On the morning of February 3, despite the VN-Index falling 13 points, QCG shares of Quoc Cuong Gia Lai Company increased by nearly 7% to the ceiling price of VND11,150/share, with a matched volume of 537,400 units. Market capitalization increased to nearly VND3,100 billion (an increase of more than VND190 billion).

Profits skyrocket, QCG shares hit ceiling right after Lunar New Year

On the morning of February 3, despite the VN-Index falling 13 points, QCG shares of Quoc Cuong Gia Lai Company increased by nearly 7% to the ceiling price of VND11,150/share, with a matched volume of 537,400 units. Market capitalization increased to nearly VND3,100 billion (an increase of more than VND190 billion).

The positive developments come after the announcement of Q4/2024 and full-year business results with many improvements. Q4/2024 net revenue was VND 486 billion, 3 times higher and gross profit was VND 157 billion, 4 times higher than the same period.

In the company's revenue structure, real estate sales revenue accounted for 81% of total revenue and increased dramatically by 5.5 times over the same period. The real estate business segment brought in VND111 billion in gross profit, accounting for 70% of the total gross profit for the quarter.

As a result, QCG's net profit reached more than 62 billion VND, an increase of 300% compared to the fourth quarter of 2023.

Accumulated for the whole year of 2024, net revenue reached 729 billion VND, an increase of 68.7% over the same period. Profit after tax reached 72 billion VND, more than 22 times higher than in 2023. Quoc Cuong Gia Lai's operating cash flow was positive while last year it was negative.

As of December 31, 2024, Quoc Cuong Gia Lai's total assets reached VND9,795 billion. Cash and deposits were nearly VND115 billion, an increase of more than VND60 billion compared to the beginning of the quarter. Inventory was at VND6,638 billion, almost all of which were construction and site clearance costs for projects.

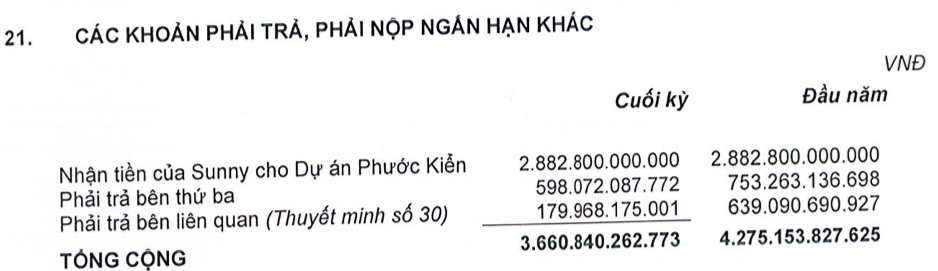

The information that attracted the attention of investors at QCG was related to the Van Thinh Phat case, QCG was forced to return Ms. Truong My Lan 2,882 billion VND in the contract with Sunny Island related to the Phuoc Kien project.

|

The Q4/2024 financial statements recorded that other payables and receivables were more than VND 3,660 billion, of which the amount received from Sunny for the Phuoc Kien project remained at VND 2,882 billion.

In 2024, QCG also divested capital from a series of affiliated companies, the value of ownership at the beginning of the year was recorded from 682 billion VND to 269 billion VND at the end of the year, a decrease of 413 billion VND (60% decrease).

|

Specifically, QCG reduced the ownership value by 197 billion VND out of a total of 312 billion VND at Pham Gia Construction and Housing Trading Company Limited, bringing it down to 115 billion VND. This investment temporarily recorded a loss of 197 million VND.

QCG divested all capital at Quoc Cuong Lien A Joint Stock Company (real estate business with charter capital of VND 250 billion), worth about VND 135 billion. Previously, at the end of 2023, Quoc Cuong Gia Lai owned 31.39% of Quoc Cuong Lien A's charter capital.

At Hiep Phuc Real Estate JSC, in 2024, QCG also reduced its ownership value by more than VND 78 billion in investment capital, down to more than VND 154 billion. This investment is currently temporarily losing more than VND 2.4 billion.

Source: https://baodautu.vn/loi-nhuan-tang-vot-co-phieu-qcg-tang-kich-tran-ngay-sau-tet-nguyen-dan-d244099.html

Comment (0)