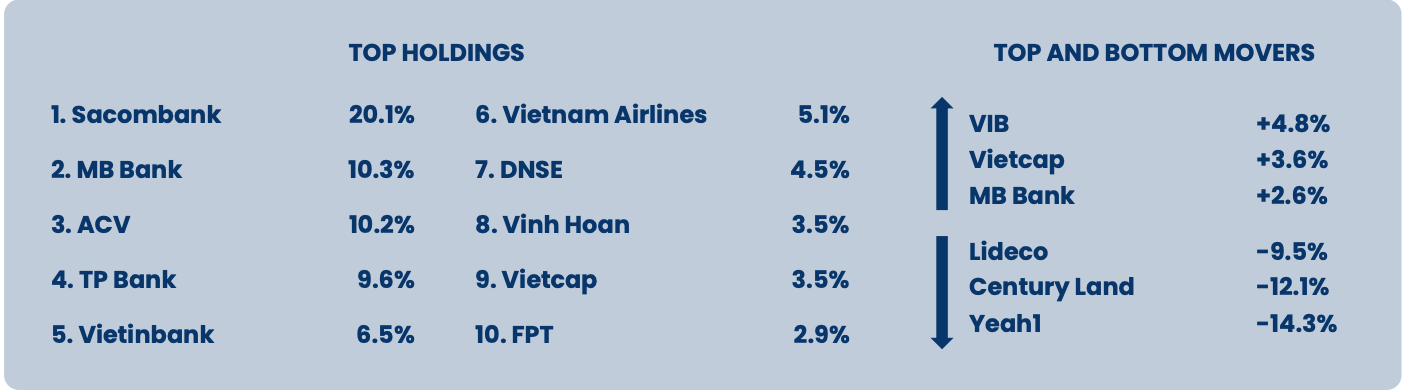

Currently, banking stocks continue to account for the majority of PYN's investment portfolio. The most held stock is STB ( Sacombank ) with a weight of 20.1%, followed by MBB, TPB, CTG.

Currently, banking stocks continue to account for the majority of PYN's investment portfolio. The most held stock is STB (Sacombank) with a weight of 20.1%, followed by MBB, TPB, CTG.

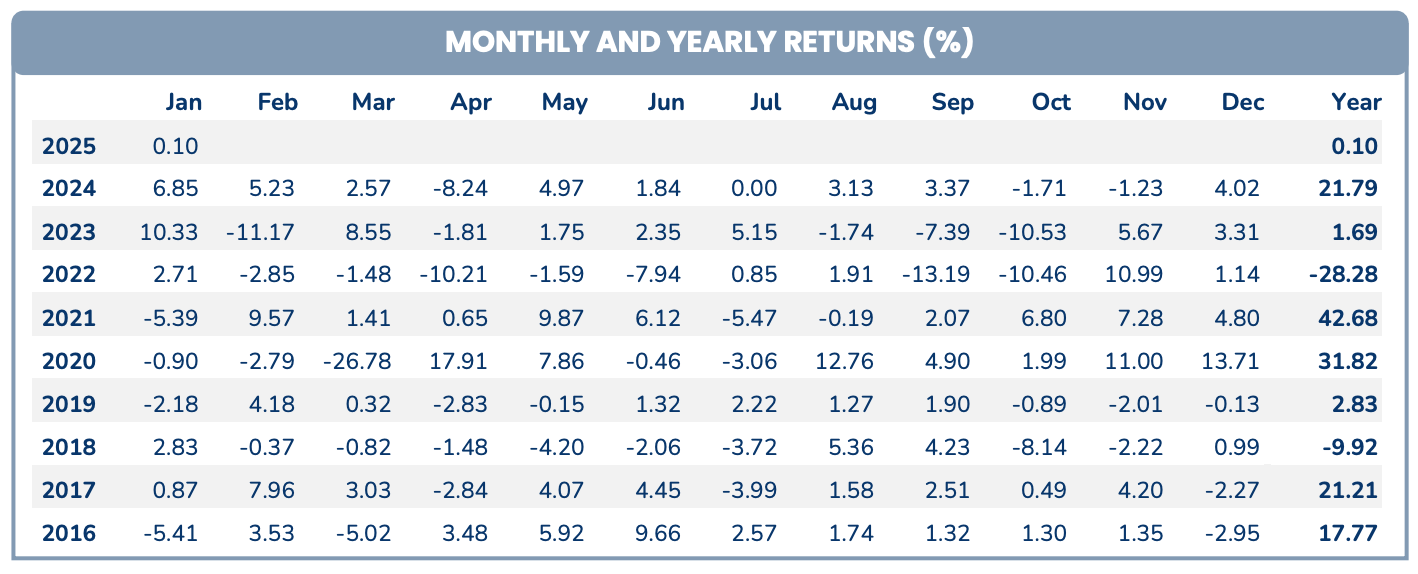

Finnish investment fund PYN Elite has just reported its performance in January 2025 with a performance increase of only 0.1%.

This is the lowest increase in January in the last 4 years (2022 - 2025) and a sharp decrease compared to the previous month (4.02% in December 2024).

|

| PYN Elite Fund Performance by Month |

PYN Elite said that this performance level slightly exceeded the VN-Index (-0.14%) and was contributed by the growth of MBB, STB and VCI.

The market started the year slowly with low trading volumes ahead of the Tet holiday. Daily liquidity fell 32% year-on-year and 22% month-on-month to $511 million, the lowest in nearly two years.

PYN Elite said that 2024 marked the return of profit growth in the stock market, with the total net profit of 400 companies in the VN-Index increasing by 17% over the same period, led by the banking sector with an impressive increase of 18.4%. The fund's core stocks achieved good results with a net profit increase of 36.6% over the same period.

A notable point in PYN Elite’s report is the information that HOSE has set the implementation time of the new KRX trading system in early May 2025, along with upcoming mechanisms such as the Central Clearing Counterparty (CCP). The investment fund said that these mechanisms will facilitate new products and services, while preparing for future market upgrades.

The government has proposed to the National Assembly to raise the official GDP growth target for 2025 to 8% from the 6.5-7.0% approved in November. The higher target is to achieve 10% growth under “favorable conditions”, laying the foundation for double-digit growth in the 2026-2030 period.

To achieve this, the public investment budget for 2025 has been adjusted to increase by 11% compared to the original plan and 32% higher than the disbursement in 2024. PYN Elite continues to express confidence in Vietnam's macro environment when public debt is only at 36-37% of GDP, Vietnam has great room to increase borrowing to promote public investment, while registered FDI increases and exchange rate pressure decreases.

|

| Top stocks held by PYN Elite |

Currently, banking stocks continue to account for the majority of PYN's investment portfolio. The most held stock is STB (Sacombank) with a weight of 20.1%, followed by MBB, TPB, CTG, the securities group DNSE and VCI while the following positions are all industry-leading stocks such as ACV, HVN, VHC and FPT.

While the three stocks VIB, VCI and MBB were the growth drivers for PYN Elite last month, NTL, CRE and YEG were the key stocks that dragged down the performance of this investment fund.

Source: https://baodautu.vn/ca-map-pyn-elite-fund-chao-2025-bang-hieu-suat-thap-nhat-4-nam-d244882.html

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)