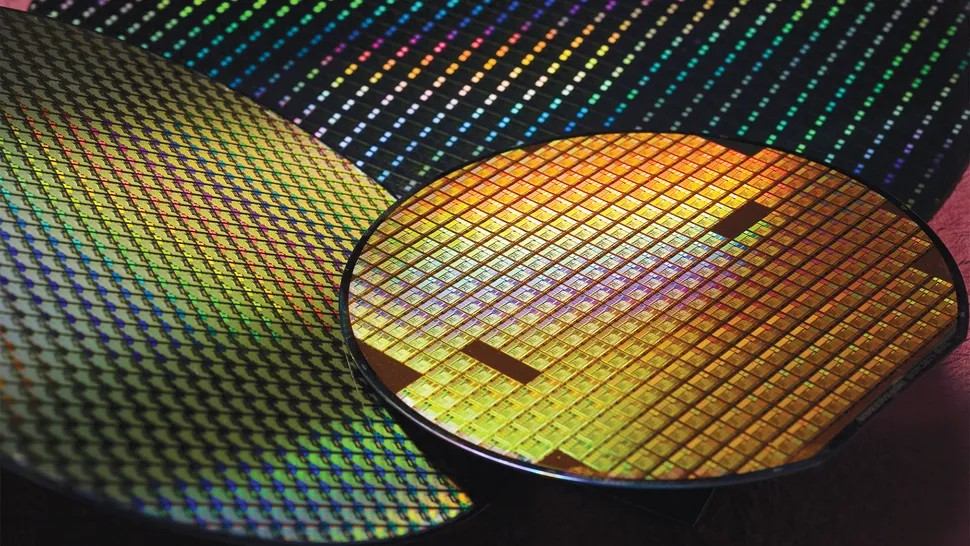

China has changed the way it determines the origin of integrated circuit (IC) products, amid increasing trade tensions with the US.

The move is expected to give a significant advantage to domestic semiconductor companies while undermining US President Donald Trump's efforts to re-industrialize.

Specifically, on April 11, the China Semiconductor Industry Association (CSIA) sent an "urgent notice" to members via the WeChat application.

In it, CSIA cited new regulations from China's customs agency, stating that from now on, the origin of chips will be determined based on the "location of the wafer fabrication plant" .

This is an important step in the semiconductor supply chain, along with design, packaging and testing. Under the new regulations, regardless of whether the chip has been packaged or not, when carrying out import procedures, businesses must declare the wafer manufacturing location as the origin of the goods.

Previously, the method of determining origin was based on “final assembly or transformation,” meaning the country where the finished product was assembled would be recorded as the country of origin. The United States is now also applying this method.

For example, a memory IC designed in the US, wafer fabricated in Japan, but packaged in China, would be considered a Chinese-origin good and subject to corresponding tariffs.

China's adjustment of the product origin definition for semiconductor chips is expected to encourage semiconductor developers to prioritize processing products at domestic foundries such as SMIC, Hua Hong, or at facilities of TSMC - a major processing partner present in China.

Once identified as Chinese-origin goods, these products will be exempt from the 125% tariff that Beijing currently applies to imports from the US.

This is a positive signal for major technology companies such as Apple, AMD, Nvidia and Qualcomm – companies that rely heavily on TSMC and Samsung Electronics for chip manufacturing.

However, according to sources from Tom's Hardware and the South China Morning Post (SCMP), the new regulation could be detrimental to businesses such as Intel, Global Foundries and Texas Instruments - companies that maintain chip production operations mainly in the US.

According to a report from consulting firm ICWise, this change could have significant impacts on the US semiconductor industry, in the context that China - the world's largest IC consumer market - tends to limit the acceptance of products manufactured in the US.

This could prompt global semiconductor manufacturers to step up building factories outside the US to maintain access to the Chinese market.

As a result, President Donald Trump's goal of "making America great again" - with a focus on restoring domestic manufacturing - is at risk.

However, according to Mr. He Hui - Director of semiconductor research at Omdia - the actual impact of the tariff regulation may not be too serious, because the majority of chips imported into China are not currently manufactured or shipped directly from the US.

He also stressed that China will continue to maintain strong support for the domestic semiconductor industry, not only in production but also in key areas such as raw materials and technological equipment – which are still dependent on foreign supplies.

Tariffs are already disrupting the global chip supply chain, with US chipmaker Micron Technology, which has factories in China, Japan, Malaysia and Singapore, recently announcing it would impose surcharges on some of its product lines to offset the impact of tariffs.

According to statistics from China's customs agency, in 2024, the country imported integrated circuits (ICs) worth 386 billion USD, up 10.4% over the same period last year.

(According to SCMP, Tom's Hardware)

Source: https://vietnamnet.vn/trung-quoc-sua-mot-chi-tiet-ban-dan-my-dung-ngo-khong-yen-2390455.html

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)