The incoming administration of President-elect Donald Trump will probably succeed if it maintains an economy that is currently doing very well.

US President-elect Donald Trump campaigned on promises of high tariffs, tougher immigration restrictions, deregulation and a smaller government, but the economy he takes over next week may be asking for a different approach. Namely, don’t break anything.

With growth above trend, a labor market near full employment and still adding jobs, and inflation simmering, President-elect Donald Trump can deliver on his promised reforms to an economy that doesn’t need the kind of stimulus his 2017 tax cuts provided. The stock selloff after last week’s December jobs report suggests the economy could also be vulnerable to a correction as asset prices soar and bond markets push yields higher.

|

| The US economy is doing very well - Illustration photo |

The incoming administration of President-elect Donald Trump will probably succeed if it maintains an economy that is currently performing very well, according to Mark Zandi, chief economist at Moody's Analytics.

Donald Trump will be inaugurated as US President next week in a very different economic landscape than when he began his first term in 2017.

The situation is different now, said Karen Dynan, an economics professor at Harvard University and a former official in the Obama administration. Inflation, which has not been fully tamed since a surge during the pandemic, has shown little improvement year-over-year in recent months. President-elect Donald Trump will also face larger budget deficits and higher government borrowing costs than before, along with a faster-than-expected labor force growth due to immigration, which Trump wants to curb.

Regarding the recent economic performance of the US, which has far surpassed other developed countries and surprised many economists, Professor Karen Dynan said: “ If you believe that above-trend economic growth is due to immigration, it will be difficult to achieve the large numbers seen at the end of the Joe Biden administration .”

New context

When Donald Trump first entered the White House in 2017, the economy had been growing steadily since the end of the 2007-2009 financial crisis, but the pace was often sluggish and employment had not fully recovered. There was room for the “Tax Cuts and Jobs” bill to provide a boost, and although tariffs have since hurt the global economy, the US has shown remarkable resilience.

The longest economic expansion in modern US history ended only when the COVID-19 pandemic began in March 2020.

Inflation was not a concern then, staying below the Federal Reserve's 2% target. Homebuyers could find 30-year fixed mortgages at around 4%, and the government financed its operations with long-term Treasury bonds at around 3%.

Inflation is now above the Fed’s target, mortgage rates are near 7%, and the 30-year Treasury yield is around 5% and rising. This may reflect market skepticism about whether inflation is under control and about the future of U.S. fiscal discipline.

“ There is still concern that inflation may not be under control… We will address that, so please don’t worry, ” Federal Reserve Governor Christopher Waller said last week, referring to rising long-term bond yields. But “ the other issue that is getting more and more attention is the concern about the budget deficit… If that doesn’t change in the future, at some point the market will demand something to make up for it .”

Although President-elect Donald Trump has created an informal Department of Government Efficiency to find savings, there is no plan to address the main causes of the deficit: the costs of health care and retirement benefits for seniors, which are considered sacrosanct by both political parties.

“ The US economy is doing very, very well”

If government borrowing costs and bond market wariness are among the potential headwinds for President-elect Donald Trump, the state of the economy could pose another challenge.

Key data that Fed staff and officials watch, including figures on employment, inflation, consumer spending and overall growth, may not have much room for improvement without risk.

For example, the unemployment rate in December 2024 was 4.1%, near or well below estimates of what is considered a sustainable level without triggering inflation, and the economy added an impressive 256,000 jobs. With wages rising, consumer spending has held up well. Inflation is moderating but remains more than half a percentage point above target, with concerns that it could flare up again from any drastic moves to boost output that may already be above potential, or from additional costs from things like tariffs.

“ The U.S. economy is doing very, very well ,” Fed Chairman Jerome Powell told reporters on Dec. 18, 2024, at the central bank’s final policy meeting of 2024. “ But we have to continue to do the job ,” with monetary policy still needing to be tight enough to bring inflation back to 2% while maintaining labor market stability.

Between President-elect Donald Trump's plans and the strength of the economy, there are growing doubts about whether the Fed can cut interest rates further.

The uncertainty about the future stems from the gap between President-elect Donald Trump's expansive statements about what he thinks the economy needs and actual economic performance, particularly over the past year.

