The latest figures on compulsory civil liability insurance for motorcycles, mopeds and similar motor vehicles show that in the first 11 months of 2024, the compensation rate reached only 4% of total revenue.

Compensation rate is only about 4%

The Department of Insurance Management and Supervision ( Ministry of Finance ) has just announced updated data according to business reports of insurance companies on compulsory civil liability insurance for motorbikes, scooters and similar motor vehicles.

Accordingly, in 11 months of 2024, total revenue is 736.9 billion VND; estimated compensation cost is 28.5 billion VND; compensation rate is only about 4%.

Figures previously announced by the Ministry of Finance show that: In the first 6 months of 2024, revenue from civil liability insurance premiums for motorbike and scooter owners reached more than 431.78 billion VND, compensation expenses were 41.9 billion VND, and compensation reserves were 35.86 billion VND. The above expenses do not include commission expenses, management expenses, sales expenses... as well as arising compensation liabilities.

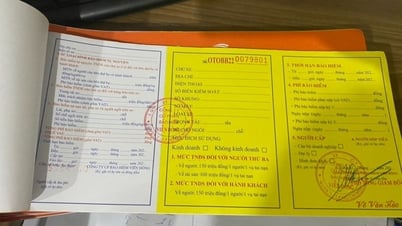

According to the Ministry of Finance, with an insurance premium of 55,000 VND or 60,000 VND, if an accident occurs to a third party in terms of health or life, the insurance will pay the third party a maximum of 150 million VND/person/accident; for property, the insurance will pay a maximum of 50 million VND/accident.

"Decree No. 67/2023/ND-CP of the Government has inherited and supplemented many new regulations to simplify compensation procedures and ensure the rights of insurance buyers," the Ministry of Finance emphasized.

In mid-January 2025, VietNamNet Newspaper published an article "Motorcycle insurance collected 431 billion, compensation of nearly 42 billion: The Ministry stated the reason why it is still mandatory to buy".

The article reflects the current situation, many opinions suggest reviewing and adjusting regulations on purchasing insurance for two-wheeled vehicles in the direction of switching to a voluntary form, not forced, to ensure the rights of the people. Because in reality, when an accident occurs, people encounter many difficulties in carrying out insurance procedures, are harassed by insurance companies, and are given a series of cumbersome procedures, leading to difficulty in getting paid.

However, the Ministry of Finance said that in the coming time, it will strengthen inspection and strictly handle violations of regulations on compulsory civil liability insurance of motor vehicle owners.

In Vietnam, motorbikes are still the main means of motor transport and the biggest source of accidents, accounting for 63.48%.

However, in the first 6 months of 2024, the whole country only had about 6.5 million motorbikes participating in compulsory civil liability insurance for motor vehicle owners, accounting for 9% of the number of vehicles in circulation (the total number of motorbikes in Vietnam is about 72 million).

“In the world , most countries apply compulsory civil liability insurance for car, motorbike and scooter owners. Some countries even apply it to electric bicycles,” said the Ministry of Finance.

The reasons given are not convincing.

After the above article, many readers of VietNamNet expressed a series of noteworthy views and opinions.

Reader Hao Chau Vu suggested that when people are required to buy insurance, there should be a corresponding law to avoid harassment by the insurance company and clearly stipulate the maximum time limit for completion. Or, there should be a hotline for people to report harassment when accidents occur.

“I myself had an accident, all procedures were met but it has been 9 years and I still have not received any compensation, so the law needs to be made to gain people's trust to be satisfactory,” this reader wondered.

Reader Tran Trung Thanh said: “For many years I have bought insurance and have been hit by other people many times, but I have never claimed insurance money. People are always required to buy insurance without any guidance on how to enjoy any benefits.”

Reader Phuc Dam requested insurance companies to provide a list and specific addresses of motorbike owners who have received insurance money in the past 5 years so that people can monitor civil liability insurance activities for motorbikes. If necessary, it is possible to propose a proposal to replace compulsory insurance with voluntary insurance.

Reader Tqlonghuy is concerned that now the traffic police check and fine if you don't have motorbike insurance, making it difficult for people, forcing them to buy something they don't know how to use and don't need.

Reader Truongthanhson1988 noted that only 9% of motorbikes in circulation buy insurance, proving that insurance is not practical and people do not need it. Therefore, it should only be encouraged to buy, not required.

According to reader Binh , the law on insurance without clear policies for buyers is very beneficial for insurance. When something happens, insurance companies will refuse in every way, and if you don't buy, you will be fined. The law should be changed to voluntary because after all, there is already personal insurance!

Many people believe that we cannot use the excuse that everyone else in the world does it so we do it too. If the people's interests are guaranteed, even if it is not compulsory, people will still respond.

Reader Trien Tran analyzed that people in many countries are willing to buy insurance because when there is an accident, they do not have to go through many procedures. Insurance is only based on the police report, whichever party is at fault, the insurance of the at-fault party will pay to the party that caused the accident. The compensation level is also very simple: The car owner only needs to ask for a quote from the repair unit and the insurance will pay according to the quote.

Source: https://vietnamnet.vn/mua-bao-hiem-xe-may-bat-buoc-thu-gan-740-ty-chi-tra-hon-28-ty-dong-2368473.html

![[Photo] Flooding on the right side of the gate, entrance to Hue Citadel](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/28/1761660788143_ndo_br_gen-h-z7165069467254-74c71c36d0cb396744b678cec80552f0-2-jpg.webp)

![[Photo] National Assembly Chairman Tran Thanh Man received a delegation of the Social Democratic Party of Germany](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/28/1761652150406_ndo_br_cover-3345-jpg.webp)

![[Photo] Draft documents of the 14th Party Congress reach people at the Commune Cultural Post Offices](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/28/1761642182616_du-thao-tai-tinh-hung-yen-4070-5235-jpg.webp)

![[Photo] President Luong Cuong attends the 80th Anniversary of the Traditional Day of the Armed Forces of Military Region 3](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/28/1761635584312_ndo_br_1-jpg.webp)

Comment (0)