Foreign exchange rates, USD/VND exchange rate today, October 16, recorded the USD increasing slightly to the highest level in more than two months.

Foreign exchange rate update table - Vietcombank USD exchange rate today

| 1. VCB - Updated: October 16, 2024 08:29 - Time of website supply source | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| AUSTRALIAN DOLLAR | AUD | 16,228.03 | 16,391.95 | 16,918.31 |

| CANADIAN DOLLAR | CAD | 17,631.08 | 17,809.17 | 18,381.04 |

| SWISS FRANC | CHF | 28,190.91 | 28,475.67 | 29,390.05 |

| YUAN RENMINBI | CNY | 3,414.08 | 3,448.57 | 3,559.30 |

| DANISH KRONE | DKK | - | 3,571.70 | 3,708.58 |

| EURO | EUR | 26,451.35 | 26,718.54 | 27,902.52 |

| Sterling Pound | GBP | 31,744.05 | 32,064.70 | 33,094.33 |

| HONGKONG DOLLAR | HKD | 3,129.34 | 3,160.95 | 3,262.45 |

| INDIAN RUPEE | INR | - | 295.86 | 307.70 |

| YEN | JPY | 161.40 | 163.03 | 170.79 |

| KOREAN WON | KRW | 15.79 | 17.54 | 19.03 |

| KUWAITIAN DINAR | KWD | - | 81,222.27 | 84,471.86 |

| MALAYSIAN RINGGIT | MYR | - | 5,728.64 | 5,853.75 |

| NORWEGIAN KRONER | NOK | - | 2,255.92 | 2,351.77 |

| RUSSIAN RUBLE | RUB | - | 245.43 | 271.70 |

| SAUDI RIAL | SAR | - | 6,624.65 | 6,889.69 |

| SWEDISH KRONA | SEK | - | 2,345.36 | 2,445.01 |

| SINGAPORE DOLLAR | SGD | 18,564.28 | 18,751.79 | 19,353.93 |

| THAILAND | THB | 661.21 | 734.68 | 762.83 |

| US DOLLAR | USD | 24,730.00 | 24,760.00 | 25,120.00 |

Exchange rate developments in the domestic market

In the domestic market, according to TG&VN at 7:30 a.m. on October 16, the State Bank announced the central exchange rate of the Vietnamese Dong to the USD at 24,177 VND, down 16 VND.

The reference USD exchange rate at the State Bank of Vietnam is listed at: 23,400 VND - 25,335 VND.

USD exchange rates at commercial banks are as follows:

Vietcombank: 24,735 - 25,125 VND

Vietinbank: 24,615 - 25,115 VND.

|

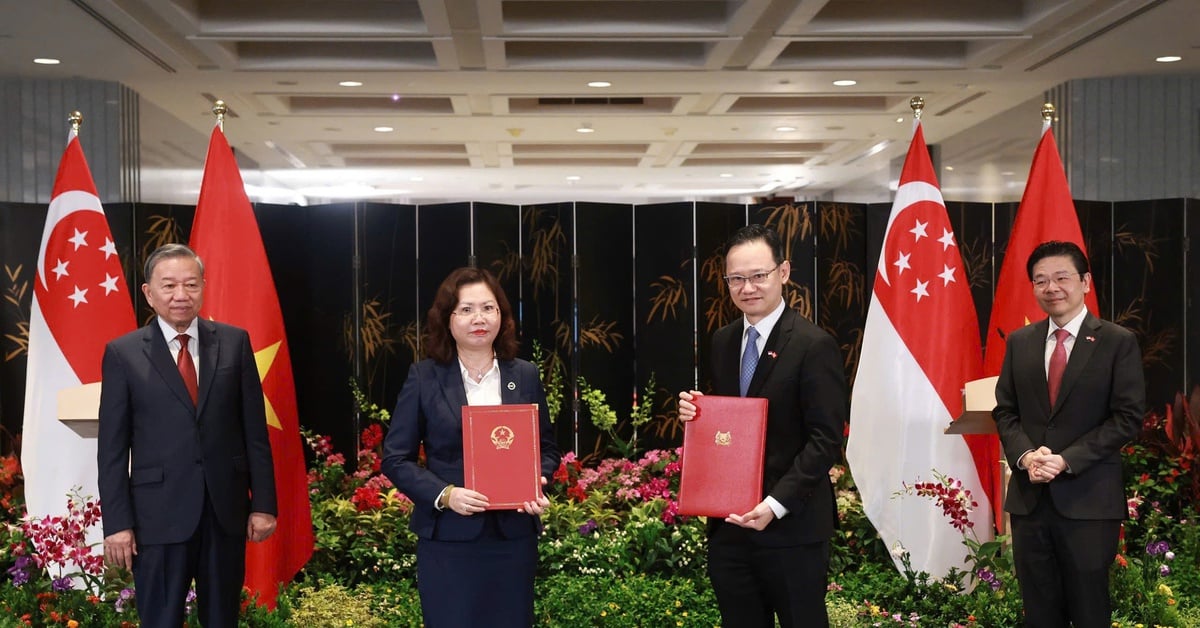

| Foreign exchange rates, USD/VND exchange rate today, October 16: USD reaches two-month high. (Source: Getty Images) |

Exchange rate developments in the world market

Meanwhile, in the US market, the US Dollar Index (DXY) measuring the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) increased by 0.02% to 103.23.

The US dollar edged up to its highest in more than two months on expectations the US Federal Reserve will gradually cut interest rates over the next year or so.

The greenback traded lower for most of the European and US sessions, partly after media reports that Israel was reluctant to attack Iranian oil targets eased market concerns about supply disruptions in the Middle East.

That pushed oil prices lower and dampened inflation expectations, putting slight pressure on the dollar.

However, analysts said the greenback's recent uptrend remains buoyed by geopolitical uncertainties.

Data showed the US economy recovering, while inflation rose more than expected in September, prompting traders to reduce bets on further rate cuts from the Fed.

The bank had previously started its easing cycle with a strong move of 50 basis points at its most recent policy meeting in September, but market expectations have shifted to a slower pace of rate cuts, which has helped boost the dollar.

Traders have placed near-100% odds of a 25 basis point cut next November, according to LSEG calculations.

The market also expects the Fed to cut rates a total of 47 basis points this year and another 100 basis points in 2025, well below the 200 basis point cut that was priced in before the Fed's September meeting.

Elsewhere, the EUR hit its lowest level since August 8 at $1.0882.

The pound edged up to $1.3068 after UK labor market data showed the slowest wage growth in more than two years, a pace that will allow the Bank of England (BoE) to cut interest rates next month.

The dollar also fell 0.4 percent against the yen to 149.25 yen, after the Japanese currency rose to 149.98 earlier in the week, its highest since August 1.

The US dollar has gained 3.8% against the Japanese yen in August so far.

Source: https://baoquocte.vn/ty-gia-ngoai-te-ty-gia-usdvnd-hom-nay-1610-usd-len-muc-cao-nhat-hai-thang-290154.html

Comment (0)