In the last two months of the year, nearly 670,000 billion VND of capital will be pumped into the economy to achieve the credit growth target of 15% this year. Currently, banks are racing to increase credit growth.

"Push" growth year end credit

Mr. Nguyen Khac Duy - Deputy Director of Chon Chinh Company, a rice exporting enterprise - said that the number of orders this year of the enterprise increased by 200% thanks to expanding the export market. The increase in orders has led to the increase in the capital demand of the enterprise. Fortunately, 2 bank Enterprises with credit relationships are reducing lending interest rates from 7%/year to 5 - 5.5%/year. It is expected that enterprises will continue to borrow more capital to invest in machinery and factories to expand production scale.

According to the report of State Bank, premises loan interest rate has decreased by about 2.5%/year in 2023; in the first 10 months of this year, the average lending interest rate has decreased by 0.76%/year compared to the end of 2023. Currently, banks are implementing a series of preferential credit packages, lending at low interest rates to promote credit growth at the end of the year, with short-term lending interest rates ranging from 4.5-6.5%/year; medium and long-term interest rates below 9%/year.

To increase access to capital for businesses and promote credit growth, banks are implementing many packages. credit Large-scale incentives to serve the year-end business season with short-term loan interest rates ranging from 4.5-6.5%/year; medium and long-term interest rates below 9%/year.

Specifically, Sacombank has a credit package short term loan with a scale of 15,000 billion VND with interest rates from only 4.5%/year for corporate customers, and for individual customers interest rates from only 5.5%/year when borrowing for production and business.

ACB currently allocates about VND5,000 billion to finance small and medium enterprises, meeting production, business, import and export needs.

Agribank has a credit package of 20,000 billion VND for businesses in the fields of agriculture, aquaculture, processing and import of raw materials with interest rates starting from only 2.6%/year for terms under 3 months...

Ms. Phung Thi Binh - Deputy General Director of Agribank - said that from the end of the second quarter to the beginning of the third quarter, credit has improved. At Agribank, compared to the first 6 months of the year, credit growth is much higher, showing that businesses' capital needs will be more positive. The bank strives to achieve target minimum assigned by the State Bank.

Credit growth will boost GDP growth

According to experts from VPBanks, the State Bank has expanded credit room for banks that achieve 80% or more of their assigned quota, based on their rating scores. This policy will promote competition among banks in gaining credit room and market share, leading to a trend of more preferential interest rates, which is beneficial to borrowers.

On credit supply, State Bank has operated in the direction of creating the most favorable conditions for credit institutions to provide credit. The operator has implemented many solutions, directing credit institutions to review procedures loan capital to shorten the time, better support people, and at the same time make some recommendations to relevant ministries and sectors to implement solutions to improve credit conditions, especially for small and medium enterprises.

With the 15% credit growth plan set by the banking industry for the whole year, the banking system will have to pump more than 2 million billion VND into the economy.

According to the report of According to the State Bank, by the end of October, credit had increased by about 10.08%. This figure is higher than the 7.4% increase in the same period last year. Thus, nearly 670,000 billion VND will be pumped into the economy in the last 2 months of this year.

Associate Professor Dr. Nguyen Huu Huan - senior lecturer at Ho Chi Minh City University of Economics - said that promoting credit growth to support economic growth must be reasonable and should not be done at all costs, especially controlling inflation. This expert said that if 670,000 billion VND flows into production, business and people's consumption, it can create GDP growth exceeding 6%.

Source

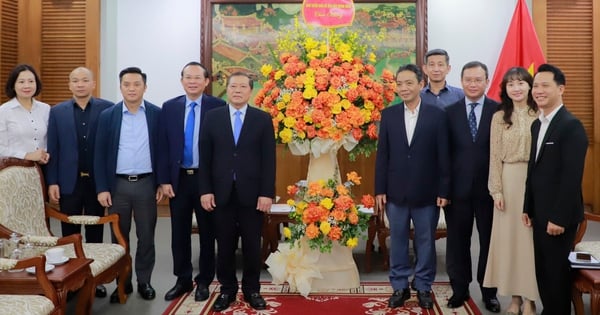

![[Photo] Head of the Central Propaganda and Mass Mobilization Commission Nguyen Trong Nghia received the delegation of Nhan Dan Daily](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/25/cdb71275aa7542b082ec36b3819cfb5c)

![[Photo] Nhan Dan Newspaper Youth Union visits Vietnam Military History Museum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/25/374e4f70a35146928ecd4a5293b25af0)

![[Photo] Prime Minister Pham Minh Chinh meets with the Ministry of Education and Training; Ministry of Health on the draft project to be submitted to the Politburo](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/25/c0e5c7348ced423db06166df08ffbe54)

![[Photo] General Secretary To Lam chairs the Standing Meeting of the Central Steering Committee on preventing and combating corruption, waste and negativity](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/25/839ea9ed0cd8400a8ba1c1ce0728b2be)

Comment (0)