The event marks the milestone of PVcomBank being one of the first banks in the country to deploy this feature after the national population database platform was completed.

In recent years, electronic identification (eKYC) is an authentication method applied by PVcomBank as well as many credit institutions in Vietnam, initially recording positive effects in promoting digital transformation for banking activities, helping customers easily access modern financial services. However, the current method still faces obstacles in cases where the system does not record or records incorrect information due to blurred, old identification documents, improperly photographed documents leading to unsuccessful account opening; or risks from customers intentionally committing fraud... In addition, according to regulations in Circular 16/2020/TT-NHNN, customers using the eKYC method are still limited to a transaction limit of no more than 100 million VND/month at the time of account opening, which more or less significantly affects the user experience with digital banking services.

Therefore, as soon as the Project "Developing the application of population data, identification and electronic authentication to serve national digital transformation in the period of 2022 - 2025, with a vision to 2030" (referred to as Project 06) was approved by the Prime Minister and the State Bank of Vietnam issued regulations allowing commercial banks to apply technology to check and compare customers' biometric characteristics with the National Population Database, PVcomBank focused on developing a plan to orient the application of chip-embedded citizen identification cards (CCCD) to identify, authenticate electronically and open payment accounts for individual customers using the eKYC method. The signing event today between PVcomBank and QTS company is expected to bring the eKYC method to a new level, helping to improve the experience and efficiency of transactions between customers and banks, ensuring operational safety and supporting crime prevention in the banking sector.

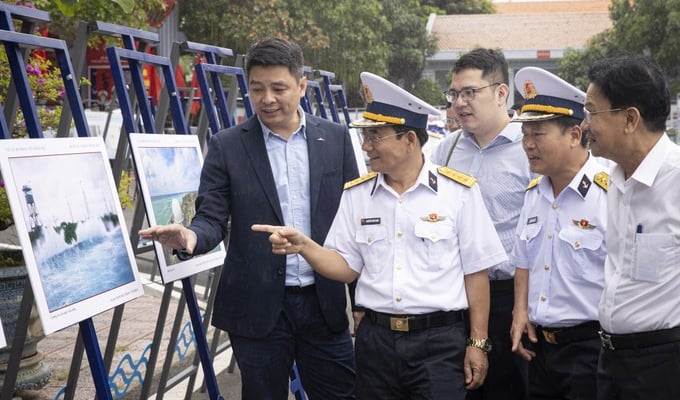

Representatives of PVcomBank and QTS signed a cooperation agreement on the application of chip-embedded CCCD in electronic identification and authentication activities.

Speaking at the signing ceremony, Mr. Le Anh Dung, Deputy Director of the Payment Department - SBV said: “Today's event marks the beginning of the banking industry in deploying the connection and application of data from the national population database, bringing new utilities and values to people and society. We expect that the online account opening service combined with population data through chip-embedded ID cards will bring a safe, convenient and fast user experience; helping to increase financial access, especially preventing risks of fraud, counterfeiting and financial scams.”

Mr. Le Anh Dung, representative of Payment Department - State Bank of Vietnam, spoke at the signing ceremony.

At the ceremony, Ms. Nguyen Thi Nga, Director of PVcomBank Digital Bank expressed her gratitude to the State Bank and C06 of the Ministry of Public Security for supporting and creating favorable conditions for the Bank and QTS company. "With a team of qualified personnel, experienced in the field of building and implementing e-Government projects, coordinating with experts from the Digital Banking Product Development Department, the cooperation between PVcomBank and QTS aims to provide innovative solutions, applying the latest technologies to create a smart, safe, convenient and fast financial transaction tool", she added.

As a solution provider, QTS highly appreciates PVcomBank's thorough preparation of the platform and modern information technology system to meet and be ready to integrate with the solution provided by QTS. "Hopefully, the cooperation will open up new opportunities in the future to help PVcomBank in particular and the banking industry in general increase reliability and safety in the transaction process and approach new potential customers," Mr. Do Quang Trung, General Director of QTS emphasized.

After today's signing ceremony, PVcomBank and QTS will focus resources on perfecting the platform and system to soon launch this new feature on the market.

Source

Comment (0)