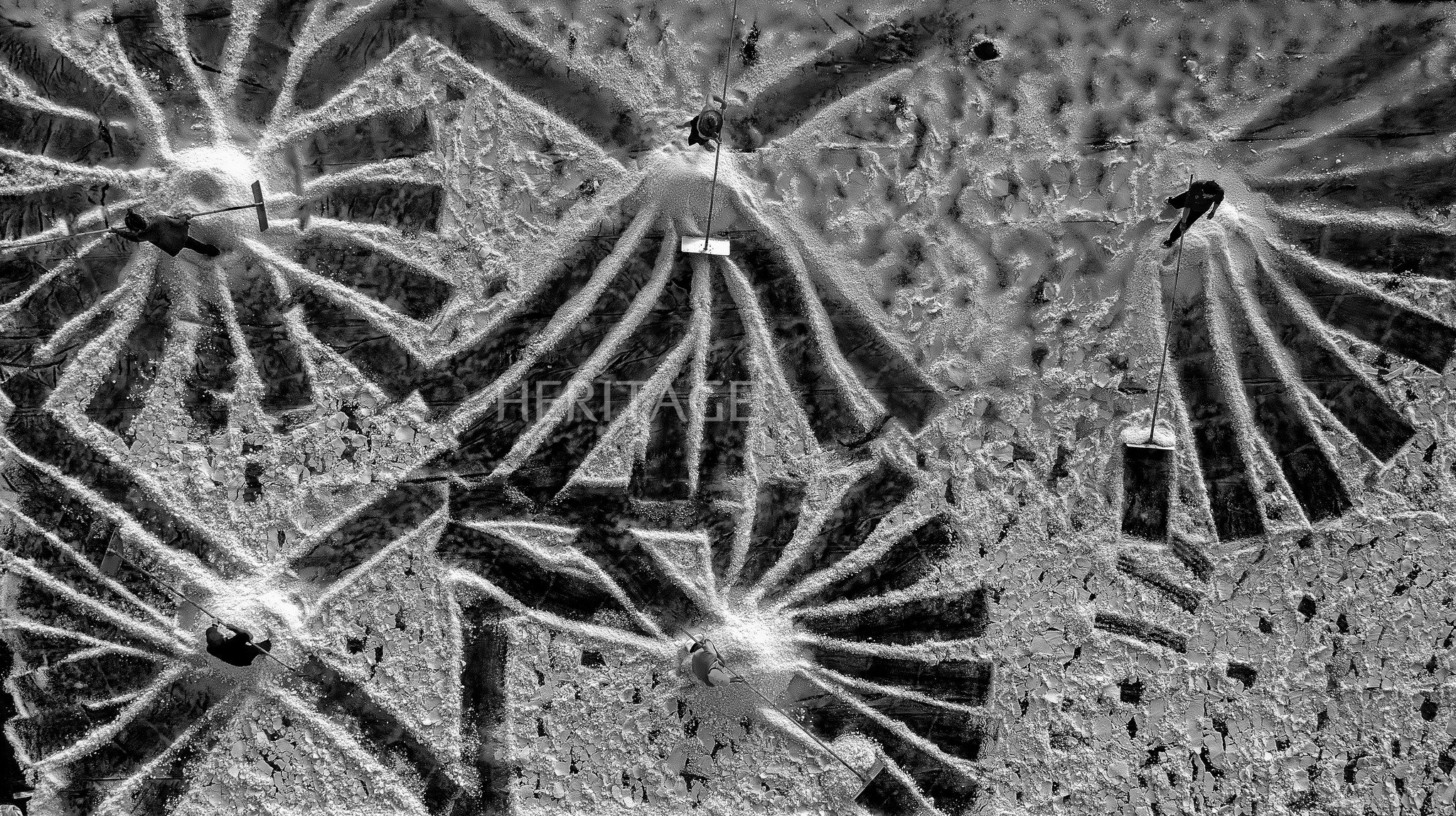

Protecting personal information, phones, especially credit card codes is extremely necessary but is sometimes neglected by many people - Photo: CT

Anyone who uses a credit card knows it by heart: spend now, pay later. The freedom to buy large-value items and then pay off the debt after 30-60 days, depending on the bank, without interest, makes many young people not hesitate to spend money without hesitation, leading to debt, even being on the bad debt list.

The appeal of the powerful card's cashback, promotions, and loyalty points is so convenient that many young people have ignored the warnings, especially those who lack skills and have an uncontrolled spending habit.

