Oman's investment fund is about to become a major shareholder of Van Phu – Invest

By converting bonds into shares, VIAC Limited Partnership Fund – an investment unit under the Vietnam Investment Fund of the Oman National Investment Commission – Sultanate of Oman (VOI) will become a shareholder of Van Phu – Invest (stock code VPI – HoSE) in the near future.

|

| VOI will convert 690,000 bonds issued by Van Phu – Invest into VPI shares at maturity. |

The cooperative relationship between Vietnam Oman Investment (VOI) and Van Phu – Invest

In the Vietnamese financial market, Vietnam Oman Investment (VOI) is a familiar name. Established in 2009, VOI is a joint venture between the Sultanate of Oman Investment Commission and the State Capital Investment Corporation (SCIC). Over the past 15 years, this fund has disbursed about 300 million USD, focusing on sectors with competitive advantages and contributing to the long-term sustainable development of the Vietnamese economy such as infrastructure, energy, education, real estate, healthcare, etc.

With Van Phu – Invest, VOI joined hands at the end of 2021 to seek investment opportunities in the real estate sector in Vietnam. Accordingly, VOI purchased 690,000 convertible bonds, without warrants, with a total value of VND 690 billion issued by Van Phu – Invest. The bond package has a term of 3 years, the collateral is 27.225 million common shares of Van Phu – Invest (code VPI) owned by a third party.

According to the agreement, VOI will convert all of the above convertible bonds into VPI shares at maturity. The conversion price is VND 35,000/convertible share, with adjustments specified in the bond purchase registration contract.

Van Phu – Invest said that the capital mobilized from VOI will be used to invest in key projects such as: Phong Phu Riverside (453 billion VND), BT Saigon (100 billion VND), the remaining amount will be used to supplement capital for the Company's business activities.

The bond package will mature in November. Van Phu – Invest and VOI have reached an agreement on converting the bonds into shares. Accordingly, the conversion price after being adjusted according to clause 6.2 of the contract is VND 23,271/convertible share, the number of convertible shares is 29.65 million shares.

At the annual general meeting of shareholders held earlier this year, the plan to issue shares to convert the above bond package was also approved by Van Phu – Invest. The 29.65 million shares issued to convert bonds to VOI will be equivalent to 9.26% of the total expected number of shares of Van Phu – Invest at the time of conversion.

Thus, after the conversion is completed, VOI will officially become a major shareholder of Van Phu – Invest.

Improve operational efficiency

VOI and Van Phu – Invest share the same goal of sustainable development. With the participation of VOI, Van Phu – Invest has gained a prestigious major shareholder, increasing the financial capacity as well as brand value for the Company.

In fact, Van Phu - Invest leaders always consider VOI as a long-term, strategic partnership, together developing Vietnamese real estate, bringing value to consumers, making practical contributions to society and improving operational efficiency for both parties.

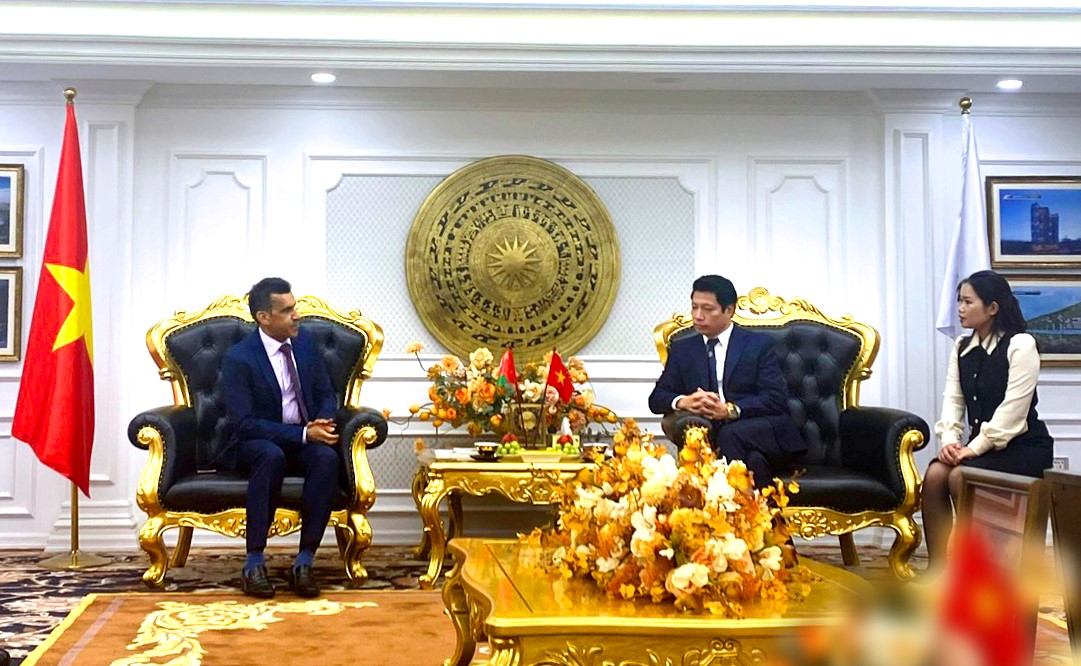

|

Leaders of Van Phu – Invest and VOI in a working session at Van Phu – Invest headquarters |

Van Phu - Invest is currently a leading enterprise in the Vietnamese real estate market, with a total asset value of nearly 12,000 billion VND and a huge project portfolio, spanning across the country, notably: Van Phu urban area, The Terra - An Hung, Grandeur Palace Giang Vo, Vlasta - Sam Son... The company is accelerating the implementation of a series of key projects such as: The Terra Bac Giang, Vlasta Thuy Nguyen - Hai Phong... contributing significantly to solving the market's thirst for supply.

According to the Company's Board of Directors, in the next 10 years, Van Phu - Invest will steadfastly develop real estate with the following pillars: focusing on developing a single product line, Vlasta, developing a chain of resort projects with its own identity, and developing multi-functional high-rise complex projects in major cities. Van Phu - Invest's goal in the next 5 years is to double revenue and profit compared to 2023. Revenue in the next 10 years will reach about 500 million USD.

Comment (0)