Several large stocks and the real estate group increased sharply, helping the VN-Index move in a positive direction. The bright spot of today's session (March 17) was also the return of foreign capital.

VN-Index increased by more than 10 points, driven by banking and real estate stocks

Several large stocks and the real estate group increased sharply, helping the VN-Index move in a positive direction. The bright spot of today's session (March 17) was also the return of foreign capital.

Entering the trading session on March 17, the stock market recorded positive developments as demand remained strong, helping the main index quickly regain momentum after two previous slight corrections. However, the general market's growth momentum still had difficulty breaking out strongly due to the clear differentiation between large stock groups. Market liquidity focused mainly on a number of key industry groups, contributing to supporting the index to maintain its increase.

Entering the afternoon session, trading on the market was still quite positive as the VN-Index maintained a steady green color. The index even gradually expanded its upward momentum thanks to the push of many pillar stocks and the real estate group. Large industry groups, especially some key industries, continued to play an important role in supporting the market's upward momentum, although the adjustment pressure from some other large stocks remained strong.

At the end of the trading session, VN-Index increased by 10.11 points (0.76%) to 1,336.26 points. HNX-Index increased by 4.04 points (1.66%) to 246.77 points. UPCoM-Index increased by 1.05 points (1.06%) to 100.43 points.

|

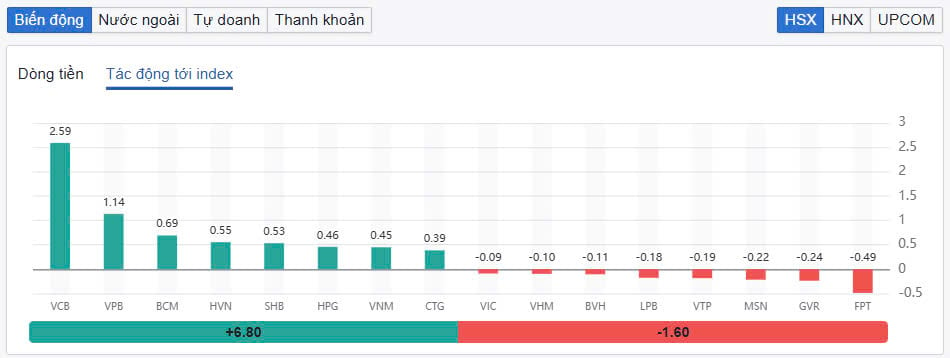

| Vietcombank shares contributed the most points to the general index. |

The number of stocks increased overwhelmingly. In total, 440 stocks increased while 305 stocks decreased and 821 stocks remained unchanged/no trading. The whole market still recorded 34 stocks increasing to the ceiling while 10 stocks decreased to the floor.

In addition, stocks such as BCM, VPB, VNM, HPG... increased well and contributed to consolidating the green color of the general market. VCB stock ranked first in terms of contribution to the VN-Index with 2.59 points. This stock closed the first trading session of the week with an increase of 2%. VPB also contributed 1.14 points when it increased sharply by 3%. After the previous ceiling price session, SHB continued to break out strongly and at one point was also pulled up to the ceiling price of 11,400 VND/share. The group of "king" stocks contributed 4 representatives in the top 10 stocks that positively impacted the VN-Index.

Another group of stocks that attracted great attention from investors today was real estate. Cash flow suddenly focused heavily on the real estate group, helping the market trade actively. HDC was pulled up to the ceiling price, NLG increased by 5.5%, CEO increased by 4.7%, DXG increased by 4%, NHA increased by 3.9%. The real estate group is considered highly speculative, so the cash flow focused on this group has helped strengthen investor sentiment in the face of difficulties in some stock groups or large-cap stocks.

