The deepest decline in nearly 2 years

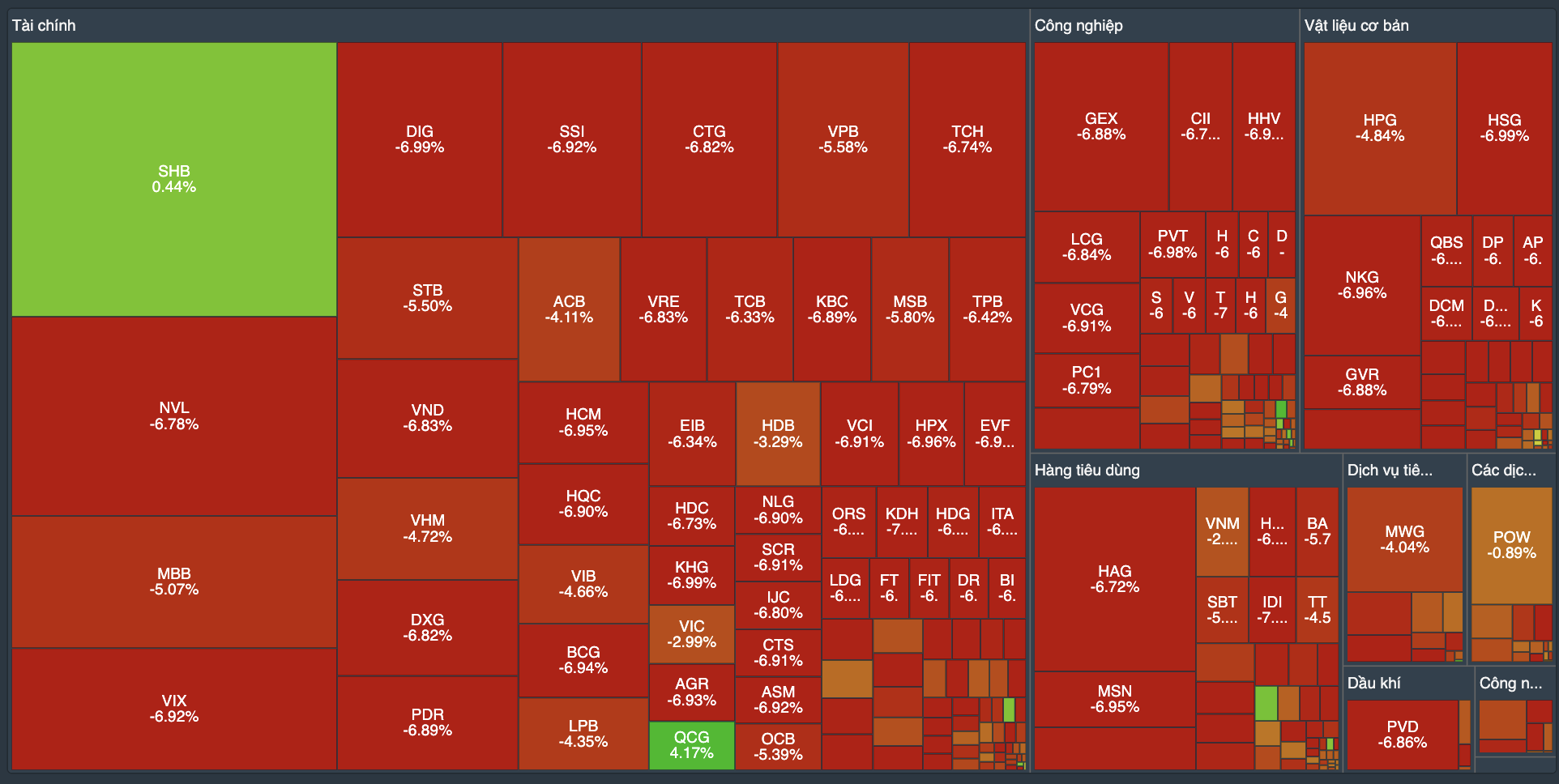

It has been nearly 2 years (about 23 months) since investors have seen the stock market on fire like today (April 15). VN-Index plummeted 59.99 points, equivalent to 4.7% in the first session of the week to 1,216.61 points. Selling pressure overwhelmed the entire board, with HOSE liquidity reaching VND33,567 billion, equivalent to more than 1.4 billion shares changing hands.

The 4.7% drop in the VN-Index made Vietnam’s stock market the worst-performing market in Asia on April 15. This figure even surpassed other markets in the region.

Along with domestic investors, foreign investors also stepped up their daily exits in the panic market. They net sold 1,238 billion VND on HOSE, focusing on VHM and CTG with a net sell of more than 200 billion VND.

News about the exchange rate somewhat affected investors' actions in the first session of the week, causing the market to fluctuate with a wide range. The free market exchange rate set a record of 25,550 VND/USD for selling. The central exchange rate was listed at 24,096, up 14 VND compared to the previous session. The USD price at banks continued to increase sharply and exceeded the USD selling price of the State Bank, even increasing to the prescribed ceiling.

Mr. Nguyen The Minh - Director of Yuanta Vietnam Securities Analysis - also said that the Israel - Iran conflict also affected the Vietnamese stock market. In fact, US stocks have been heavily discounted by this information, but the VN-Index has only now begun to "feel the impact". In addition, the pressure has also returned with the US CPI being higher than expected for the third consecutive month, which may slow down the FED's interest rate cut roadmap.

According to Vietcombank Securities Company, if the 1,220 point area is lost, pessimism will increase significantly and the nearest support level will be around the 1,190 point area. Investors should keep calm and resolutely restructure their portfolios towards reducing leverage ratios in the coming sessions. At the same time, they can consider continuing to hold stocks that have maintained an accumulation status in today's session, but need to wait for the recovery time during the session to reduce the proportion of stocks that have broken through the support level. Limit new disbursements during the period when the market continuously experiences large fluctuations like now.

Be prepared for market panic

Talking to Lao Dong, Mr. Pham Hoang Quang Kiet - Deputy Head of Investment Research and Analysis Department at FIDT Investment Consulting and Asset Management JSC, some risk management principles to follow when the market is in panic that all investors can apply:

First, keep a calm mind. Investors should avoid letting emotions control them and should not sell stocks when the market is down sharply. Instead, take the time to analyze the market situation and make decisions based on logical analysis.

The second is to take precautions, such as placing stop-loss orders, staying away from leverage, and diversifying your portfolio.

Third is to observe the market and make appropriate decisions. You can consider factors such as what is the reason for the market panic? What is the macroeconomic situation? Which stocks are likely to recover well?

Finally, be patient and wait for the right time. Panic markets are often an opportunity to buy quality stocks at cheap prices. However, investors need to be patient and wait for the right time to buy. Do not rush to buy when the market is still in the panic phase.

"The most important thing is to have a clear investment strategy, so that it can be applied and reacted to any market conditions," the expert shared.

Source

Comment (0)