Silver supplies are tightening while demand continues to increase, especially in the industrial and investment sectors.

So, since the beginning of the year, silver prices have been on a remarkable upward trend. It may not catch up with the momentum of gold prices, but according to MXV, silver is likely to become an attractive investment item in the precious metals market in 2025.

|

| Silver price development in the period 2024 - 2025 |

According to the Vietnam Commodity Exchange (MXV), in the first two months of this year, silver prices have increased by 10%. Notably, at the beginning of the new year, silver prices increased by nearly 5% after only 7 sessions of climbing. At the close of trading on February 18, world silver prices surpassed the threshold of 33 USD/ounce - the highest level since 2012. According to experts' forecasts, silver prices may return to the historical peak of 40 USD/ounce in the near future due to the risk of a global trade war, declining mining activities while demand exceeds supply for the fourth consecutive year.

Energy conversion “needs” silver

This acceleration is not just a temporary effect, but a signal of a long-term price increase. As the metal with the highest electrical and thermal conductivity, silver is very suitable for the production of solar panels, electric vehicles, in the grid infrastructure... So, until now, silver has been, is and will be an indispensable material in the green energy revolution.

Meanwhile, silver supplies are tighter than ever. Moreover, silver is being sought by investors as a safe haven asset against global economic fluctuations and escalating trade tensions.

Silver is emerging as a pillar of the economy as it plays a key role in the green energy revolution. The race to reduce emissions and develop renewable energy is driving silver consumption to record levels.

It is forecasted that by 2030, silver demand in the solar energy industry could increase by up to 170%, making silver an indispensable material in solar panels, electricity storage systems, and energy transmission equipment.

In addition, the electrification boom is taking silver demand to new heights. In 2024 alone, total investment in the electric vehicle industry reached $757 billion, leading to a silver rush as the metal becomes an essential material in the production of controllers, sensors, and charging systems. With its rapid growth, silver is gradually becoming the key to this industry.

The wave of investment in green energy is not just limited to the corporate level but is spreading globally. Governments are pouring trillions of dollars into securing their place in the green revolution.

In 2024, China will lead with an investment of 818 billion USD, the US will pump 338 billion USD, and the European Union (EU) will not be left out with 375 billion USD. Vietnam is also accelerating with Power Plan VIII, aiming to increase the total capacity of solar power plants to more than 34% by 2050.

|

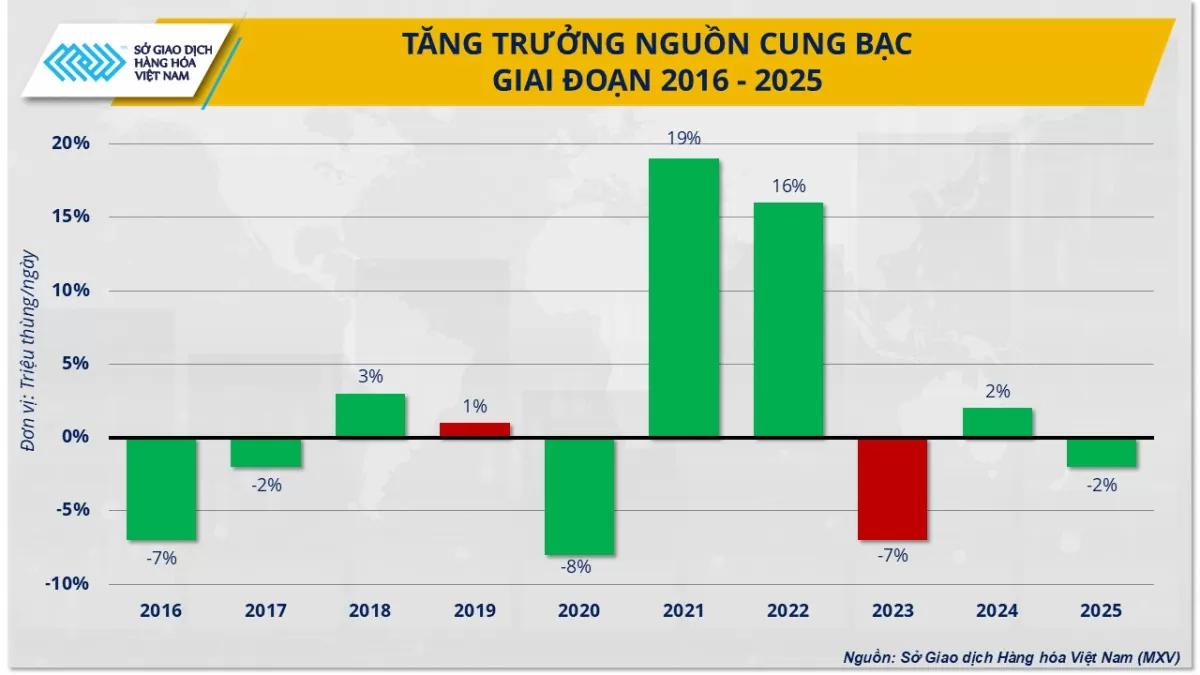

| Silver supply growth 2016 - 2025 |

To achieve net zero emissions, the world is estimated to need to invest $5.6 trillion a year in clean energy, but currently only 37% of that is needed. This means that demand for silver will continue to rise strongly in the coming years, pushing the price to new highs.

