An apartment project in Cau Giay, increased by 30.7% in 1 year

In 2023, the real estate market fell into a slump, although not yet at the level of crisis. However, housing prices, especially in large cities such as Hanoi and Ho Chi Minh City, still increased sharply.

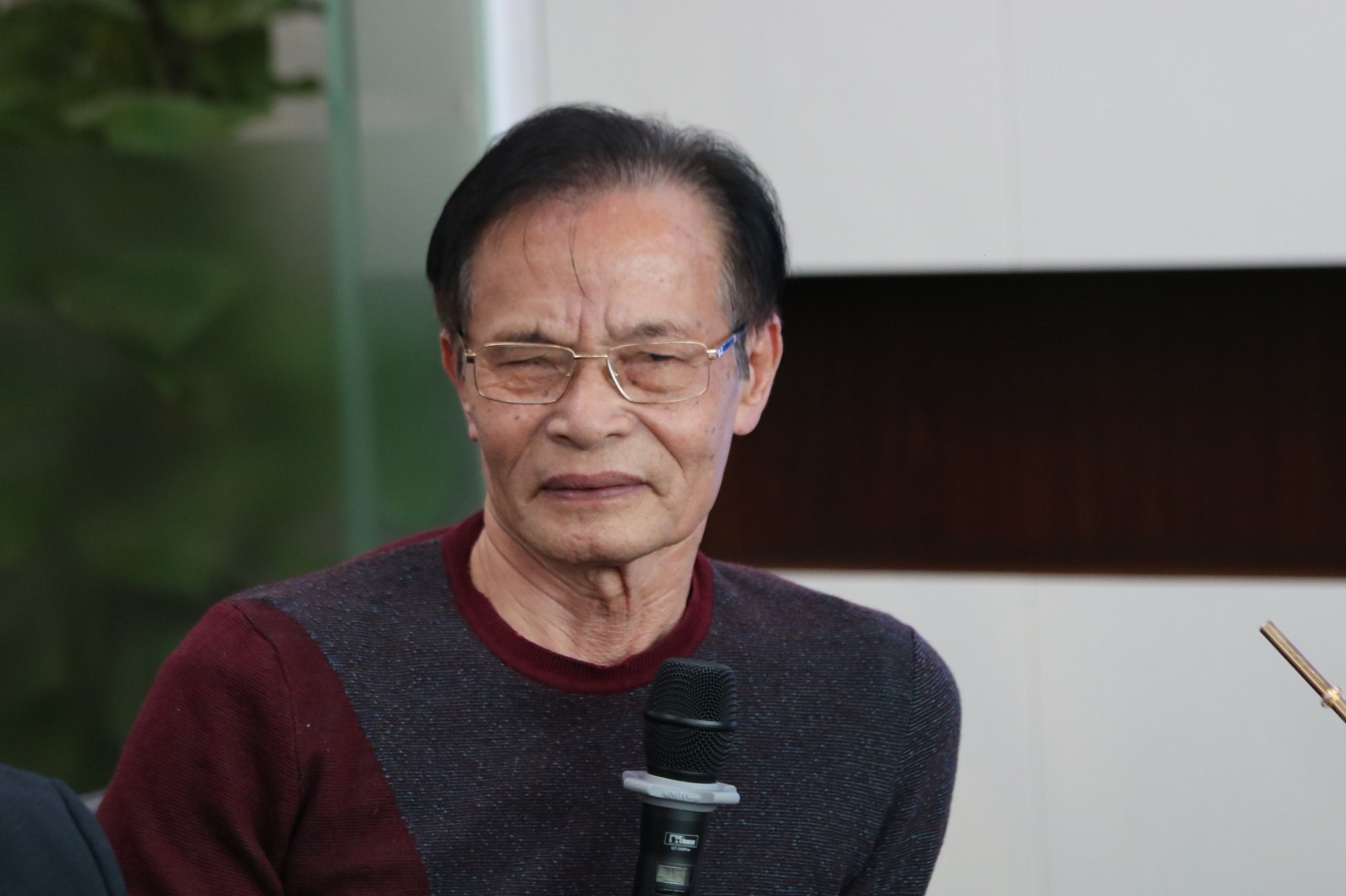

In the seminar “Identifying real estate financial flows” held on December 12, Mr. Nguyen Quoc Hiep, Chairman of the Board of Directors of GP. Invest, said that the most important issue that needs to be solved at the present time is the imbalance between supply and demand in the market.

Overview of the seminar "Identifying real estate financial flows". (Photo: BT)

Mr. Hiep said that the selling prices of real estate projects are still increasing every day. For example, a project in Mai Dich Ward, Cau Giay District, in the second quarter of 2022 was advertised for sale at around 45 - 60.4 million VND/m2. However, in the third quarter of 2023, it increased to 58.8 - 69.2 million VND/m2.

Thus, the selling price of apartments in this project has increased by 14.5% - 30.7% over the past year. This shows that in the real estate segment, real demand is very high but supply is scarce.

Regarding the cause of this supply-demand imbalance, the Chairman of GP. Invest said that the problem lies in legal bottlenecks.

