 - 2028 term, due to retirement according to the regime. Along with that, Mr. Nguyen Phuoc Hai also submitted a resignation letter from the position of Head of the Supervisory Board of Vicasa - VNSteel due to declining health.

Vinh Hoan Corporation (VHC, HOSE) received a resignation letter from Ms. Nguyen Thi Cam Van from the position of Head of the Board of Supervisors for the 2022-2026 term, citing personal reasons for not being able to continue her position.

Binh Minh Plastics Joint Stock Company (BMP, HOSE) announced the dismissal of Mr. Chaowalit Treejak from the position of General Director due to his resignation due to health reasons, effective from June 1. Mr. Chaowalit Treejak also submitted a letter of resignation from the position of member of the Board of Directors. Instead, Mr. Niwat Athiwattananont, a Thai national, was appointed to the position of General Director of Binh Minh Plastics from June 1 to May 31, 2030.

Vimeco Joint Stock Company (VMC, HNX) received 3 resignations from the positions of Chairman of the Board of Directors, member of the Board of Directors, and member of the Supervisory Board before the shareholders' meeting. Specifically, Mr. Duong Van Mau resigned from the position of Chairman of the Board of Directors of VMC; Mr. Nguyen Khac Hai also resigned from the position of member of the Board of Directors of VMC; Mr. Nguyen Tien Khanh also resigned from the position of member of the Supervisory Board of Vimeco for personal reasons.

Investment strategy before short-term "shake-up"

VN-Index has had 8 consecutive weeks of increasing points from the 1,220 point price range to the 1,350 point price range. In 5 sessions from March 10-14, the main index fluctuated strongly when conquering the high score around the 1,340 point threshold with a very strong differentiation in industry groups, capitalization groups...

Based on this development, the scenario for the new trading week is given by experts with a cautious view on the short-term trend in the context of the market having had a long increase. Investors should build an investment strategy that balances finding opportunities and controlling risks.

Accordingly, the investment strategy for investors is as follows: Maintain a reasonable stock ratio, avoid following market sentiment; Focus on stocks with good fundamentals, benefiting from economic cycles; Be flexible in holding and taking profits; Closely monitor foreign capital flows and global macroeconomic policy developments.

At the same time, this is also an opportunity to hold potential stocks with attractive valuations during the "shake" period, including: Banking and Steel.

Opportunities come from high credit growth targets, the recovery of cash flow and income of residents and businesses, leading to the demand for banking products and services, which are expected to have a positive impact on the business picture of the banking industry. As for the steel industry, the story of domestic market protection measures, the expansion of production capacity and the recovery of the civil construction market open up good opportunities for leading companies.

Comments and recommendations

Mr. Huynh Quang Minh, Head of Investment Consulting, Mirae Asset Securities, commented that after 7 consecutive weeks of increase, the market has encountered increased selling pressure and had sessions of fluctuations and downward adjustments.

In the short term, there will often be a cautious FOMO risk-averse mentality, so most people will choose to take profits rather than buy new ones. If a correction occurs, the VN-Index may retreat to the support zone of 1,300 - 1,310 points, and this is a healthy "resting" correction scenario, without breaking the previous medium-term uptrend of the market.

VN-Index may fall back to 1,300 - 1,310 points with short-term adjustment scenario

In the medium term, the market has many supporting factors at the macro level such as loose monetary policy and low interest rates continue to be the main driving force along with the highly expected market upgrade story. Next is the shareholder meeting season which will be the catalyst for positive business results growth in the first quarter of 2025.

Therefore, this is still an attractive investment channel compared to many other investment channels at the moment. He expects that the market will continue to maintain an upward trend, bringing good profits to investors.

However, in any market condition, choosing stocks for the portfolio with growth stories and attractive valuations should be a top priority.

Evidence of the recent period, although the index continuously set new highs, many stocks fell sharply, causing disappointment for investors. In addition, risk management, especially in the use of leverage, needs to be carefully considered, the market has completely unexpected corrections.

Potential stock sectors in my opinion are Banking and Steel.

BSC Securities said that, with the recent strong increase, along with somewhat negative signs last week, the market has potential risks of increasing in the short term, the index may fall back to 1,315 - 1,320 points and retest the old support zone.

Asean Securities believes that the market is maintaining a positive development with trading volume remaining high above the average, showing the tug of war between buyers and sellers. The market is moving quite cautiously, with most industry groups making slight adjustments. At the present stage, investors need to prioritize caution and maintain cash ready to disburse when the market adjusts, in order to create a solid position and take advantage of strong growth potential in the long term.

Dividend schedule this week

According to statistics, there are 20 enterprises that have decided to pay dividends for the week of March 17-21, of which 19 enterprises paid in cash and 1 enterprise exercised the right to buy shares.

The highest rate is 50%, the lowest is 2.5%.

1 company exercises stock purchase rights:

Prosperity and Development Joint Stock Commercial Bank (PGB, UPCoM) , ex-right trading date is March 18, rate 19.1%.

Cash dividend payment schedule

*Ex-right date: is the transaction date on which the buyer, upon establishing ownership of shares, will not enjoy related rights such as the right to receive dividends, the right to purchase additional issued shares, but will still enjoy the right to attend the shareholders' meeting.

| Code | Floor | GDKHQ Day | Date TH | Proportion |

|---|---|---|---|---|

| ABT | HOSE | 17/3 | April 16 | 30% |

| COM | HOSE | 17/3 | 4/4 | 15% |

| THG | HOSE | 17/3 | 10/4 | 10% |

| ACE | UPCOM | 17/3 | 30/5 | 10% |

| VFG | HOSE | 18/3 | 4/4 | 10% |

| VNL | HOSE | 18/3 | 3/4 | 5% |

| LBM | HOSE | 18/3 | April 16 | 2.5% |

| LHC | HNX | 19/3 | April 18 | 10% |

| TCM | HOSE | 19/3 | 4/4 | 5% |

| STP | HNX | 19/3 | 9/5 | 8% |

| VDP | HOSE | 19/3 | 15/5 | 15% |

| DRG | UPCOM | 19/3 | 10/4 | 2.5% |

| DSN | HOSE | 3/20 | 10/4 | 16% |

| CMF | UPCOM | 3/20 | 8/5 | 50% |

| DP3 | HNX | 3/21 | 8/7 | 30% |

| PPP | HNX | 3/21 | April 21 | 15% |

| PMC | HNX | 3/21 | 8/4 | 14% |

| SDC | HNX | 3/21 | April 15 | 5% |

| SD5 | HNX | 3/21 | April 15 | 7% |

Source: https://phunuvietnam.vn/chung-khoan-tuan-17-21-3-than-trong-voi-nhip-rung-lac-ngan-han-20250317091016796.htm

Comment (0)