Winning a series of large contracts in the electricity industry

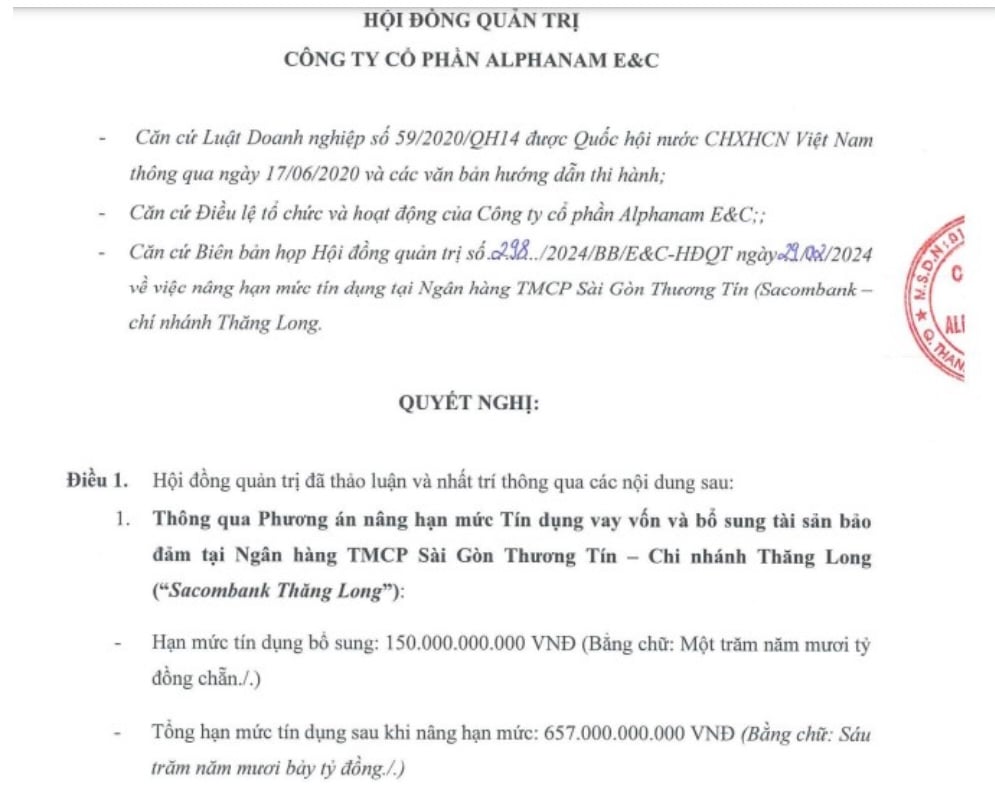

At the end of February 2024, the Board of Directors of Alphanam E&C Joint Stock Company (HNX: AME) approved a Resolution on increasing the credit limit for loans, mortgages, and asset pledges at Saigon Thuong Tin Commercial Joint Stock Bank (Sacombank) from VND 150 billion to VND 657 billion, equivalent to an increase of VND 507 billion.

Additional collateral is all assets/property rights of the Marriott Hotel Complex, Serviced Apartments and Houses for Sale Project at 58 Bach Dang, Hai Chau 1 Ward, Hai Chau District, Da Nang City of Foodinco Real Estate Joint Stock Company.

It is known that Alphanam E&C and Foodinco Real Estate Joint Stock Company are both enterprises belonging to the Alphanam Group ecosystem of businessman Nguyen Tuan Hai.

Alphanam E&C has made a move to increase its credit limit in the context that this enterprise has just won a series of large bid packages in the first 2 months of 2024.

Most recently, on January 30, 2024, Alphanam E&C was selected by the Central Power Project Management Board - National Power Transmission Corporation as the unit to implement Package No. 20: Construction and installation of power lines from VT130 to VT142, project: 500kV Quynh Luu - Thanh Hoa power line, winning bid price of 63,351 billion VND.

Also at the Central Power Project Management Board - National Power Transmission Corporation, Alphanam E&C also won 3 other bid packages with a total winning bid amount of about 271,181 billion VND.

In addition, Alphanam E&C also won Package No. 56: Construction and installation of power lines from VT190 to VT196 (including VT196), invested by the Northern Power Project Management Board - Branch of the National Power Transmission Corporation, with a winning bid of more than 83 billion VND.

Thus, in just the first 2 months of 2024, Alphanam E&C won 5 construction and installation packages in the electricity industry, with a total winning bid value of more than 400 billion VND.

Cash left 25 million VND, debt increased rapidly

Previously, Alphanam E&C announced its financial report for the fourth quarter of 2024 with many notable financial information.

Accordingly, as of December 31, 2023, Alphanam E&C's total assets reached VND 2,516 billion, an increase of VND 370 billion after 12 months.

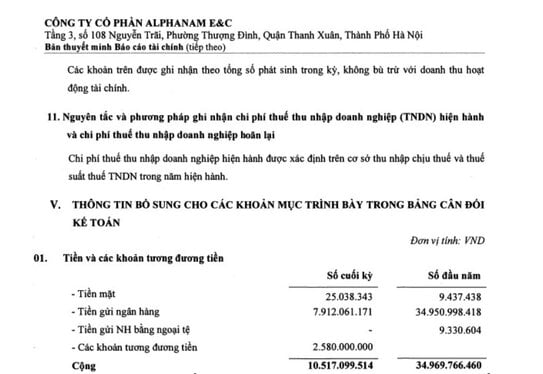

Of which, cash and cash equivalents were about 11 billion VND, a sharp decrease compared to 35 billion VND at the beginning of the year. Including, cash at the company was 25 million VND, bank deposits were 8 billion VND, and cash equivalents were approximately 3 billion VND.

In addition, Alphanam E&C also has nearly 11 billion VND in investments held to maturity, while in the same period it was not recorded.

In addition, Alphanam E&C also recorded an inventory of more than VND 668 billion, down VND 212 billion compared to the same period. Most of the fluctuations in Alphanam E&C's assets last year came from short-term receivables, increasing from VND 1,115 billion (January 1, 2023) to VND 1,747 billion (December 31, 2023).

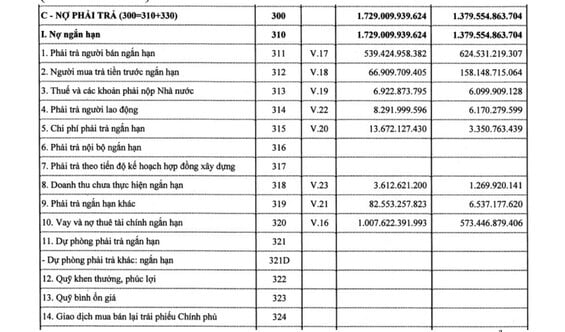

On the other side of the balance sheet, at the end of last year, Alphanam E&C's payables reached VND1,729 billion, an increase of VND350 billion after 12 months. Of which, the company's debt was about VND1,007 billion, a sharp increase compared to VND573 billion at the beginning of the year.

As of December 31, 2023, Alphanam E&C is owing nearly VND 7 billion in taxes and payables to the state, including nearly VND 5 billion in corporate income tax and VND 1 billion in personal income tax.

At the end of 2023, Alphanam E&C brought in 2,215 billion VND in revenue, an insignificant change compared to the same period. At the same time, the company reported a profit after tax of more than 21 billion VND, while in 2022 it was approximately 21 billion VND. With this business result, Alphanam E&C has completed both the revenue and profit targets set at the beginning of the year.

Source

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)