(NLDO) – Real estate has opportunities but you should not borrow too much to invest, stocks are expected when the economy grows and there is a wave of upgrading...

In 2024, VN-Index will increase by about 12% but in reality many investors will still lose money; real estate only has opportunities in a few segments, the rest is still quiet.

Entering the new year of At Ty 2025, reporters from Nguoi Lao Dong Newspaper recorded opinions on the opportunities of these investment channels.

Economist, Dr. Dinh The Hien:

Stocks are still "bright", real estate is not "easy to eat"

The real estate market has just recovered in the apartment segment because it had not increased much before. The price level is still low, so apartments are attracting more attention and transactions are more active than before. However, this segment is not enough to be a reference for the whole market.

Real estate this year cannot be too bright because the prices of the segments are still high compared to the income of many people. If the prices are too high, buyers will be hesitant and liquidity will not increase strongly. This investment channel has opportunities but is only suitable for those who have done careful research and evaluated each potential segment to achieve good profits. In particular, you should not borrow too much to buy real estate because of the high risk.

Real estate has mainly recovered in the apartment segment in recent times.

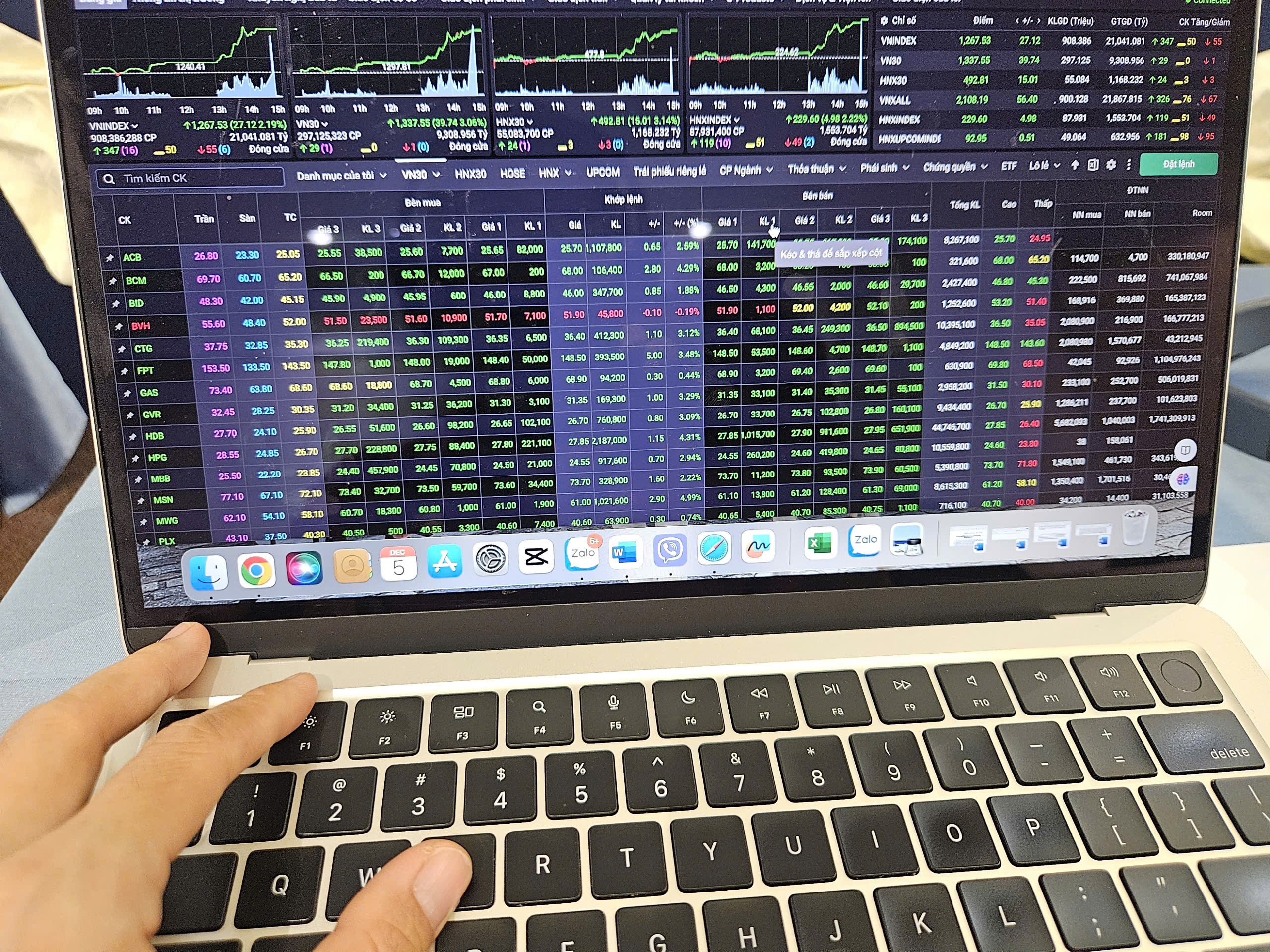

With stocks, the market will be brighter because gold investment channels have increased very hotly, real estate is facing difficulties. Recent policies show the Government's determination to upgrade stocks from frontier to emerging markets, which will be the driving force to attract foreign capital back.

However, when the economy develops stably, investment channels can hardly bring profits too high 20 - 30%/year. This profit level is only for a group of talented people who accept high risks in many stages.

Individual investors should not set their expectations too high for big profits when trading stocks.

Financial expert Phan Dung Khanh:

How to allocate capital to investment channels

Securities have potential as the economy moves towards the digital age. In 2024, the VN-Index will increase by 12% but high returns will be concentrated in technology stocks amid the booming trend of AI and semiconductor chips. In particular, financial and real estate stocks account for a large proportion of the market but have not increased as expected.

In 2025, technology stocks are expected to maintain their attractiveness, especially as the Government cooperates with NVIDIA to build AI centers, promote the development of the semiconductor industry, digital transformation...

Securities are considered an investment channel with many opportunities this year.

Energy, raw materials, consumer goods, transportation and real estate groups are all expected to open up positive trends. Many stocks in the mid-cap group have positive business results but still decreased, but are expected to grow. Individual investors can choose stocks expected to grow higher than the increase of VN-Index.

With real estate, the market has escaped the bottom and will continue to recover in 2025 - 2026. If dividing capital into investment channels this year, it can be divided into 40% for stocks, 40% for real estate and 20% for gold depending on the risk appetite of each individual investor.

Mr. Dao Hong Duong, Director of Industry and Stock Analysis, VPBank Securities Company:

Neck potential bank notes

Banking will be the industry leading the market up. With the current expectation of double-digit GDP growth in 2025, credit growth must be around 16-18%, along with the pressure to disburse public investment, the banking industry's profit outlook will be higher than 2 years ago. The banking industry will have profit growth, financial indicators ROE and ROA almost lead the market, helping stock prices reflect this result.

The capitalization of the banking industry accounts for a very large proportion, about 25 - 30% of the total capitalization of HOSE. Banks have all the factors of liquidity, capitalization, receiving the attention of financial institutions, foreign investors as well as cyclicality and reasonable valuation.

Source: https://nld.com.vn/sau-tet-xuong-tien-mua-bat-dong-san-hay-dau-tu-co-phieu-196250202113250042.htm

Comment (0)