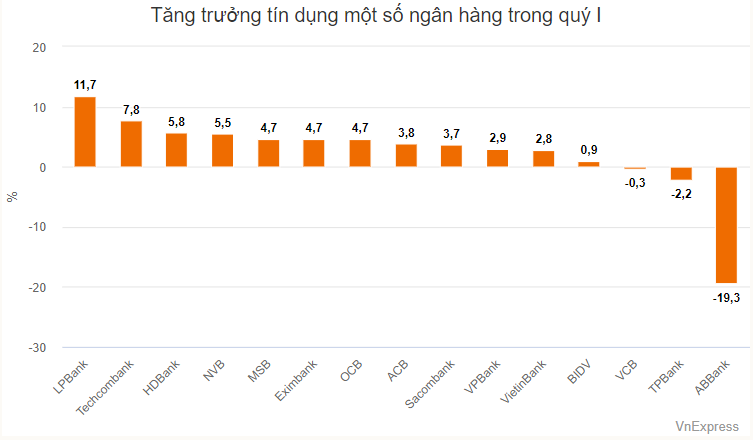

In the first quarter of this year, credit was still a problem for the banking system. In the first two months of the year, this indicator was negative 0.72%. By the end of March, credit to the economy had increased again, reaching 0.9%. However, this figure is the average of the whole system, and each bank has a different development.

The list of high credit growth in the first quarter is entirely private banking. LPBank is at the top with credit growth of 11.7% in the first three months of the year.

The bank's outstanding loans by the end of the first quarter reached more than VND307,000 billion, an increase of more than VND30,000 billion compared to the beginning of the year. The sectors receiving the most capital are wholesale and retail, auto repair, motorbikes, scooters and other motor vehicles, with outstanding loans increasing by about VND15,000 billion in the first three months of the year. This sector also accounts for a quarter of LPBank's total outstanding loans.

Unlike this bank, most of Techcombank's outstanding loans - ranked second in credit growth in the entire system - are devoted to real estate business.

By the end of the first quarter, Techcombank had lent more than VND539,000 billion, an increase of more than VND37,400 billion compared to the beginning of the year. Of this, more than VND17,000 billion was allocated to real estate lending. The proportion of this segment in total outstanding loans increased from 35.21% at the beginning of the year to 35.98% at the end of the first quarter.

Ranked second in terms of the scale of increase in outstanding loans with Techcombank is professional, scientific and technological activities, increasing by nearly 10,000 billion VND in the first quarter. In 2023, this sector will only be lent more than 500 billion VND.

In addition to Techcombank, other banks also recorded an increase in outstanding loans for professional, scientific and technological activities , such as SHB at more than VND 3,200 billion (an increase of nearly VND 3,000 billion in the first quarter), MB recorded more than VND 600 billion (an increase of more than VND 30 billion).

According to VnExpress 's investigation, at the end of 2023, Techcombank and GSM - the electric taxi company of billionaire Pham Nhat Vuong - registered a secured transaction, with GSM mortgaging 3,598 VinFast cars to Techcombank. SHB, MB and a number of other banks also recorded secured transactions with GSM since the beginning of this year.

The banking group saw outstanding loans increase by over 5% in the first quarter, including HDBank and NVB. By the end of March, HDBank had lent more than VND360,000 billion, an increase of about VND20,000 billion compared to the beginning of the year (5.5%). According to the financial statement, the two sectors with the strongest growth were construction and wholesale and retail.

Real estate business or lending to business households accounts for the highest proportion in HDBank's group but has not changed significantly after the first three months of the year.

Compared to other banks, NVB is in the group of high credit growth mainly due to the low base level in the system. The outstanding loans of this bank by the end of the first quarter were more than 58,300 billion VND, an increase of about 3,000 billion compared to the beginning of the year. The increase in outstanding loans is also a positive signal for NVB, when the ratio of bad debt to outstanding loans of this bank is at the top of the system (nearly 29% by the end of the first quarter).

Credit growth is in the range of 4-5% for three banks, including OCB, EIB and MSB. Of which, MSB has a similar risk appetite to Techcombank, when focusing on real estate business and technology - science and technology services.

In the state-owned group, the change was somewhat more modest, partly due to the high scale of outstanding loans, all above 1 quadrillion VND. VietinBank had the best increase in outstanding loans in this group, with 2.8%. BID increased outstanding loans by nearly 1% in the first quarter, while Vietcombank reduced outstanding loans by 0.3%.

In addition to Vietcombank, TPBank and ABBank also recorded a decrease in outstanding debt in the first quarter.

ABBank's loan size by the end of the first quarter was more than VND79,000 billion, down more than 19% compared to the beginning of the year. This bank did not explain in detail the change in outstanding debt, but the explanatory note added that the change was mainly in short-term debt (down from VND56,900 billion to VND41,200 billion).

According to the analysis team of SSI Securities Company (SSI Research), low credit growth at the beginning of the year reflects the weak credit demand of the economy. Except for real estate loans (up 1.52%) and securities-related industries (up 2.56%), most industries are facing difficulties, especially consumer loans (down 1.77%). "This explains why domestic consumption has not recovered in the first two months of 2024. However, the situation has shown an improvement trend in March," SSI Research commented.

In particular, credit flow into the real estate industry continues to expand due to high capital demand from investors, with the need to restructure loans.

"If we exclude the An Dong bond lot (related to Van Thinh Phat), the estimated amount of non-bank corporate bonds maturing in the first two months of the year is about VND10,000 billion. We believe that loan restructuring activities may limit the recognition of bad debt in the coming quarters," the analysis team assessed.

TN (according to VnE)Source

Comment (0)