Neutral recommendation for GVR stock

KB Securities Vietnam (KBSV) positively assessed the prospect of converting rubber land of Vietnam Rubber Group (GVR), thanks to the clearer legal status of industrial parks. KBSV estimated that GVR will convert more than 3,444 hectares of rubber land in the period of 2025 - 2028, contributing an income of VND 1,911 billion/year.

The converted land area includes Binh Duong (786 ha), Dong Nai (2,658 ha) and Binh Phuoc (184 ha), of which the land area in Dong Nai has been approved by the Provincial People's Council and agreed on the compensation and site clearance plan (February 2025), creating favorable conditions to help speed up the land conversion process.

KBSV expects that the main export market, China, will increase rubber imports due to increased demand for tire production and rubber inventories at historic lows. In addition, global supply shortages will support prices to remain high. KBSV forecasts rubber revenue in 2025/2026 to reach VND22,004/22,374 billion (growth of 8%/2%).

GVR's share price has increased by 25% since the beginning of the year, partly reflecting its profit growth potential. Therefore, KBSV recommends neutral on GVR shares, with a fair valuation of VND38,800/share.

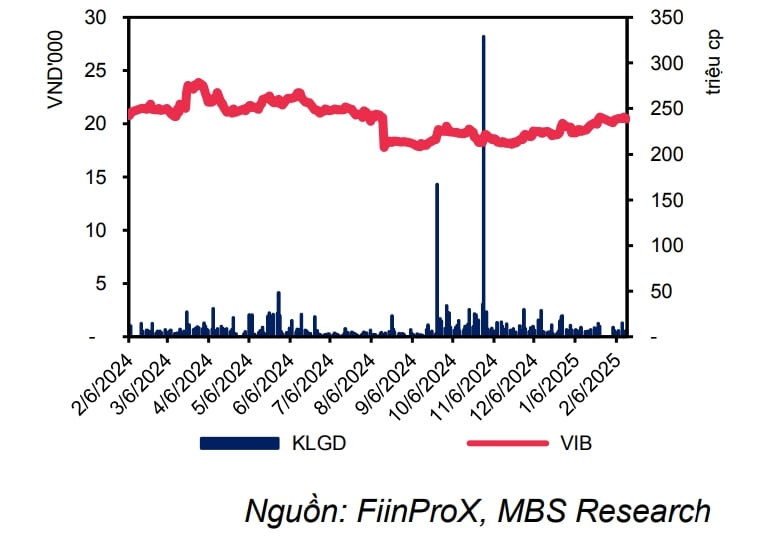

Hold recommendation for VIB stock

According to MB Securities Company (MBS), in the fourth quarter of 2024, Vietnam International Commercial Joint Stock Bank (VIB)'s credit growth reached 8.9% compared to the previous quarter, but NIM decreased by 95%, causing net interest income to decrease by 6%. Thanks to a 33.7% decrease in provision expenses, profit after tax had positive growth for the first time since the third quarter of 2023, reaching VND 1,921 billion (up 1% over the same period and up 20.1% over the previous quarter).

Accumulated for the whole year of 2024, net interest income and non-interest income decreased by 3.5% and 20.4%, respectively. Provision expenses reached VND4,354 billion (down 10.2%), causing after-tax profit to decrease by 15.9% compared to the previous year, reaching VND7,204 billion, the largest one-year decrease since listing.

Provisioning expenses are forecast to increase by 30.6%. Together with the provision utilization ratio reaching about 85%, NPLs are expected to decrease to 3% and LLR to increase to 57.1% by the end of 2025. MBS expects that NPLs will continue to decrease to 2.6% by the end of 2026.

With credit growth above 20% and NIM recovering to 3.9% in the next 2 years, we forecast net interest income (NII) to grow 24.5%/22.1% in 2025/2026. Provision expenses will increase by 30.6%/21.6% in 2025/2026 due to maintaining the provision/total outstanding loan ratio at 1.5%, leading to profit after tax growth of 23.9%/25.3% respectively.

MBS recommends holding VIB shares and maintains a target price of VND22,650/share based on using 2025 book value with a target P/B of 1.3x; reducing 2025/2026 profit after tax forecast by 13%/22.3% compared to the latest forecast. Downside risks to the target price include higher-than-expected provisioning costs due to a stronger-than-expected increase in bad debt as retail credit is boosted. In addition, deposit interest rates may increase higher than expected, causing NIM to decline further.

► Stock market commentary March 21: VN-Index may continue to fluctuate near 1,320 points

![[Photo] Meet the pilots of the Victory Squadron](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/fd30103acbd744b89568ca707378d532)

![[Photo] Prime Minister Pham Minh Chinh receives French Minister in charge of Transport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/aa649691f85546d59c3624b1821ab6e2)

![[Photo] Prime Minister Pham Minh Chinh receives the head of the Republic of Tatarstan, Russian Federation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/7877cb55fc794acdb7925c4cf893c5a1)

Comment (0)