"70% of the problems are legal. I have talked about this many times in many forums, but today I still have to emphasize that only by resolving the legal issues can the real estate market be unblocked," said Mr. Nguyen Quoc Hiep.

GP. Invest leaders reflected that currently too many administrative procedures are needed, which greatly affects businesses.

To stimulate real estate finance, Mr. Nguyen Quoc Hiep proposed that it is necessary to continue restoring confidence in corporate bonds because many real estate businesses are struggling with bonds.

Mr. Nguyen Quoc Hiep, Chairman of GP. Invest. (Photo: BT)

In addition, Chairman of GP. Invest Nguyen Quoc Hiep also recommended that real estate businesses need to make good use of FDI capital because this capital is quite cheap.

Finally, to resolve the current difficulties in the real estate market, Mr. Nguyen Quoc Hiep also proposed that relevant agencies should soon have a land valuation plan for local application, and at the same time shorten the process to support credit for businesses more promptly.

Agreeing with this opinion, lawyer Nguyen Thanh Ha, Chairman of SBLaw Law Firm, said that to come up with an investment policy for a real estate project, there are actually many difficulties for investors. The difficulties are not only in terms of capital and resources to implement the project but also in terms of the agency that licenses the project.

Currently, in the context that the Land Law is in the process of being approved and legal regulations on investment and bidding are unclear, there is a fear of responsibility of state agencies in licensing new projects.

Lawyer Nguyen Thanh Ha said that normally when a project is submitted, the authorities raise many different legal issues.

According to the lawyer, the law in Vietnam is unclear in many cases and there are many complicated procedures. It takes 3-4 years for a project to be approved, and investors are also very impatient.

Therefore, lawyer Nguyen Thanh Ha believes that in order to stimulate real estate finance, in addition to the efforts of investors, there must be support from state management agencies.

Focus all resources on social housing

Meanwhile, Dr. Le Xuan Nghia, member of the National Financial and Monetary Policy Advisory Council, said that the current financial flow throughout the entire economy is blocked and is likely to last.

According to Mr. Nghia, there is a global trend of saving, but not because people do not have money.

In the US, unemployment is low, jobs are good, incomes are high, Europeans are too, but they still save. They save because they feel prices are rising, interest rates are high, while Americans often borrow to spend.

"Secondly, they feel the risk of war and rising energy prices, so they don't dare to spend. Next, people feel the need for new investments, so they need to save more and live more simply," Dr. Le Xuan Nghia shared.

Dr. Le Xuan Nghia, Member of the National Financial and Monetary Policy Advisory Council. (Photo: BT)

Dr. Le Xuan Nghia said that starting from 2026, all Vietnamese products exported to Europe must report greenhouse gas emissions.

The State Securities Commission (SSC) has also issued a handbook on greenhouse gas emissions reporting for businesses. In the near future, it is likely that the SSC will require businesses to report greenhouse gas emissions together with their financial statements and have them audited.

“That said, current businesses are starting to fear borrowing capital, and banks are also afraid to lend for fear that old loans may be blocked and new loans may not meet green criteria,” said Mr. Nghia.

"The financial flow is only in real estate because no one requires real estate businesses to report emissions. This is a great opportunity to restore the real estate market, although it is not a good opportunity, but we have nowhere to go so we have to go. In difficult times, there also needs to be a place to revive capital consumption needs," said Dr. Le Xuan Nghia.

Currently, according to the doctor, the real estate market as well as the construction market and capital market are in a dire situation when the debt of contractors and related companies reaches 170 trillion VND. Construction contractors currently only dare to exploit public investment, not daring to jump into investment.

"It can be seen that the economic flow is really at a standstill, a standstill of the entire economy and there is only one way out: real estate," said Dr. Le Xuan Nghia.

To unblock real estate finance, Dr. Le Xuan Nghia said that we should focus all financial resources on building low-cost housing and social housing. This is a market with very good cash flow and very high demand, but we have not been able to do it yet.

Through a survey of 5 social housing projects in Hanoi, Dr. Le Xuan Nghia found the following difficulties:

Firstly, social housing does not have to pay land use tax, and that land is public land and cannot be mortgaged to banks for loans, so banks are not interested.

"Why don't we tax a few percent to make it private land for 50 years, then the bank can accept mortgages?", expert Le Xuan Nghia asked.

Second, the entire bidding mechanism should be more open, and any capable enterprise should be assigned to build for quick implementation.

Third, remove the regulation that profits cannot exceed 10% so that businesses building high-end, mid-range, and low-end housing are equal.

Fourth, regarding financing for home buyers, it is necessary to finance directly through the budget, not through banks. Or we can use banks to finance like Singapore does, for example, when buying a social housing, the buyer can borrow money from the bank and only pay an interest rate of 2.5%/year, the excess interest is compensated by the government.

Dr. Le Xuan Nghia emphasized that the current real estate crisis is due to a lack of supply and excess demand, and that management agencies have not created a balanced environment. The expert reaffirmed the view that it is necessary to focus all resources (legal, administrative, banking, budget) to solve social housing, thereby lowering the price level of the entire market, thereby restructuring this system.

Source

Comment (0)