Speaking to Lao Dong, Ms. Nguyen Thi Bich Van - Communications Director of Central Retail Group - said that, in addition to the efforts of retail businesses and the Government's programs, the 2% VAT reduction has contributed to stimulating demand and increasing revenue. "We hope the Government will extend the time for VAT reduction to clearly see the purchasing power and savings of the people" - Ms. Van shared.

Similarly, Mr. Nguyen Van Truong - General Director of Hoang Gia Seafood International Trading Company - said that immediately after the 2% VAT reduction took effect, the company implemented many discount programs and adjusted selling prices to benefit customers. "The VAT reduction has a direct impact on customers, helping people consume more, reducing costs and improving purchasing power. I hope the VAT reduction will be extended for a longer period of time" - Mr. Nguyen Van Truong said.

In Ho Chi Minh City, businesses in a number of sectors such as tourism, food, retail, etc. said that the reduction of value-added tax has contributed to promoting economic growth. This not only affects businesses, brings benefits to consumers, but also acts as a catalyst to open up the market for goods consumption.

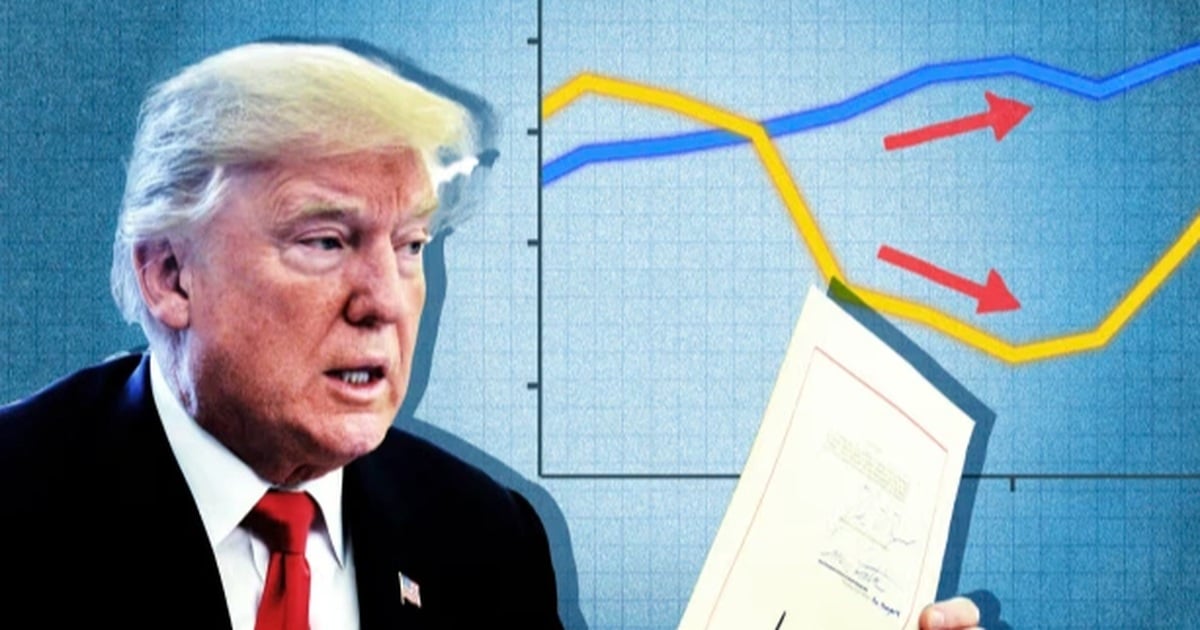

According to Ms. Ly Kim Chi - President of the Ho Chi Minh City Food and Foodstuff Association, the market is still facing many difficulties, so reducing VAT by 2% is reasonable. In 2023, thanks to the 2% VAT reduction policy, many companies will be able to stabilize their production and business as they are now. This is one of the solutions to effectively stimulate consumption, when the price of goods decreases, people will actively go shopping, and the more they shop, the more they produce, creating momentum for economic recovery.

Assessing the impact of the 2% VAT reduction, according to Mr. Bui Ta Hoang Vu - Director of the Department of Industry and Trade of Ho Chi Minh City, VAT is an indirect tax, levied on the final consumer. Therefore, when VAT is reduced, the price of goods will decrease accordingly, making goods cheaper and directly affecting buyers, thereby stimulating purchasing power.

Source

Comment (0)