Some stocks to watch on October 12

VN-Index may surpass the psychological threshold of 1,300 points

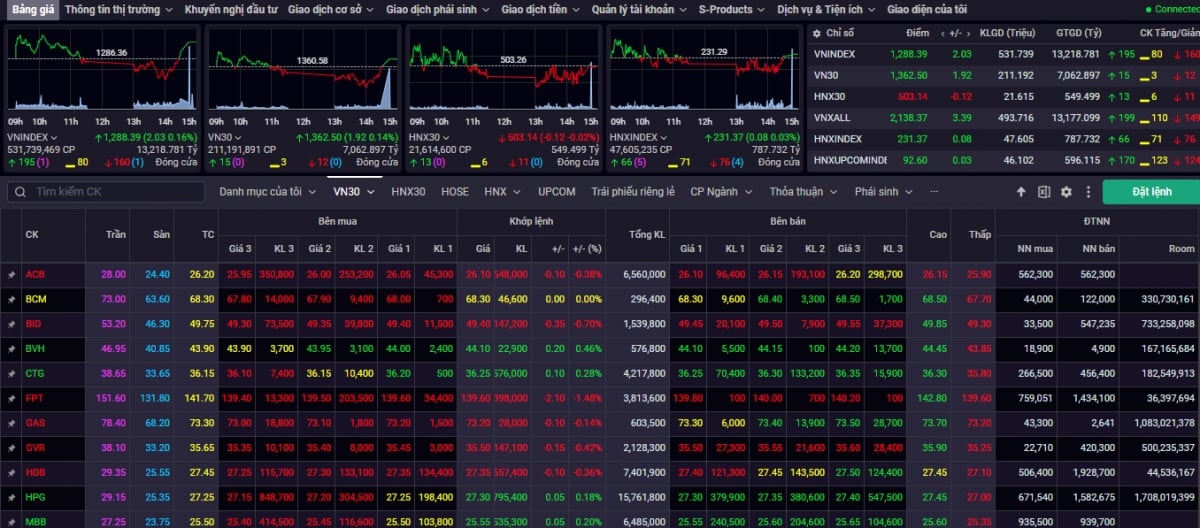

After a week of more than 20 points in early October, the stock market tried to regain its momentum with 4/5 sessions of increase last week. On the technical chart, the VN-Index ended the week up nearly 18 points and had the third consecutive week of sideways trading around the 1,260-1,300 point range. The MACD indicator tended to move sideways and gradually converge, giving a relatively positive signal. In terms of developments, the market traded relatively sideways last week. The market was differentiated and cash flow tended to spread to large-cap stocks in the VN30 basket.

The pillar stocks played a supporting role in the market last week, the VN30 index increased by more than 26 points, contributing greatly to the market's recovery. The negative point came from trading liquidity when caution pulled the matched liquidity below the average of 20 trading sessions. Closing the trading week from October 7 to October 11, the VN-Index closed at 1,288.39 points +17.79 points (+1.40%).

Market liquidity dropped sharply, down -8% compared to the average of 20 trading weeks. Accumulated to the end of the trading week, the average trading liquidity on the HSX floor reached 571 million shares (-25.12%), equivalent to VND 15,228 billion (-17.87%) in trading value.

The market opening quickly regained green with 17/21 industry groups gaining points. Among them, the strong acceleration last week included industry groups such as: Aviation (+8.31%), Telecommunications Technology (+4.20%), Steel (+3.64%),... On the contrary, selling pressure still overshadowed the industry groups: Consumer Goods (-2.36%), Retail (-1.40%), Electricity (-0.61%), Oil and Gas (-0.02%).

According to experts from Kien Thiet Securities Company (CSI), VN-Index had its 4th consecutive session of increase, but the increase was quite weak and liquidity decreased sharply. The matched volume on HSX in the last session of the week, October 11, decreased (-29.3%) compared to the average of 20 sessions, showing that the index's increase lacked support momentum, so the recovery trend has not been confirmed. Although there have been 4 consecutive sessions of increase, the main trend is sideways, sideways within a narrow range. However, this is a positive signal showing that the selling momentum of the previous week's decrease has weakened a lot.

“The VN-Index may surpass the psychological threshold of 1,300 points and move towards the resistance level of 1,320 - 1,330 points, however, with the current developments, the market will probably need more time to accumulate momentum. Because the confirmation signal is not clear, investors should limit opening new buying positions, but continue to gradually increase the proportion of stocks that have made profits in the portfolio. To mobilize all buying power, it is necessary to wait for more clear confirmation signals before taking action,” said the CSI expert.

VN-Index can expect to rise back to the resistance of 1,300 points

According to the analysis team of ASEAN Securities Company (ASEANSC), liquidity decreased quite sharply in the last session of the week with the general market's tug-of-war situation, showing a cautious sentiment when the index approached the resistance zone of 1,292 - 1,300 points. The rapid circulation of cash flow between groups helped strengthen the index's upward momentum, however, the possibility of a breakthrough is not really clear due to weak trend force and low consensus. It is expected that the market will continue to accumulate tightly above the support zone of 1,283 points with demand waiting to be ready for a more decisive increase later.

“We have a good assessment of the medium and long-term market prospects, however, investors should pay attention to potential risks that may come from information from the US stock market in the coming time, so it is necessary to closely observe the world markets to confirm how long the uptrend can continue. Investors should maintain a moderate proportion, avoid chasing the buying mentality, restructure the portfolio to focus on stocks with good fundamentals and positive Q3 business results, and be ready with cash to disburse when large stocks reach attractive levels,” ASEANSC experts noted.

Experts from Saigon - Hanoi Securities Company (SHS), in the short term, VN-Index is growing above the support zone around 1,275 points, equivalent to the average price of the current 20 sessions with the goal of returning to test the very strong resistance, psychologically 1,300 points. In the positive case when VN-Index still maintains the short-term uptrend, it can be expected to rise to the resistance of 1,300 points this week from October 14 to October 18. Currently, VN-Index is fluctuating in a narrow range of 1,280 points -1,300 points and we need to wait for further developments of the market when approaching the above resistance zone. However, with positive growth macro conditions and growing business results, it can be expected that VN-Index can overcome this strong resistance in the near future.

Medium-term trend, VN-Index grows above the support zone around 1,250 points, heading towards the price zone of 1,300 points, expanding to 1,320 points. It is expected that VN-Index will surpass the price zone of 1,300 points to head towards price zones higher than 1,320 points. In which, 1,300 points - 1,320 points are very strong resistance zones, peak prices in June-August 2022 and peak prices in the first months of 2024. These are fundamental resistance zones, the market can only overcome these strong resistance zones when there are good macro support factors, outstanding business growth results. At the same time, uncertain factors such as geopolitical tensions such as the Russia-Ukraine war, the Middle East cool down.

“Investors can consider increasing their weight when macro factors grow beyond expectations and market capitalization is at a reasonable level. However, they should not chase the trend when the VN-Index continues to move towards 1,300 points. Investors should maintain a reasonable weight, below average weight, and new cash flow can still consider increasing their weight when the market is in the stage of receiving business results information. The investment target is to focus on leading stocks with good fundamentals, good growth in Q2 business results, and positive growth prospects for Q3 business results,” SHS experts recommended.

Source: https://vov.vn/thi-truong/chung-khoan/nhan-dinh-chung-khoan-1410-1810-vn-index-co-the-vuot-qua-nguong-tam-ly-1300-post1127881.vov

Comment (0)