The new generation of C919 passenger jets is turning China’s decades-long ambition into reality. The narrow-body twin-engine C919, which has been in production for 15 years by the Commercial Aircraft Corporation of China (Comac), can carry up to 192 passengers on trips as long as 5,555 kilometers.

A year after its maiden flight in May 2023, the plane has burnished China's reputation as a global player in aviation manufacturing, a position befitting its status as the world's second-largest air travel market.

But there are still many hurdles before the C919 and Comac can achieve the same success as their rivals Airbus and Boeing. Airworthiness certification by foreign authorities and proving the aircraft’s profitability are two important milestones yet to be achieved.

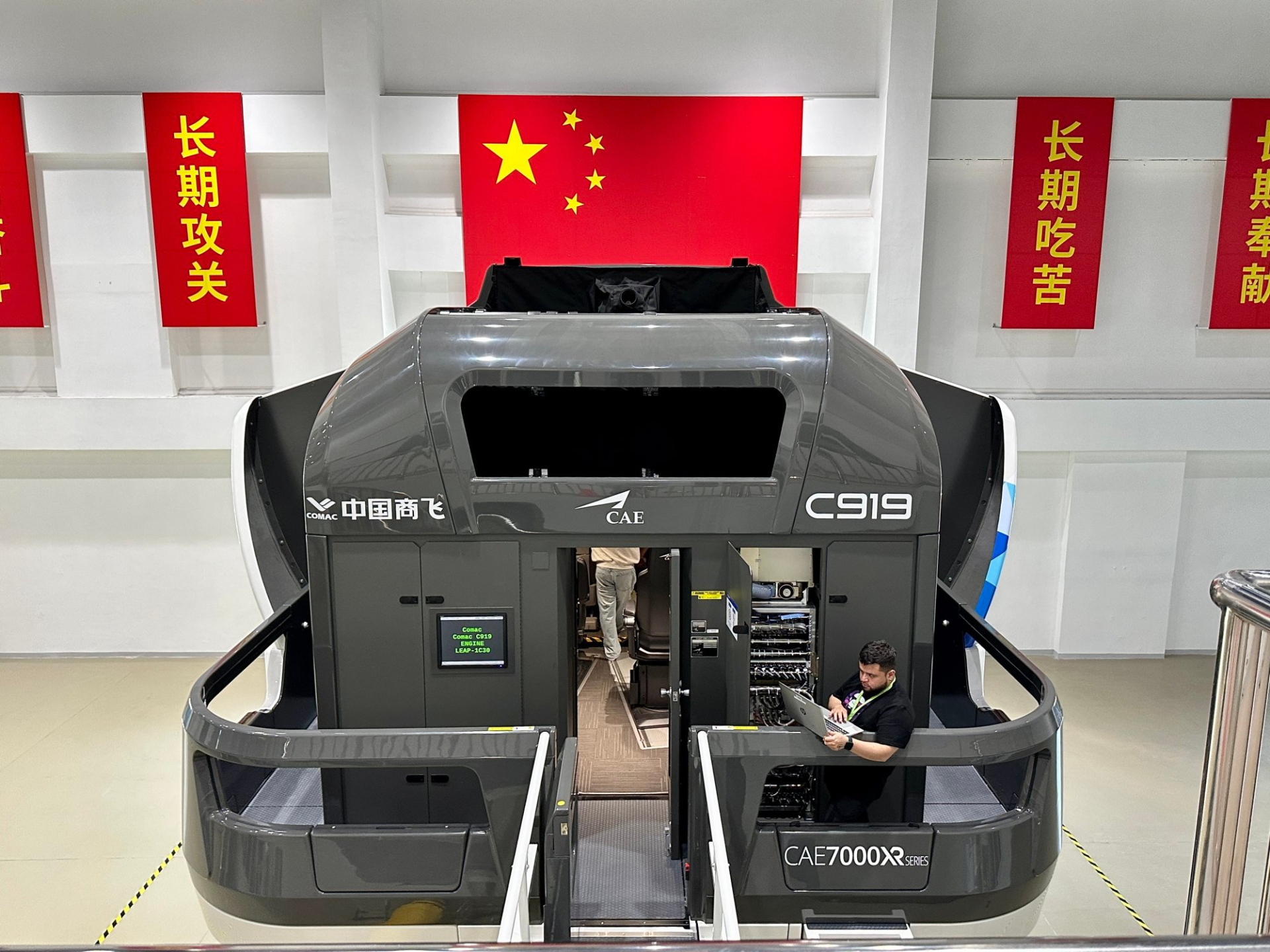

Comac has ambitions to bring the C919 aircraft to the world. Photo: Lau Ka-kuen

Domestic success story

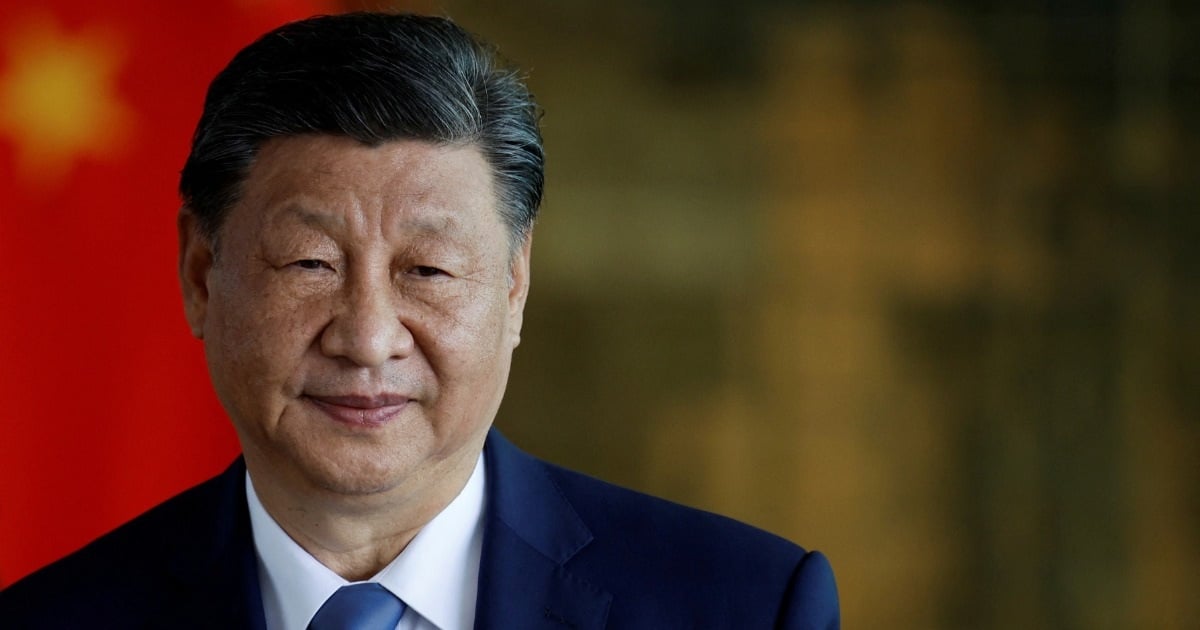

Almost exactly 10 years ago today, President Xi Jinping visited Comac’s headquarters in Shanghai. Sitting in the pilot’s seat of the C919 prototype cockpit, he urged a team of pilots and engineers to work hard to build China’s first modern commercial jetliner.

Over the next decade, more than 100,000 engineers and workers worked together on the C919. They came from 36 universities and 200 enterprises across China, with a total investment of hundreds of billions of yuan.

Despite some initial hiccups, the C919 has had a fairly smooth takeoff. The Chinese aircraft has been in commercial service with China Eastern Airlines for a year, with four planes flying domestic routes between Shanghai and three major cities. As of early May, the model had carried a total of 245,000 passengers on 1,800 flights.

Following its international debut at the Singapore Airshow in February, the C919 is preparing for its first commercial flight outside mainland China: a charter flight from Hong Kong to Shanghai scheduled for June 1.

For Beijing, the C919 is a source of pride and a testament to China's progress in advanced technology research and manufacturing.

Beyond the political implications, Beijing’s dogged pursuit of its own aircraft also makes commercial sense, as it can leverage its huge market and state capacity to ensure the C919 can take off. More than a fifth of the world’s new aircraft will fly in Chinese airspace between now and 2041.

