In recent years, Vietnam, Thailand and Indonesia have introduced policies to try to increase their market share for electric vehicles, however, the race is still inconclusive.

|

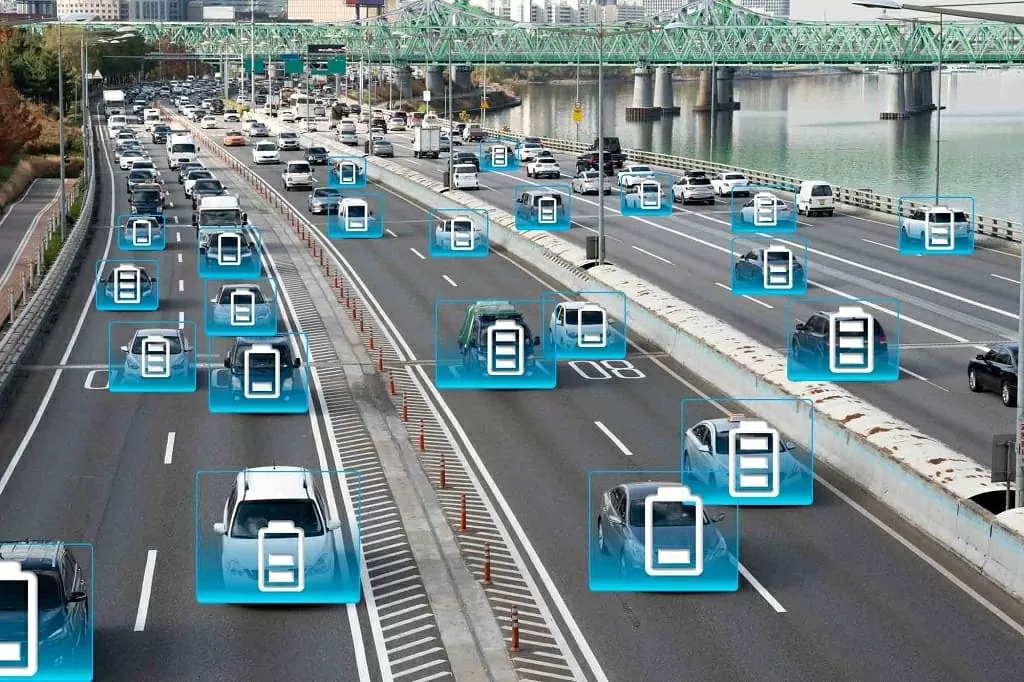

| By attracting early investment, the three countries of Vietnam, Thailand and Indonesia are expected to become important manufacturing hubs, while also benefiting from reduced air pollution. (Source: auto.economictimes) |

By attracting early investment, Thailand, Indonesia and Vietnam are expected to become major manufacturing hubs while also benefiting from reduced air pollution. However, given the huge investment amounts, the plans appear risky.

Efforts to increase market share

Thailand is the most aggressive of the three, hoping that its booming consumer market will lead to increased production.

Under the "EV 3.0" program, which will be implemented from 2022, the purchase of electric vehicles is supported by the government through tax cuts and direct subsidies of up to 150,000 baht (equivalent to 4,500 USD) per vehicle, helping to make electric vehicle prices equal to gasoline-powered vehicles.

Thanks to that, Thailand's electric vehicle market share has increased to about 15%, from almost zero just a few years ago.

In Indonesia, the market share of electric vehicles is only 5%, partly because the government focuses on manufacturers rather than consumers. Many preferential policies such as tax exemptions and investment support have been implemented.

In addition, Southeast Asia's largest economy is taking advantage of its strength in minerals used in electric vehicle production by banning the export of raw ores, aiming to promote domestic manufacturing companies.

In the nickel sector, where Indonesia is globally dominant, a ban on raw ore exports from 2020 has spurred investment in smelters.

In Vietnam, VinFast - an automobile manufacturing company under Vingroup, the country's largest corporation, has dominated the domestic electric vehicle market in Vietnam since 2022.

Currently, this company is continuing to conquer the Indian and Indonesian markets.

Core issue

However, each strategy has its difficulties.

Thailand is under pressure because electric vehicles require fewer components than conventional vehicles.

Specifically, Japanese manufacturers in Thailand still depend on the auto parts supply chain, while Chinese electric car companies in this country import components from home. Therefore, the policy of the land of golden pagodas risks reducing the number of jobs.

|

| The three Southeast Asian countries face a common risk: the risk of wasting resources and becoming mere assembly hubs, the lowest value-added part of the electric vehicle supply chain. (Source: Getty Images) |

In Indonesia, the industrial strategy attracts electric vehicle manufacturers, however, the results of this strategy have been less optimistic in practice.

According to the Lowy Institute, from 2016-2024, Indonesia attracted $29 billion in direct investment in the electric vehicle sector.

However, the bulk of this investment comes from Chinese companies, which assemble vehicles mainly from imported components. In theory, these companies should comply with the increasing localization requirements over time, but the ability to enforce them remains an open question.

Meanwhile, VinFast's efforts to expand its market to the US have not achieved the expected results.

All three countries face similar risks.

First, there is the risk of wasting resources when the global supply of electric vehicles is in excess, largely due to production in China.

Second, the possibility that all three countries will only become assembly hubs, the lowest value-added part of the electric vehicle supply chain.

The core problem is that the region largely receives technology from abroad, much of it from the world's second-largest economy.

Governments hope to combine subsidies with technology transfer requirements, but it is difficult to force foreign companies to comply, because the market size is small and manufacturers can easily "bargain" between countries.

Indonesia, the largest market among the three Southeast Asian countries, is heavily dependent on Chinese investment, making it difficult for the country to exert pressure.

Optimists expect that electric car makers in the country of a billion people will eventually choose a few regional hubs to concentrate production. This also means that, in the most positive scenario, only one of the three Southeast Asian countries will be "chosen to entrust the gold".

Source: https://baoquocte.vn/ba-quoc-gia-dong-nam-a-tang-toc-tren-duong-dua-xe-dien-xuat-hien-rui-ro-tuong-dong-308167.html

Comment (0)