Fed officials said at a meeting last month that slower growth and higher unemployment would likely be immediate consequences of trade and other expected policies. Policymakers highlighted the uncertainty they are thinking about.

Businesses themselves remain optimistic about conditions ahead, despite potential disruptions from tariffs and deportations, with Richmond Fed President Tom Barkin saying last week: “ I expect more positives than negatives on growth ,” although he also acknowledged inflation risks.

And, he also said of the incoming administration's likely policy initiatives that some policies will need to be adjusted if they hurt the economy.

| Although President-elect Donald Trump has created an informal Department of Government Efficiency to find savings, there is no plan to address the main causes of the deficit: health care costs and retirement benefits for seniors, which are considered sacrosanct by both political parties. |

Source: https://congthuong.vn/kinh-te-my-co-the-khong-can-den-cac-cai-cach-lon-369602.html

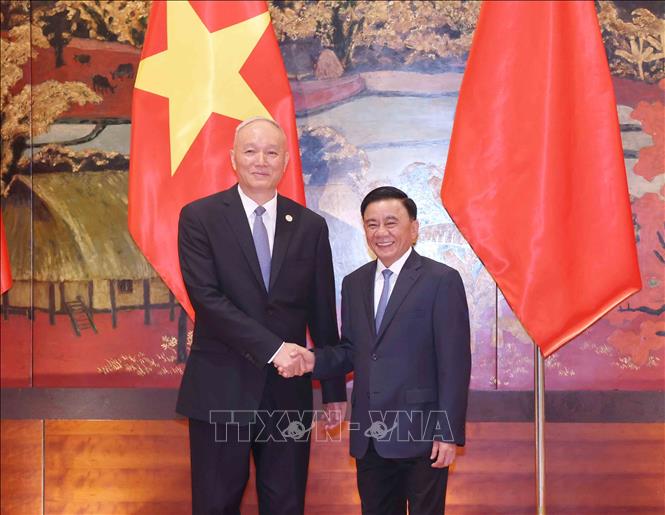

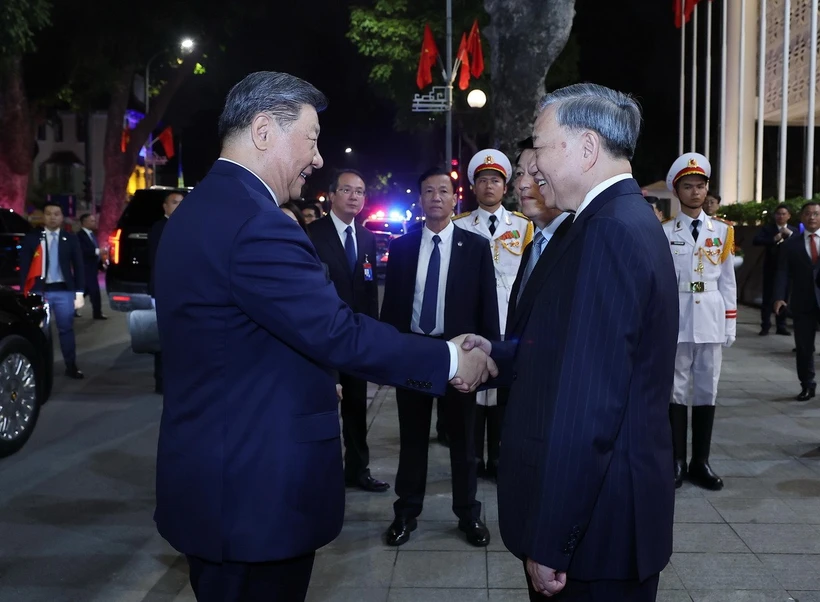

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

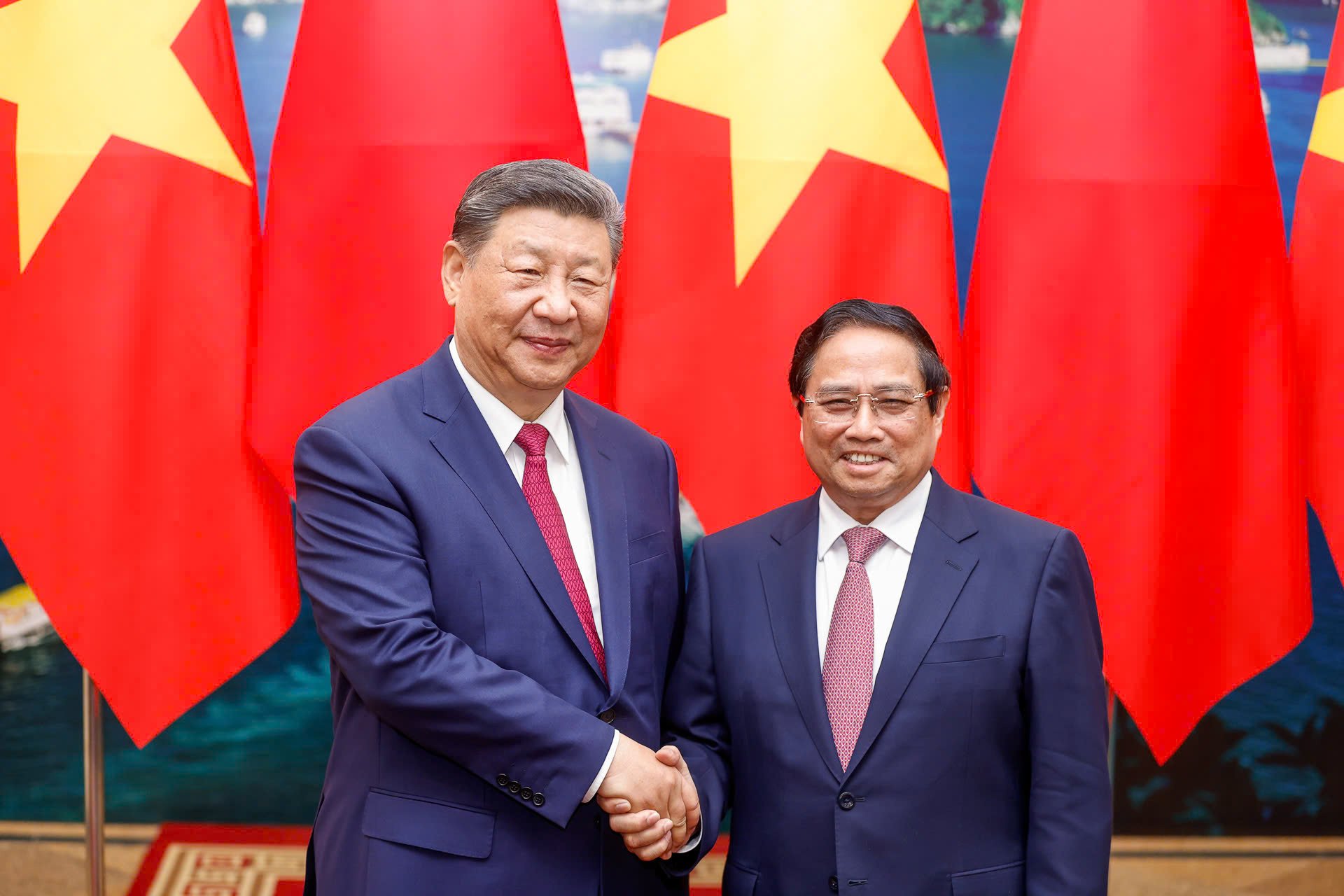

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

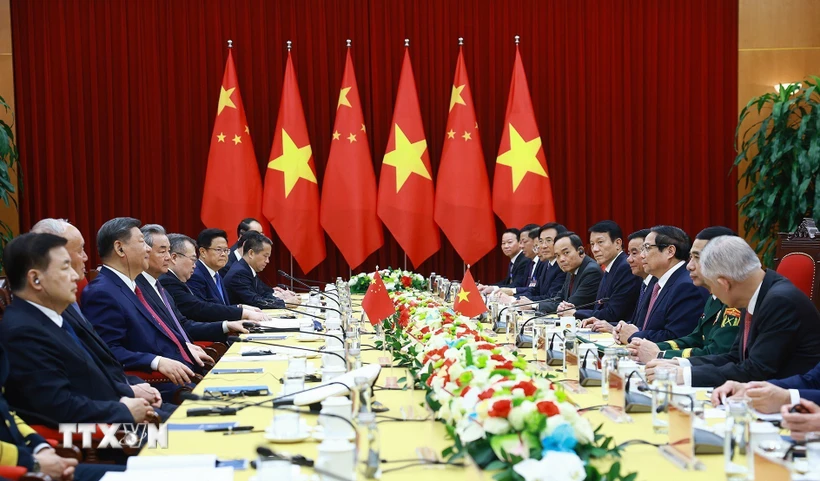

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

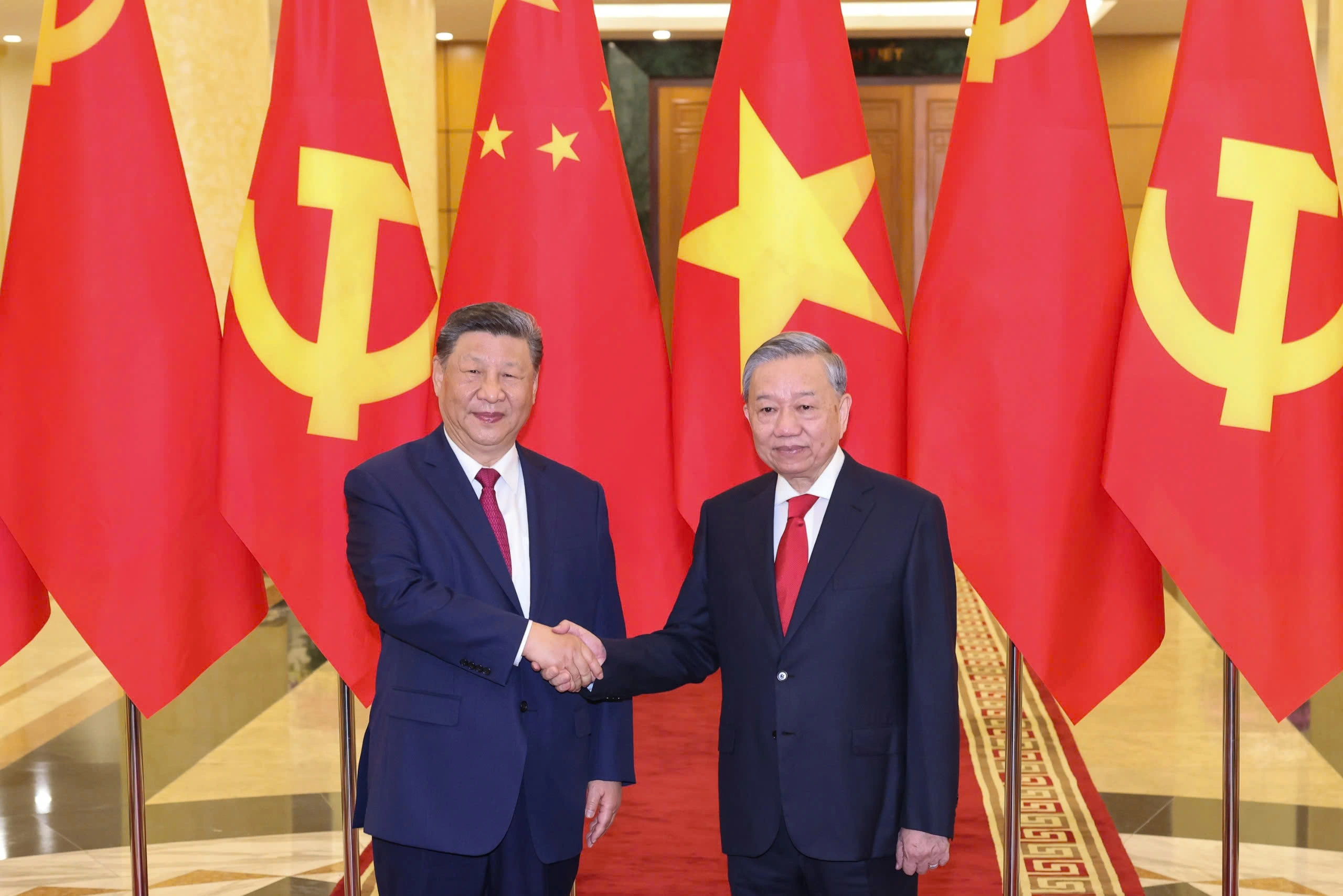

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9afa04a20e6441ca971f6f6b0c904ec2)

Comment (0)