At the regular Government press conference this afternoon, November 4, talking about the impact of monetary policy and the reduction of operating interest rates on the general interest rate level, Deputy Governor of the State Bank of Vietnam Dao Minh Tu said that the State Bank has reduced operating interest rates four times, with a reduction of 2%.

At commercial banks, by the end of July and early August 2023, interest rates had decreased by about 1% compared to the end of 2022.

In the context of the world economy still facing many difficulties, considering the resilience of the domestic economy to the double impact, to ensure the inflation target below 4.5%, while supporting economic growth, the State Bank only expected the lending interest rate to decrease by 1-1.5%. However, up to now, the interest rate reduction has exceeded expectations.

"At the beginning of the year, we set a target and expected that by the end of this year we could achieve an average reduction in lending interest rates of about 1-1.5% for commercial banks.

However, up to now, the average interest rate of new loans at commercial banks has decreased by about 2-2.2%, exceeding our expectations," said Deputy Governor Dao Minh Tu.

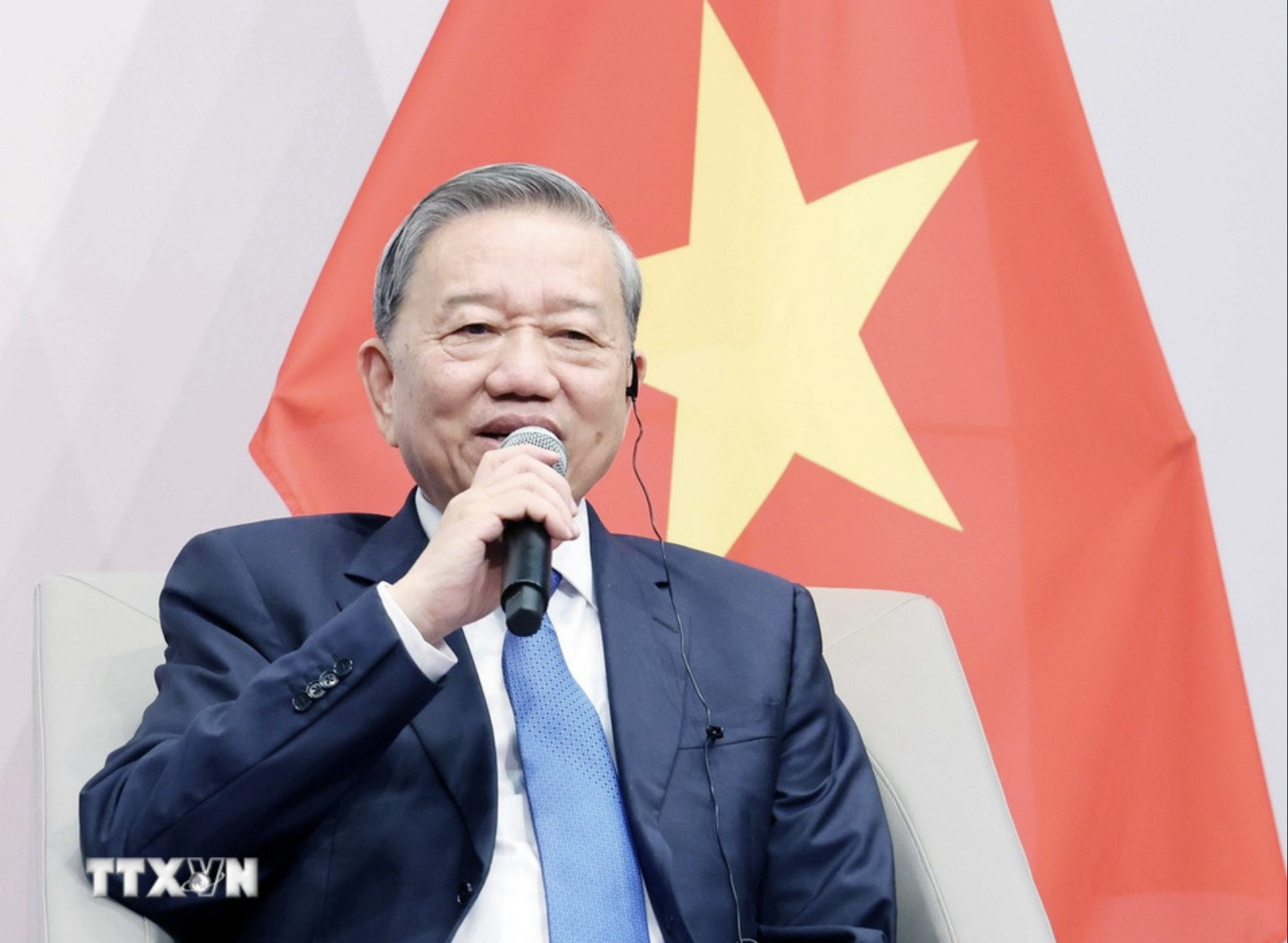

Regular Government press conference on November 4. (Photo: Government)

According to Mr. Tu, the reduction of operating interest rates at the State Bank as well as the reduction of mobilization interest rates at commercial banks aims to help businesses easily access capital at low interest rates because when mobilization interest rates decrease, lending interest rates will decrease accordingly. This will help promote the recovery and development of the socio-economy.

Statistics from the State Bank of Vietnam at present show that the interest rate management has achieved certain effective targets. However, for previous loans, interest rates are still high, because when banks mobilize at high interest rates, they lend at high interest rates to ensure financial harmony for commercial banks.

“We have asked commercial banks to reduce lending interest rates by all means, even for previous loans, to ensure support for businesses, ” Mr. Tu emphasized.

The Deputy Governor added that on the afternoon of October 27, a conference was held for the entire industry with 35 large commercial banks, which account for the majority of lending to the entire economy, and which banks have high interest rates and which banks have low interest rates so that banks with high interest rates can find ways to reduce interest rates to support the economy.

Cong Hieu

Source

Comment (0)