Silver is not only a strategic metal in the green economy, but it is also asserting its position as a safe haven amid global turmoil. Since US President Donald Trump officially took office on January 20, the price of silver has increased by more than 5% in less than two months.

The US’s aggressive policy of imposing tariffs on a range of imported goods has sparked escalating global trade tensions. In response to this pressure, many countries have responded with new tariffs and increased protection for domestic manufacturers. This domino effect has not only negatively impacted supply chains but also raised concerns about a wave of widespread economic instability.

Silver has historically been one of the biggest beneficiaries of global trade uncertainty due to its safe-haven status. This status is further reinforced by the risk of rising prices in the US, making precious metals like silver an ideal inflation hedge for any portfolio.

Silver may soon “return” to its historical peak of $40/ounce

While demand for silver is booming, the market is facing an unprecedented supply crunch. The silver market has been in deficit for four consecutive years from 2021 to 2024, with the shortfall in 2024 alone estimated at 6,700 tonnes, or more than 21% of global supply. Notably, this shortage shows no signs of abating, with a forecast for 2025 to record a deficit of more than 4,600 tonnes.

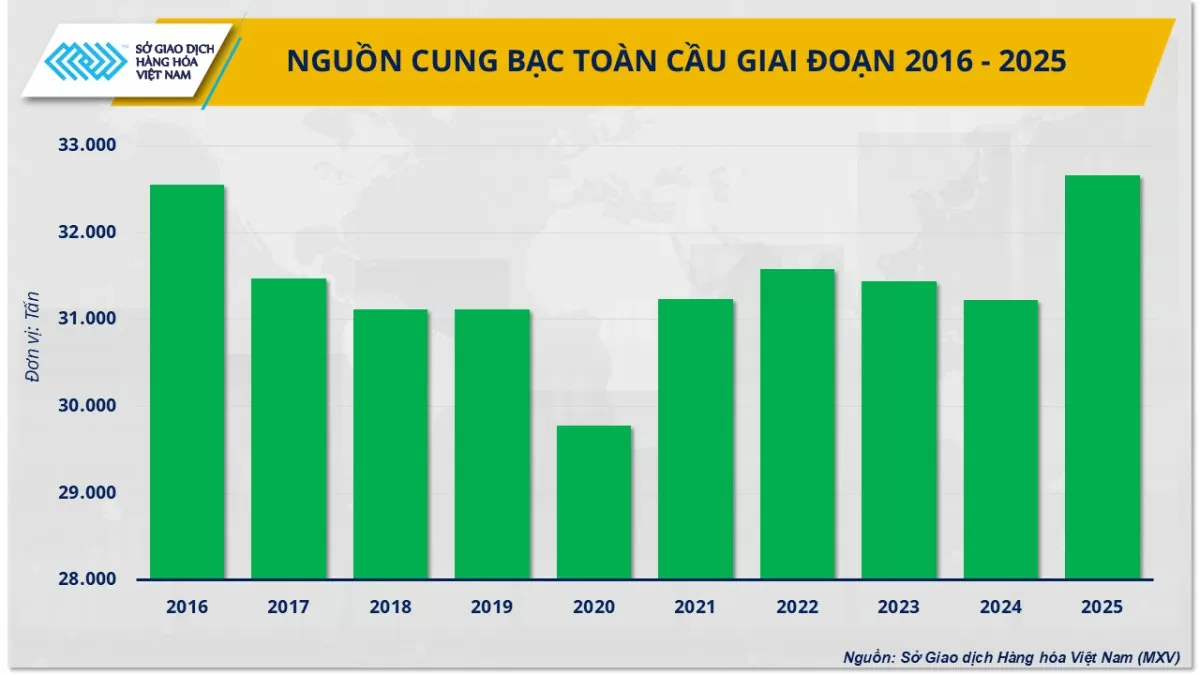

Silver production is also not enough to fill the gap. After reaching a high of 32,566 tonnes in 2015, silver supply has steadily declined due to depleted reserves, major mine closures, and declining ore quality.

Although global silver supply is forecast to improve to 32,660 tonnes by 2025, it will not be enough to close the current severe deficit. As supply continues to be tight amid booming industrial demand, the precious metal could enter one of the most impressive bull cycles in history.

|

| Global silver supply 2016 - 2025 |

According to the Vietnam Commodity Exchange (MXV), the current supply-demand foundation can create a sustainable price increase momentum, pushing silver closer to the $34-36/ounce range in the first half of 2025, equivalent to an increase of 5-11%.

Notably, if the market continues to face tariff shocks like earlier this year, safe-haven flows could trigger a stronger price rally, pushing silver closer to $38/ounce (up more than 17%) in 2025.

With positive signals from the market, investors can proactively expand their trading portfolio to take advantage of the emerging silver price trend. For businesses and manufacturers using silver in the industrial sector, participating in the derivatives market is an optimal strategy to fix raw material costs and limit the negative impact of unpredictable price fluctuations.

| As geopolitics and trade policies continue to weigh on financial markets, silver is not only a potential investment but also a hedge, making it an unmissable choice in 2025. |

Source: https://congthuong.vn/bac-se-la-mat-hang-kim-loai-dau-tu-hap-dan-nhat-378091.html

Comment (0)