Demand for new aircraft from the world's second-largest economy will reach 9,284 units during that period, worth about $1.47 trillion. Comac estimates that the country's demand for narrow-body jets between now and 2041 will be 6,288, a potential supply worth $749.3 billion.

The race for overseas approval

To expand its domestic success, Comac has embarked on an international effort to have the C919 gain airworthiness certification from the European Union Aviation Safety Agency (EASA).

Once certified, Comac could pitch its aircraft to foreign buyers as an alternative as the EU's Airbus struggles to increase production and Boeing is in crisis after a series of fatal crashes.

"We have set a target of getting full approval from EASA by 2025," said Jie Yuwen, deputy director of the Civil Aviation Administration of China (CAAC) Airworthiness Certification Center. He signed the C919's domestic certification certificate for the aircraft to fly toll-charging flights.

Center director Gu Xin also confirmed the timeline as 2025. "We believe that an aircraft that has been certified to fly in China is also safe to fly elsewhere," he said, adding that he and his colleagues had meticulously reviewed more than 6,100 reports related to the C919's domestic certification.

From left, Mr. Jie Yuwen and Mr. Gu Xin. Photo: Frank Chen

Some industry observers say the 2025 certification target is ambitious. Mayur Patel, head of Asia at OAG Aviation, a leading global travel data provider, said the EU certification process is rigorous.

“It may be a bit optimistic to expect things to be settled soon, but I would be cautiously optimistic that the C919 will eventually be certified by EASA,” he said.

However, recent reports suggest the C919 remains in doubt, with EASA saying the Chinese plane is “too new” to be approved in 2026 and the EU watchdog will take “whatever time is necessary” to clear the plane for service.

Jie confirmed that the 2025 target remains unchanged, although he acknowledged there are many hurdles to approval and some differences in standards and methods between CAAC and EASA.

Will selling the C919 be smooth?

Chinese aviation officials admit that luring foreign airlines may be a more difficult task than convincing EU regulators. The threshold for a series of aircraft to be commercially successful is deliveries of 1,000 or more, according to Gu Xin.

Airlines are still not interested in the C919, said John Grant, founder of London-based aviation consultancy JG. “The C919 may have some appeal to regional airlines in China, but it is not very attractive to non-regional airlines that are committed to Boeing or Airbus.”

“For airlines, aircraft selection is a fundamental consideration, the most important cost factor. They require complete confidence in the aircraft type and its performance, operational support and flexibility across multiple routes,” he said.

Aviation analyst Li said the limited availability of the C919 means that the cost of flying and servicing it will be higher than that of mainstream models. Some analysts also pointed to design flaws in the C919 compared to competitors from more established manufacturers.

There are also concerns that the C919's relatively high use of steel versus composite materials could make it heavier and less fuel-efficient than its Western counterparts. Analysts also point out that the C919's conservative design is less efficient than Airbus's A320neo.

Technicians work on a C919 simulator at the Comac training facility in Shanghai. Photo: Frank Chen

However, these have not dampened Comac's efforts to capture the market, and the manufacturer has begun to make every effort to get potential customers on board its aircraft.

Comac has taken the C919 on a roadshow across Southeast Asia, securing special landing permits in Vietnam, Laos, Cambodia, Malaysia and Indonesia so carriers there can get a closer look.

"Asia is more likely to be the place for the C919 to prove itself than Europe," Yusof said. "I wouldn't be surprised if a major airline outside China places an order within the next 24 months. Overall, the aircraft flies well, is quiet and is good value for money."

In Europe, executives at Ireland's low-cost carrier Ryanair have repeatedly stated their interest in Chinese aircraft in the years since the company signed a memorandum of understanding (MOU) with Comac in 2011.

OAG's Patel said it was "good timing" for the C919 to try to take market share from the two heavyweights, as Airbus faces production bottlenecks as airlines reassess Boeing's safety.

Ngoc Anh (according to SCMP)

Source: https://www.congluan.vn/may-bay-c919-cua-trung-quoc-tren-hanh-trinh-chinh-phuc-phuong-tay-post297152.html

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)