(Dan Tri) - The conditions for withdrawing social insurance (SI) one time in 2025 remain unchanged compared to 2024, although the Social Insurance Law 2024 takes effect from July 1, 2025.

Before July 1

Before July 1, the social insurance regime was applied according to the provisions of the Social Insurance Law 2014. Accordingly, the conditions for employees to withdraw social insurance at one time were stipulated in Article 60 of the Social Insurance Law 2014, then supplemented in Resolution 93/2015/QH13.

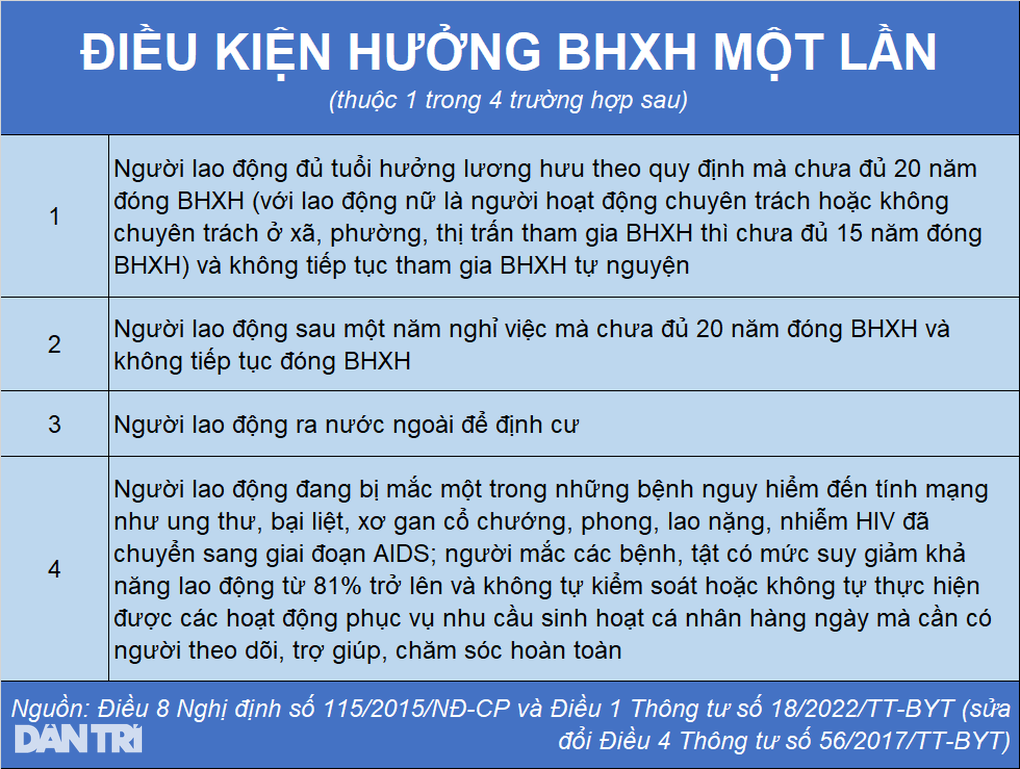

On November 11, 2015, the Government issued Decree No. 115/2015/ND-CP detailing a number of articles of the Law on Social Insurance on compulsory social insurance, including provisions that more clearly define cases where one-time social insurance withdrawal is allowed.

Specifically, Clause 1, Article 8 of Decree No. 115/2015/ND-CP stipulates 4 cases of one-time withdrawal of social insurance for employees who are Vietnamese citizens participating in compulsory social insurance and those working abroad under contract.

Firstly, employees who are old enough to receive pension according to regulations but have not paid social insurance for 20 years; female employees who are full-time or part-time workers in communes, wards and towns who retire without paying social insurance for 15 years and do not continue to participate in voluntary social insurance.

Second, employees who have not paid social insurance for 20 years after one year of unemployment and do not continue to pay social insurance.

Third, workers go abroad to settle down.

