In late September, despite no improvement in fundamentals, iron ore prices gradually recovered and increased by more than 14% in just three weeks.

Iron ore prices have been on a downward trend throughout the first nine months of the year due to pressure from a sharp decline in demand in China. However, in late September, despite no improvement in fundamentals, iron ore prices gradually recovered and increased by more than 14% in just three weeks. The main reason supporting prices is mainly due to psychological factors. Therefore, the outlook for iron ore prices in the second half of the year is still challenging due to strong resistance from consumption factors.

China's demand problem puts pressure on iron ore prices

After a recovery period at the end of last year, iron ore prices quickly weakened again and have maintained a downward trend since the beginning of the year. According to the Vietnam Commodity Exchange (MXV), from the beginning of this year to mid-September, iron ore prices listed on the Singapore Exchange (SGX) have decreased by about 35% to around $91/ton, and at one point even dropped to a nearly two-year low.

|

| SGX iron ore price developments in the period 2023 - 2024 |

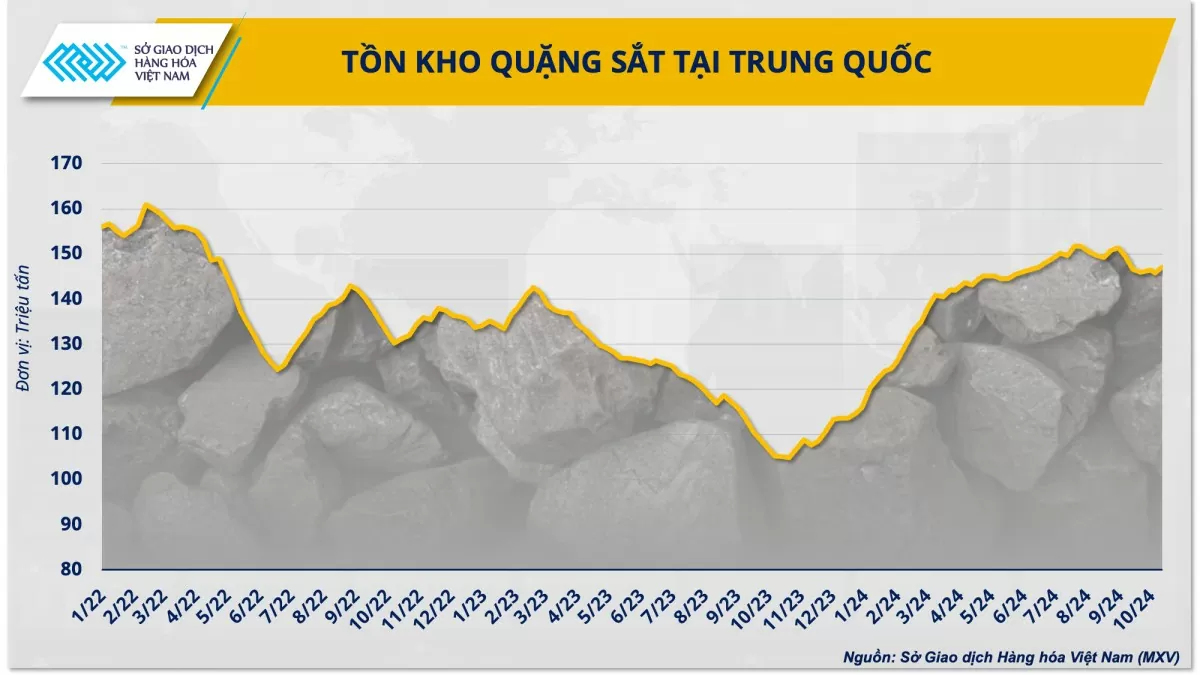

Explaining this downward trend, Mr. Duong Duc Quang, Deputy General Director of MXV, said: “The main reason for the pressure on iron ore prices during this period is the sharp decline in demand in the leading consumer market of China, with the biggest drag coming from the real estate sector. The unresolved steel surplus crisis in this country has caused a significant surplus of raw materials. Although demand has increased slightly in other sectors such as manufacturing, shipbuilding, etc., this increase is not enough to offset the sharp decline in demand in the real estate segment.” Data from consulting firm SteelHome shows that since falling to a seven-year low in the last week of October last year, iron ore inventories at Chinese ports have continuously increased sharply over the past 12 months and are currently hovering around 150 million tons, the highest in the past two years.

|

| Iron Ore Inventory in China |

In addition, the pressure is not only coming from weak demand in China, but also from excess iron ore supply, which is putting significant pressure on prices. Vale, the world's largest iron ore miner, reported a 4.6% year-on-year increase in production to 242.2 million tonnes in the first three quarters of this year. In the third quarter alone, Vale raised its output to a six-year high of 91 million tonnes. Two other major iron ore producers, Rio Tinto and BHP, also reported strong increases in iron ore production in the first nine months of this year.

However, despite no change in fundamentals, iron ore prices recovered and increased strongly in the last week of September. According to MXV, in the 3 weeks from September 23 to October 13, iron ore prices reversed and increased from a 22-month low to the price range of 105 - 106 USD/ton, even reaching a 3-month peak of 110.5 USD/ton. In just these 3 weeks, iron ore prices have regained more than 14% of their value. So, has iron ore prices entered a recovery phase after a long period of decline?

Price outlook for the end of the year remains challenging

To answer this question, it is necessary to understand the reasons why iron ore prices have increased recently. More specifically, in the last week of September, the Chinese government launched the largest and most important economic stimulus package since the COVID-19 pandemic to revive the slowing economy.

Since then, the country’s leaders have continued to introduce other supportive policies, including a commitment to fiscal stimulus packages, demonstrating their strong determination to help the economy achieve its growth target of around 5% this year. These moves have raised expectations that iron ore consumption will improve in the country, thereby supporting a sharp price increase. However, since the support is mainly psychological and these policies need more time to take effect, iron ore prices are unlikely to maintain a sustainable upward momentum in the long term without improvements in supply and demand in the market.

Assessing the outlook for iron ore prices at the end of the year, Mr. Quang commented: “In recent weeks, the main reason supporting iron ore prices has been the improvement in market sentiment after China announced a large-scale economic stimulus package. Given the current difficulties of China's iron and steel industry, this is considered a rare ray of hope to help the market have confidence in the recovery of this country's giant industry. However, due to the main psychological factors, this increase in iron ore prices is unlikely to last long. The most important market factor to pay attention to at present is still actual demand in China.”

|

| Steel Demand Forecast in China – WorldSteel |

In the current context, the demand for iron ore in this country has not improved much, but mainly increased due to basic seasonal factors. Regarding the outlook for the last quarter of this year, the demand for iron ore will generally be restrained by the gloomy outlook of the steel industry as the real estate sector is still in crisis. China's largest steel producer China Baowu Steel has warned that the country's steel industry is facing a crisis even more severe than the major recessions that occurred in 2008 and 2015.

The World Steel Association (WorldSteel) recently forecast that steel demand in China, the main driver of global steel demand growth over the past two decades, is expected to decline for the fourth consecutive year to 869 million tonnes this year, threatening demand for the key raw material, iron ore. As a result, with the demand outlook still in the grey zone, iron ore prices have yet to reverse their upward trend and will struggle to hold the $100/t mark by the end of this year. The outlook will brighten next spring as demand improves during the peak consumption season.

Source: https://congthuong.vn/nhu-cau-yeu-thach-thuc-da-phuc-hoi-cua-gia-quang-sat-354425-354425.html

Comment (0)