The market opened in a choppy state as demand was still quite weak. After opening with a slight decrease, the market quickly reversed and recovered.

Only 4 groups increased slightly by more than 1%, including the securities group. The large-cap group is still the main pressure on the market when NVL, MSN, VHM, HPG, BCM, VCB negatively affected the VN-Index.

At the end of the morning session on November 30, VN-Index increased by 0.44 points, equivalent to 0.04% to 1,103.2 points. The entire floor had 210 stocks increasing and 202 stocks decreasing. HNX-Index increased by 1.04 points to 228.07 points. UPCoM-Index decreased by 0.04 points, equivalent to 0.05% to 85 points.

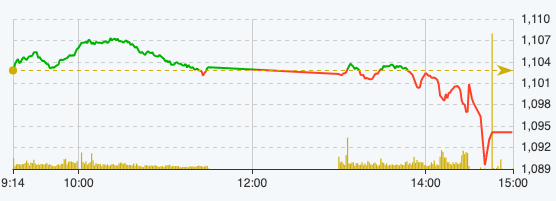

VN-Index performance on November 30 (Source: FireAnt).

Entering the afternoon session, investor sentiment was still very cautious and strong selling pressure at the end of the session caused the VN-Index to fall to 1,089 points at times.

At the end of the trading session on November 30, VN-Index decreased by 8.67 points, equivalent to 0.79% to 1,094.1 points. The entire floor had 138 stocks increasing, 362 stocks decreasing, and 89 stocks remaining unchanged.

HNX-Index decreased by 0.88 points, equivalent to 0.39% to 226.15 points. The whole floor had 77 stocks increasing, 83 stocks decreasing and 61 stocks remaining unchanged. UPCoM-Index decreased by 0.06 points to 84.99 points.

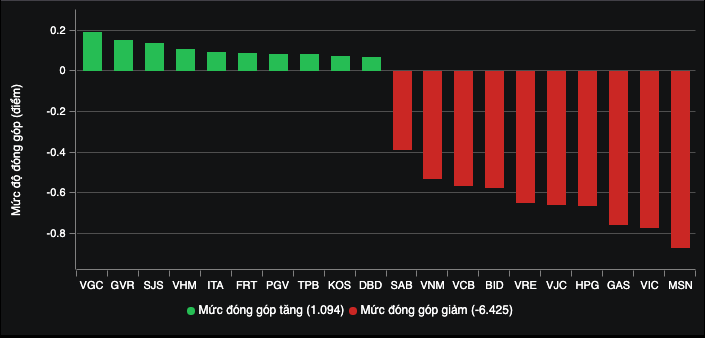

The VN30 basket alone recorded 25 stocks decreasing in price. The impact of large-cap stocks was evident when MSN, VIC, GAS, VJC, HPG, VRE, BID, VCB, VNM, and SAB took away 6.4 points from the general market.

The real estate group had a strong differentiation when NVL, DIG, CEO, PDR, VRE, VIC ended the session in red. In particular, the VRE and VIC duo took away 1.4 points from the market. On the contrary, HQC, DXG, TCH, KBC, VHM, KHG, IDC ended the session in green but only fluctuated around 1%. The bright spot of the real estate group in today's session was ITA when it hit the ceiling right from the beginning of the session.

Red covered almost all stocks of the securities group, liquidity concentrated in SHS with more than 40 million units matched, VIX matched 38.6 million units, VND matched 28.3 million units.

The construction and building materials group was a bright spot in today's session. Despite the divergence, the overall score of the group still increased slightly. HUT ended the session up 2.05% after the Board of Directors approved the establishment of Tasco BOT LLC with an initial charter capital of nearly VND1,158 billion.

This newly established member unit will receive and manage the operations of existing BOT projects to centrally manage the BOT sector, supporting overall financial restructuring solutions for BOT projects.

Stocks that move the market.

The total value of matched orders in today's session reached VND17,082 billion, up 16% compared to the previous session, of which the value of matched orders on the HoSE floor reached VND14,670 billion, up 16%. In the VN30 group, liquidity reached VND4,857 billion.

Foreign investors continued to net sell with a value of nearly 394.4 billion VND, of which this group disbursed 1,1171.4 billion VND and sold 1,565.8 billion VND.

The codes that were sold strongly were VNM 104 billion VND, FUESSVFL 91 billion VND, MSN 80 billion VND, HPG 63.4 billion VND, VIC 55 billion VND,... On the contrary, the codes that were mainly bought were VHM 86.3 billion VND, NKG 58.3 billion VND, EVF 39 billion VND, FRT 37 billion VND, KOS 31 billion VND,... .

Source

Comment (0)