Foreign businesses in China are facing a major test as consumers increasingly turn to domestic products.

As global consumer brands grapple with China’s fragile economic recovery, they are also facing another concern: Chinese consumers are increasingly turning to domestic brands.

Five years ago, the country’s consumer market was dominated by foreign brands, while domestic brands struggled to compete and were often plagued by low quality and poor marketing, according to the WSJ .

But now, many Chinese brands are becoming popular in online marketplaces, supermarkets and shopping malls, with their reputations for quality, design and merchandising improving, capturing the rapidly changing tastes of consumers.

The pandemic years have been a boon for local brands, who have adapted quickly to the livestreaming trend. They have increasingly hired celebrities and influencers and used short-form video apps to market their products. They have also tailored their products to local tastes. Examples include eyeshadows for Chinese skin, ginseng toothpaste and $200 sneakers from Li Ning, named after the Olympic gold medalist.

Global brands such as Adidas, Procter & Gamble and L’Oréal, which generate the majority of their global sales in China, have been forced to follow the tactics of their domestic rivals, such as promoting online sales and tailoring their products to Chinese culture.

James Yang, a Shanghai-based partner at consulting firm Bain, said it is no longer enough to simply bring foreign brands to China and open stores. “You have to work hard to make money now,” he said.

China is a huge draw, according to Bain. It is expected to overtake the US this decade to become the world’s largest consumer market, with spending reaching $5.4 trillion by 2026.

Many people shopped online during the pandemic and are continuing to do so. E-commerce sales in China rose 13.8% in the first five months of the year, while sales at individual brands’ small stores rose 6%.

Consumers are saving more as the country’s economic growth slows. Many of them are increasingly China-centric in their purchasing decisions. In part, this is due to national pride amid tensions with the United States. And because they see Chinese products as being on par with — if not better than — Western brands.

Xiaohan Dou, 47, who works in Beijing, has switched to buying makeup from a local brand called Perfect Diary. She is attracted by the price and presentation. The company’s 12-color eyeshadow palette comes in a box decorated with animal motifs, with names like “fox tail” and “fur.” It costs just $15, compared to L’Oréal’s six-color palette, which starts at $23. “Most consumers are more price-sensitive now than they were before,” Dou said.

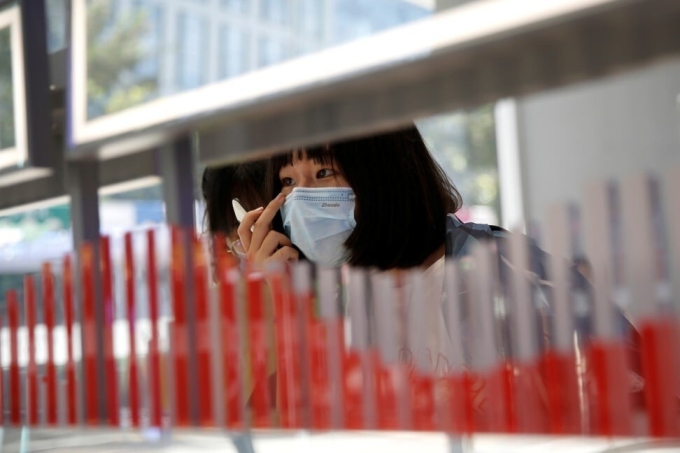

A girl tries on products in a Perfect Diary store. Photo: Reuters

Perfect Diary started as an online brand on Alibaba in 2017, before opening physical stores. It has since become China’s top-selling domestic makeup retailer, according to market research firm Euromonitor International.

Perfect Diary’s parent company and another upstart, Florasis, together accounted for about 15% of the country’s $9 billion-plus color makeup market in 2021, up from nothing six years ago, according to Euromonitor. Their advantage is that their makeup is more suited to Chinese skin.

In a recent Perfect Diary livestream sales show, the host introduced lipstick colors and used the products to more than 25,000 viewers. She then distributed coupons, gifts, and free shipping to buyers. According to McKinsey, livestreaming accounted for about 10% of Chinese e-commerce sales in 2021 and is growing rapidly.

Multinationals like L'Oréal have seen their market share decline from 2016 to 2021, according to the latest data from Euromonitor. L'Oréal now has online stores on Douyin, and consumers can consult beauty advisors via live video calls. A spokesperson for L'Oréal said it still maintains its leadership in the Chinese market, and the brand's origins are not the reason for its success.

In addition to good prices and trust in quality, Chinese consumers’ shopping habits are changing in part thanks to younger shoppers who are more interested in the country’s heritage and increasingly open to new brands. The government is also supporting domestic brands. At the Party Congress in March, some delegates urged consumers to support local brands.

A decade ago, Chen Meiting, a Shenzhen resident, bought Nike shoes, Converse All-Stars and L'Oréal cosmetics because of the quality, design and brand reputation. Now the 32-year-old buys everything from shoes to sunscreen from local brands, which she says are just as good as foreign brands.

She spent $200 on shoes from Chinese sportswear maker Li Ning, which she uses for hiking and dancing. “I like them even better than Yeezys,” Ms. Chen said, comparing them to Adidas.

Part of the reason more people are buying domestic is the trend of “guochao,” a term for “national fashion,” which combines designs with elements of Chinese culture. The trend has been growing since Li Ning debuted a streetwear collection in signature red and yellow at a New York fashion show in 2018.

“Consumers didn’t care much about Chinese elements in their clothes before. Now that desire is growing,” said Ivan Su, China analyst at Morningstar.

Western brands are following suit. Germany’s Adidas has launched a line of T-shirts with bold Chinese characters. Last year, US luxury brand Coach produced a range of clothes featuring the White Rabbit candy logo, a popular design in China.

Two domestic sportswear brands, Li Ning and Anta Sports, have invested in new production lines, and Morgan Stanley forecasts their market share will reach 22% by 2024, up from 15% in 2020. They are gaining on Adidas and Nike as Chinese consumers see Li Ning and Anta Sports products as better value for money, given the quality and price.

A Li Ning store in Shanghai. Photo: Bloomberg

Morgan Stanley forecasts Adidas' market share will fall to 11% by 2024, from 19% in 2020. In 2021, Anta surpassed Adidas to become the second-largest sportswear company in China by sales.

In November 2022, Adidas CFO Harm Ohlmeyer admitted the company faced many challenges, including geopolitics that made lifestyle influencers hesitant to collaborate with Western brands.

An Adidas spokesperson said the company is expanding its product innovation center in the country and is tailoring its marketing and retail operations for Chinese customers. Nike remains the leader in the Chinese sportswear market, with 15% of its revenue coming from mainland China, Taiwan, Hong Kong and Macau.

To stay relevant, Nike is also trying to tap into local tastes. Nike CEO John Donahoe said the company is catering to Chinese consumers with localized designs, such as putting the 12 zodiac signs on sneakers sold in the country.

Domestic companies are also gaining ground in consumer products like toothpaste. Yunnan Baiyao Group sells more toothpaste than Procter & Gamble, which owns the Crest and Oral B brands in China, according to Euromonitor.

Analysts say consumers are drawn to Yunnan Baiyao toothpaste because it contains Chinese herbs. Yunnan Baiyao Group also sells shampoos and ointments. Revenue doubled in the seven years to 2021 to more than $5 billion.

China is P&G’s second-largest market after the United States, accounting for about 10% of global sales. In February, P&G CEO Jon Moeller said the company was looking to improve its reach to Chinese consumers by shifting to online retail, livestreaming and social media.

Phien An ( according to WSJ )

Source link

Comment (0)