Voters in Binh Phuoc province suggested that it is necessary to evaluate and clarify the necessity of requiring the purchase of compulsory civil liability insurance for motorbike owners to avoid waste.

“ Currently, there are many insurance sales units, so do the authorities strictly manage this issue? Is the process of handling and resolving incidents effective, ensuring the rights and interests of insurance participants? ”, a voter from Binh Phuoc province asked.

Responding to voters, the Ministry of Finance said that civil liability insurance for car, motorbike and scooter owners is regulated as compulsory insurance by most countries in the world such as the US, Japan, Korea, the EU... and developing countries with a large number of motorbikes and scooters participating in traffic (India, China, ASEAN countries...), and some countries even apply it to electric bicycles.

According to statistics, the number of motorbikes participating in compulsory civil liability insurance for motor vehicle owners in the first 6 months of 2024 was only about 6.5 million, accounting for about 9% of the number of vehicles in circulation. The total number of motorbikes in Vietnam is about 72 million.

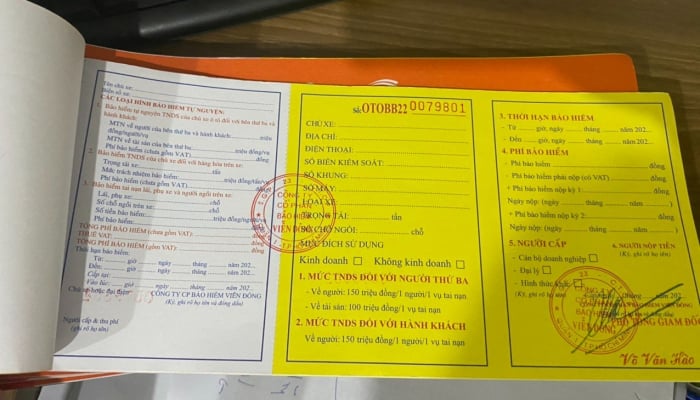

According to the Ministry of Finance, with an insurance premium of VND55,000 or VND60,000, if an accident occurs to a third party that affects the health or life of a person, the insurance will pay the third party a maximum of VND150 million per person in an accident. Regarding property, the insurance will pay a maximum of VND50 million per accident.

Currently, compulsory civil liability insurance for motor vehicle owners, including motorbike owners, is regulated in the Law on Insurance Business 2022; Law on Road Traffic Order and Safety 2024 effective from January 1, 2025; Decree 67/2023/ND-CP on compulsory insurance, including compulsory civil liability insurance for motor vehicle owners.

Accordingly, many new regulations have been inherited and added to increase benefits for motor vehicle owners regarding: insurance premiums, insurance amounts, simplifying documents, compensation procedures...

On December 30, 2024, the Government issued Decree No. 174/2024/ND-CP regulating administrative sanctions for violations in the field of insurance business, effective from February 15, 2025.

The Decree stipulates additional penalties for violations of compulsory civil liability insurance of motor vehicle owners such as: Suspension of part of the content and scope directly related to the administrative violation in the establishment and operation license for cases of violations of regulations on insurance scope, exclusion of insurance liability, insurance premiums, insurance deductibles, insurance liability limits, minimum insurance amount for compulsory insurance,...

The Ministry of Finance also said it will strengthen inspection, examination and strictly handle violations of regulations on compulsory civil liability insurance of motor vehicle owners (if any).

At the same time, the Ministry will coordinate with relevant agencies to continue researching and simplifying procedures and records for insurance compensation and humanitarian aid payments, ensuring that insurance compensation is carried out quickly and in accordance with regulations, avoiding cases of insurance fraud.

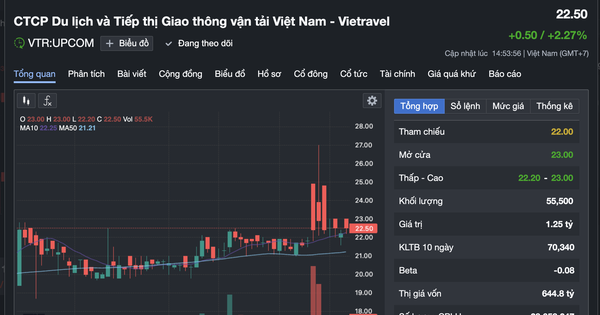

According to the Ministry of Finance, in the 11 months of 2024, the total revenue from compulsory motorbike insurance was VND 736.9 billion; estimated compensation costs were VND 28.5 billion; compensation rate was about 4%. |

Source: https://vietnamnet.vn/bo-tai-chinh-quyet-giu-bao-hiem-xe-may-vi-tai-nan-duoc-boi-thuong-150-trieu-dong-2381798.html

Comment (0)