Fourth, the worker is suffering from one of the life-threatening diseases such as cancer, paralysis, cirrhosis, leprosy, severe tuberculosis, HIV infection that has progressed to AIDS and other diseases as prescribed by the Ministry of Health.

Conditions for receiving one-time social insurance benefits before July 1 (Graphic: Tung Nguyen).

From 1/7 onwards

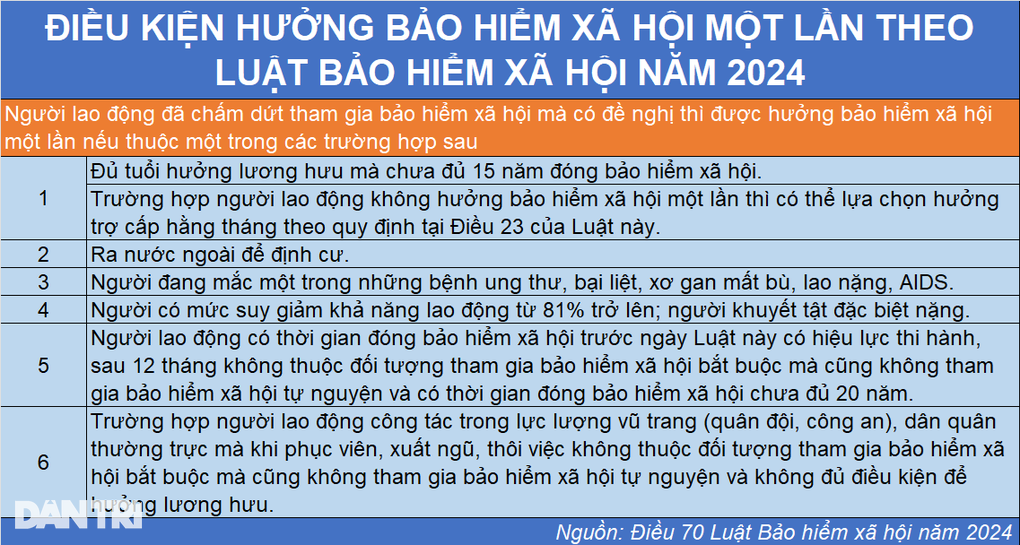

From July 1, when the Social Insurance Law 2024 takes effect, those who participated in social insurance before July 1 will still be entitled to receive one-time social insurance benefits upon request in 6 prescribed cases, no different from the conditions for receiving one-time social insurance benefits before July 1.

Firstly, employees who are old enough to receive pension but have not paid social insurance for 15 years. In case employees do not receive social insurance in one lump sum, they can choose to receive monthly benefits.

Second, workers go abroad to settle down.

Third, the worker is suffering from one of the following diseases: cancer, paralysis, decompensated cirrhosis, severe tuberculosis, AIDS.

Fourth, workers with a working capacity reduction of 81% or more; people with especially severe disabilities.

Fifth, employees who have paid social insurance before the effective date of this Law (July 1, 2025), after 12 months are not subject to compulsory social insurance but also do not participate in voluntary social insurance and have paid social insurance for less than 20 years.

Sixth, employees working in the army, police, and militia who, when demobilized, discharged, or quit their jobs, are not subject to compulsory social insurance, nor do they participate in voluntary social insurance, and are not eligible for pension.

Conditions for receiving one-time social insurance benefits from July 1 onwards (Graphic: Tung Nguyen).

As for employees who start participating in social insurance from July 1 onwards, they are still entitled to receive one-time social insurance upon request in 5 cases, except for the 5th case.

However, in 2025, no employee will fall into the 5th case, so the conditions for one-time withdrawal of social insurance in 2025 will remain almost unchanged compared to 2024.

Source: https://dantri.com.vn/an-sinh/ai-duoc-rut-bao-hiem-xa-hoi-mot-lan-trong-nam-2025-20250124141246908.htm

Comment (0)