Received bad debt news, shocked to find myself using 5 cards

With a stable job and income, and a small amount of savings, Mr. TN (Binh Thanh District, Ho Chi Minh City) was able to easily open several credit cards with good limits. Continuously receiving calls and text messages inviting him to quickly open online cards from banks was the beginning of a tragedy that N. did not expect.

In early December 2023, N. lost his wallet and phone. He immediately called four banks to block all the cards he was using. After a week, N. received his wallet and documents back intact. Thinking that there is a silver lining in every misfortune, he almost did not pay attention to the detailed statements of the cards.

"That whole month I didn't do any gambling, didn't spend any money or buy anything, so I was complacent. Suddenly the bank called to inform me that there was a debt that was one day overdue on my credit card statement and was being charged late interest. I was shocked," N. said resentfully.

It turned out that N. forgot to lock the fifth card and the thief withdrew a sum of cash from this card. The overdue debt was not too large, within N.'s ability to pay, but he was busy explaining and suing the bank about confidentiality, requesting a review to prove that he did not make that transaction, which inadvertently pushed the bad debt to last for nearly half a month.

"A few tens of millions of dong in credit card debt with overdue interest charges will add up very quickly," N. said sadly.

Bankrupt because of lust for splendor

Perhaps the saying "cash on delivery" is only true when you don't have a credit card. But at present, if you have an income of 15 - 20 million VND/month, you can comfortably register to open a credit card with a limit three, four, or even ten times your income. And opening a card is very quick, just need a phone with an Internet connection, and it's done with just a few steps.

TMĐ. (Binh Chanh District, Ho Chi Minh City) also started using a credit card when his monthly income was around 7 million VND. Currently, with an income of nearly 15 million VND/month, Đ.'s card limit has been increased to nearly 60 million VND.

There are also more conditions and if each month D. spends more than 70% of the card limit, the refund percentage will be higher and the accumulated bonus points will also be higher.

"I was so eager to hear that, so the first few times I tried to buy a little more, but gradually I overspent. I asked acquaintances to buy something for me, but some people paid, some didn't, so I had to shoulder it all by myself. When I couldn't pay anymore, the bank called the company and I lost my job," D. said.

T. (Binh Tan district) from the group "Vietnam Bad Debt Community" on Facebook said he was terrified of credit cards after spending too much money a few times and then regretting it, and having bad debt. T. had a stable income, using two credit cards at the same time from a bank and a finance company with a total payment limit of up to 150 million VND/month.

Seeing the attractive cashback and bonus points, along with the attraction of shopping and showing off the flashiness of holding a credit card in hand, T. fell into spending on credit cards without realizing it. T. also used the trick of registering to have the payment periods of those two cards rotate.

Everything was under control for the first few months. But the more he shopped, the more enthusiastic he became. Then T.'s travel photos here and there from the reward points and cashback received a shower of likes and compliments. Things started to spiral out of control from there.

"I continuously renew my loan, even using a service to renew it, so the interest keeps accumulating beyond my ability to pay," T. said.

After three months of "disappearance", T. created an anonymous account on the "Vietnam Bad Debt Community" to ask for tips on debt evasion and negotiation experiences, hoping to cool things down and avoid being chased for debt.

Make money with bad debt checking service

When the information about a customer with a credit debt of 8.5 million VND, which the bank calculated to be over 8.8 billion VND after nearly 11 years, spread, social networking sites, especially financial groups, were buzzing with discussion. In particular, the bad debt checking service caught on to the trend all over the internet. And also witnessed the number of people wanting to check bad debt and credit history was countless.

Ms. Nhu Ngoc (Binh Tan District) said she was also afraid of not knowing her credit history. She said she read online that people were telling each other to go to the Vietnam National Credit Information Center (CIC) to look it up, but because she was not familiar with the machines, and heard that registration had to wait several days for approval, she was impatient so she looked for a service to look it up.

According to research, the fee for checking credit history is offered in some groups such as "Check bad debt CIC", "Vietnam Banking Association, financial support - credit and cards", "Check CIC, Check CIC"... with prices ranging from 300,000 - 500,000 VND/time. Along with the offer is a commitment such as knowing the result after 15 minutes, clear, detailed...

However, in the same groups, posts "exposing" scams from this service are not rare with quite simple tricks. The subjects post, seek out those who need to check credit history, make offers, and after receiving the service fee transfer, the subjects disappear, "the subscriber cannot be contacted".

Source

Comment (0)