On the other hand, FPT continued to make things difficult for VN-Index when it continued to decrease by 1.07% and took away 0.49 points from VN-Index. In addition, MSN, GVR or the trio of stocks VIC, VHM and VRE were also in red and somewhat put pressure on investor sentiment.

|

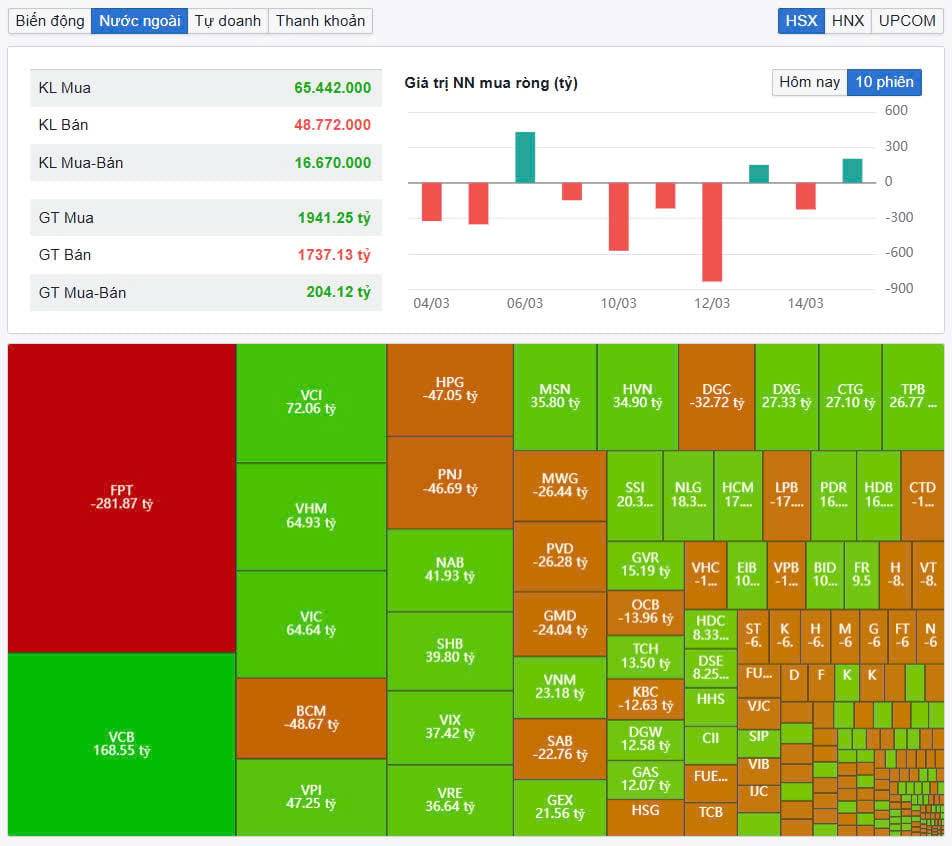

| Foreign investors return to net buying. |

Market liquidity, although down from the previous session, remained at a fairly good level. Total trading volume on HoSE reached 971 million shares, equivalent to a trading value of VND20,675 billion, down 10.3% from the previous session. The value of matched orders was VND18,018 billion, down 15.5%. Trading values on HNX and UPCoM reached VND1,046 billion and VND587 billion, respectively.

VPBank and SHB shares led in trading value today with liquidity exceeding VND1,000 billion. VPB led the market in trading with VND1,437 billion. SHB followed with a value of over VND1,066 billion. However, strong selling pressure caused this stock to increase by 5.14% at the end of the session, with matching volume reaching 95 million units. FPT and MBB traded VND875 billion and VND620 billion, respectively.

Foreign investors unexpectedly returned to net buying VND159 billion, of which, this capital flow net bought the most VCB code with VND169 billion. VCI and VHM were net bought VND72 billion and VND65 billion respectively. In the opposite direction, FPT was still strongly net sold by foreign investors with VND282 billion. BCM was behind with a net selling value of VND48 billion.

Source: https://baodautu.vn/vn-index-tang-hon-10-diem-luc-day-tu-dong-co-phieu-ngan-hang-bat-dong-san-d255381.html

Comment (0)