Specifically, the Ha Nam Provincial Tax Department has sent a document to the Immigration Department (Ministry of Public Security) regarding the temporary suspension of exit for Mr. Vu Duy Tung (born in 1995, residing in Ngoc Khanh ward, Ba Dinh district, Hanoi).

Mr. Tung is the director of Thuan Phat Architecture & Interior Exterior Company Limited located in Hai Ba Trung Ward, Phu Ly City, Ha Nam Province.

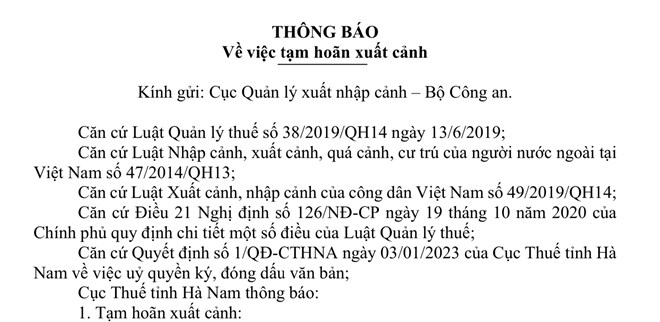

The reason for the temporary suspension of exit is that "the individual is the legal representative of the taxpayer, which is an enterprise that is being forced to execute an administrative decision on tax management and has not fulfilled its tax payment obligation".

The period of temporary suspension of exit is from September 28 until the taxpayer completes his/her tax payment obligation to the state budget.

Previously, with the same reason as above, the Tax Department of Ha Nam province also announced a temporary suspension of exit from the country for Mr. Vu Van Phong (born in 1976, residing in Minh Khai ward, Hai Ba Trung district, Hanoi), director of Minh Huy Materials Company Limited (address in Phu Ly city, Ha Nam).

The temporary suspension of exit for Mr. Vu Van Phong is from September 26 until the taxpayer completes his tax obligations to the state budget.

Regarding this issue, for taxpayers with tax arrears of more than 90 days or tax arrears subject to enforcement, the General Department of Taxation has directed tax departments to immediately apply enforcement measures to recover tax arrears to the state budget.

In case the enforcement decision expires and the taxpayer has not paid or has not paid the full amount of tax debt subject to enforcement to the state budget, it is necessary to promptly switch to applying appropriate enforcement measures in accordance with regulations.

The General Department of Taxation also requires tax departments to publicly disclose information of taxpayers with overdue tax debts in accordance with the law, especially focusing on taxpayers with large and long-term tax debts.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's special meeting on law-making in April](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/8b2071d47adc4c22ac3a9534d12ddc17)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)