Private debt accounts for 44% of total debt in the entire economy.

At the workshop, Deputy Governor of the State Bank of Vietnam (SBV) Dao Minh Tu said that the banking sector has many policies to support businesses, especially small and medium-sized enterprises (SMEs), such as restructuring debt repayment terms and reducing lending interest rates when businesses face difficulties in capital flows or natural disasters such as storms and floods. This is a very practical support policy to help businesses maintain production activities.

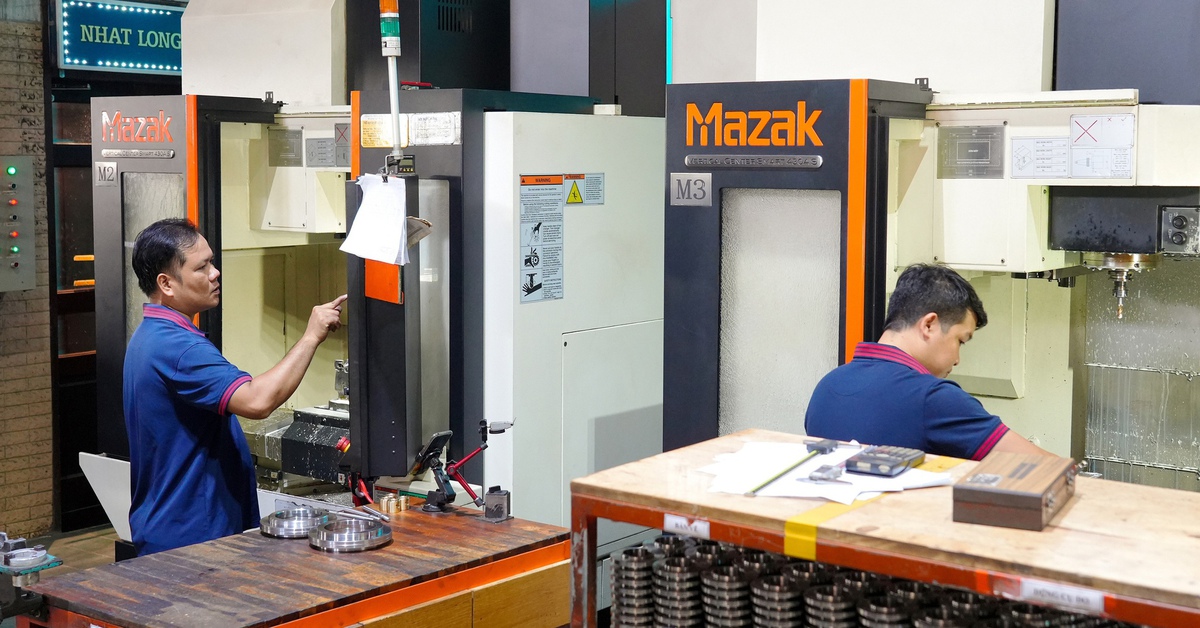

Up to now, the bank's credit activities for the private economy have achieved very positive results. Outstanding credit loans for private enterprises by the end of 2024 reached about 7 million billion VND, an increase of 14.7% compared to 2023, accounting for 44% of the total outstanding loans of the whole economy.

“With capital accounting for 44% of total outstanding loans, the lending turnover to the private economy is very large,” said Deputy Governor Dao Minh Tu, affirming that most credit institutions lend to SMEs in particular and the private economy in general. The number of 208,992 SMEs with outstanding loans shows that bank credit capital has promptly met the capital needs for production and business purposes of private enterprises, while contributing to promoting economic development and increasing revenue for the state budget.

Ms. Phung Thi Binh, Deputy General Director of the Vietnam Bank for Agriculture and Rural Development (Agribank) informed that with the goal of economic growth reaching 8% in 2025, Agribank was announced to increase credit growth by 13% with an absolute figure of 230 trillion VND. Meanwhile, with the current outstanding debt of 1.74 trillion VND, 90% is for the private economic sector. "The above figures show that we are very interested in private economic customers, especially when Agribank is always associated with the mission of developing rural agriculture and farmers" - Ms. Binh said.

Currently, Agribank is implementing 9 preferential credit programs for all subjects, including 8 programs for private economic households, including import-export enterprises, small and medium enterprises, consumer production and business, etc. In these programs, the interest rate applied is 1-2% lower than normal loans and there are preferential programs for import-export and participation in the value chain.

In the coming time, Agribank hopes to provide capital to small and medium enterprises to have effective business plans and have a source to repay the bank. In the current context, with the target of 8% economic growth and the next phase of double-digit growth, the pressure to mobilize capital is very large. With the fact that Agribank is a 100% state-owned bank, the capital to increase charter capital comes from the state budget. Agribank has proposed to the National Assembly to retain profits and pay them to the state budget to increase capital.

In addition, Agribank is implementing a reasonable capital structure to maintain mobilization interest rates to support businesses.

Solutions for private sector to better access bank capital

Although the private economic sector has developed strongly, enterprises still face many difficulties. Most enterprises are small and medium-sized, with limited financial potential and competitiveness. "This is also one of the reasons why private enterprises still face many difficulties in accessing capital, although the credit quality in this sector is quite good. This is also the foundation for the banking sector to continue to promote credit for private enterprises in the coming time," said Mr. Tu.

|

Delegates contribute solutions to help the private economy access capital from banks better. |

Mr. Tu also said that in recent times, the banking sector has had policies to reduce interest rates, in which SMEs are defined as one of the five subjects entitled to low interest rates if they meet the conditions for accessing loans. This is a huge advantage in terms of interest rates. Loan terms, repayment terms, and access procedures also have better conditions... All of these things show equality in policies and mechanisms between state-owned enterprises and private enterprises, only the access conditions are different.

For example, in agriculture and rural areas, which are mostly small-scale economic models and collective economies, there are many preferential policies. The most recent is Resolution 55 and in the future there will be more open and liberal policies. There are many differences in the market economy, but Vietnam has provided timely support. That is the potential and opportunity of the private economy.

In the coming time, with the development of technology and creative economy, in addition to existing support, the State Bank has been researching to have stronger solutions for capital in the private economy; organizing many seminars and talks to increase the access of private enterprises to bank capital even more.

ASCO Auditing Company Chairman Nguyen Thanh Khiet said that the Government and financial institutions need to increase capital for credit guarantee funds and expand the scope of guarantees to help more SMEs access capital more easily. At the same time, it is necessary to improve the guarantee process to ensure transparency and efficiency, helping businesses save time and costs when accessing capital.

In addition, it is necessary to promote alternative financial models to expand capital mobilization channels such as financial leasing, supply chain credit by allowing businesses to borrow based on input and output contracts, helping them maintain production activities without collateral; crowdfunding); peer-to-peer lending; Directly connecting investors and businesses, reducing strict requirements of banks and helping small businesses access capital more easily...

![[Photo] Overview of the Workshop "Removing policy shortcomings to promote the role of the private economy in the Vietnamese economy"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/d1c58c1df227467b8b33d9230d4a7342)

![[Photo] Prime Minister Pham Minh Chinh receives the head of the Republic of Tatarstan, Russian Federation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/7877cb55fc794acdb7925c4cf893c5a1)

Comment (0)