(Dan Tri) - When having enough years of social insurance contributions to receive pension, employees are not allowed to withdraw their social insurance at one time. However, there are still cases where they are allowed to choose to receive one of the two above regimes.

From July 1st onwards, the conditions for receiving pension are reaching retirement age and having paid social insurance for at least 15 years. Thus, employees who retire from July 1st onwards and have paid social insurance for at least 15 years will not be able to withdraw their social insurance at one time.

However, there are still cases where employees who are eligible for pension are still allowed to choose to receive social insurance in one lump sum. These cases are stipulated in Clause 6, Article 70 of the Social Insurance Law 2024.

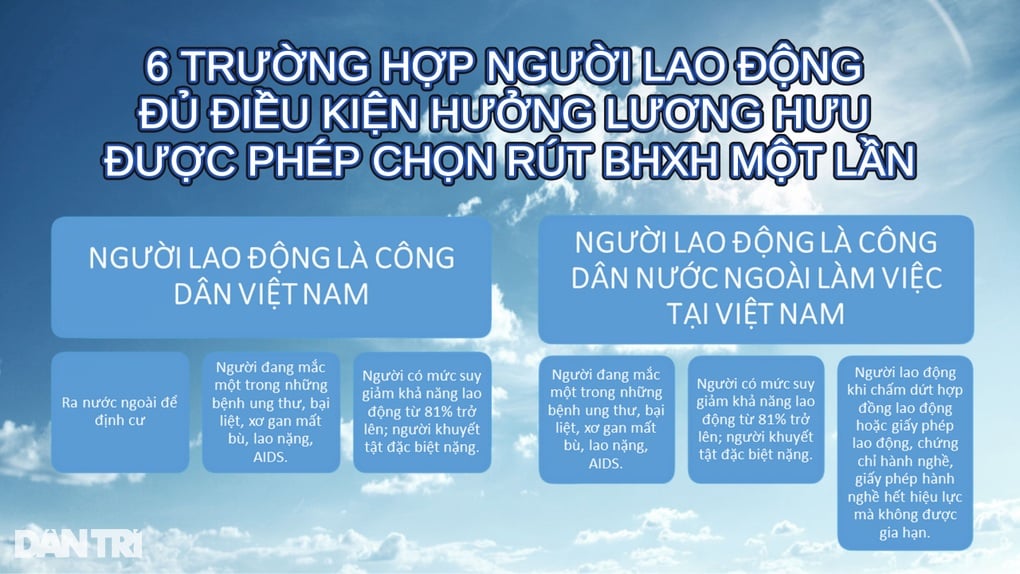

Accordingly, there are 6 cases where employees are both eligible for pension and one-time social insurance, employees can choose to receive monthly pension or one-time social insurance.

In case employees are eligible for pension, they are allowed to choose to withdraw social insurance at one time (Graphic: Tung Nguyen).

Source: https://dantri.com.vn/lao-dong-viec-lam/nguoi-du-dieu-kien-huong-luong-huu-van-duoc-rut-bao-hiem-xa-hoi-mot-lan-20250225134827416.htm

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

Comment (0)