The workshop is part of a series of activities within the Ho Chi Minh City Digital Transformation Week with the theme “Exploiting digital data, achieving digital transformation success”, in response to the National Digital Transformation Day on October 10, under the direction of the State Bank of Vietnam (SBV) and the City People’s Committee. Within the framework of the event, MSB participated in introducing “1-touch QR” – a payment solution combined with revenue management for business owners and entrepreneurs.

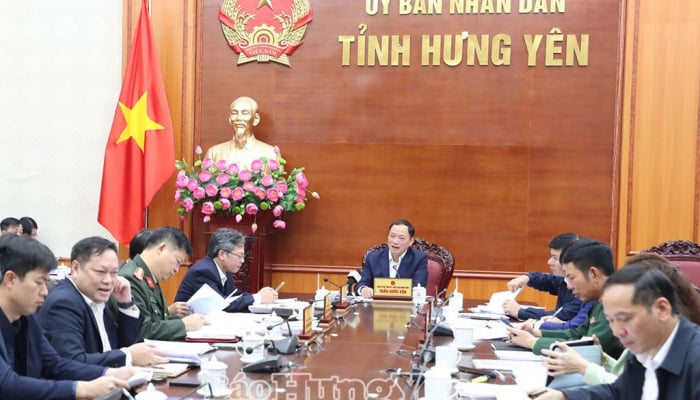

Deputy Governor of the State Bank of Vietnam Pham Tien Dung visited and experienced M-Merchant at MSB's booth.

With this solution, Bank staff can create QR codes in advance when meeting customers. Shop owners/businesses who are given QR codes will proactively attach the QR code to their payment accounts opened at MSB through 100% online operations from registering to open an account (if they do not have an MSB account) to creating a transaction management account on the website https://msbpay.msb.com.vn. After successfully registering to open an account and attaching the QR code, customers download the MSB Merchant application or access the transaction management website, log in with the name and password just created to use the service.

M-Merchant helps customers conveniently manage revenue and control payments of each store/business they manage, saving time and human resources in cash management. Store/business owners can also create user accounts for employees to control customer payment information without having to take a screenshot of the payment or confirm payment from the store/business owner. Through this solution, MSB affirms itself as one of the pioneering banks in digitizing multi-utility, multi-channel payment services, contributing to promoting cashless payments, which are currently becoming a trend in Vietnam.

With the desire to apply technology to help people easily access financial services on smart applications, MSB constantly researches and deploys digital solutions that are convenient for business owners and small traders, bringing services closer to people, helping them access financial services easily at low cost.

Source

Comment (0)