After a session where the market recovered but liquidity dropped sharply, this cautiousness continued to be maintained at the opening of today's session as the VN-Index struggled within a narrow range around the reference. Cash flow also slowed down in the second half of the morning session.

Steel was the most active group when green dominated. Of which, SMC increased the most by more than 5.5%, HSG increased by 3.6%, POM increased by nearly 2%; HPG and NKG, although increasing more modestly, also increased by around 1.5%. HSG and HPG are the 2 codes with the best liquidity on the HoSE floor, NKG code is also in the top 6 liquidity.

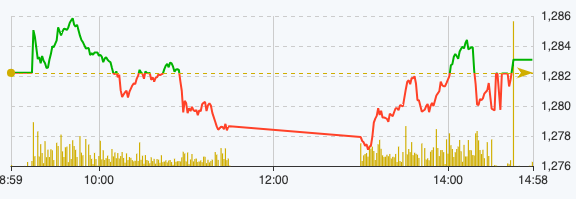

At the end of the morning session on March 27, VN-Index decreased by 3.56 points, equivalent to 0.28% to 1,278.65 points. The entire floor had 179 stocks increasing and 247 stocks decreasing.

VN-Index performance on March 27 (Source: FireAnt).

Entering the afternoon session, the buyers and sellers were quite balanced, causing the market to constantly fluctuate above the reference level, although the VN-Index ended the session with a slight increase.

At the end of the trading session on March 27, VN-Index increased by 0.88 points, equivalent to 0.07% to 1,283.09 points. HNX-Index increased by 0.82 points to 242.85 points. UPCoM-Index decreased by 0.02 points to 91.18 points.

After a period of not very positive developments, the technology group gradually recovered and led the increase in today's session. Of which, VGI increased by 9.59%, ELC increased by 3.28%, SRA increased by 2.78%, FPT increased by 0.17%, VTK increased by 5.61%, SMT increased by 5.88%, especially PIA increased by the ceiling of 10%.

The retail group also increased positively by 2.36% with MWG increasing by 4.21%, DGW increasing by 0.77%, PET increasing by 1.58%, TTH increasing by 2.08%, LMH increasing by 7.69%, PIV increasing by 13.79%. However, the giant FRT still decreased by 0.61%.

On the downside, the banking group fell slightly by 0.28% in today's session. For example, STB, EIB, HDB, VIB, MSB, TCB, LPB, BID, SSB, VCB, although the decline was only less than 1%. There were still a few stocks gaining points in the group, such as MBB, TPB, ACB, CTG, NAB, KLB, BAB, VBB, although they only increased by less than 1%, while OCB increased by 1.35%.

Cash flow continued to be gloomy in today's session, however, the real estate group attracted money quite well with NVL matching 43.7 million units, DIG matching 22.4 million units, DXG matching 21.3 million units, CEO matching 13.2 million units. In the securities group, VND matched nearly 37 million units but mainly on the selling side, VIX matched 26 million units, SSI matched 18.7 million units.

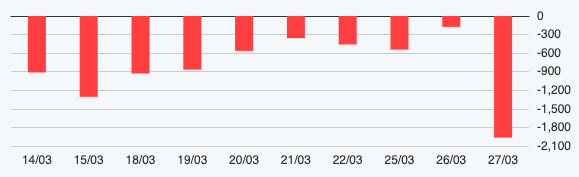

Foreign block transaction developments.

Total matched order value in today's session was VND26,618 billion, up 10%.

Foreign investors net sold for the 12th consecutive session with a value of 1,963.8 billion VND today, of which this group disbursed 3,200 billion VND and sold 5,164 billion VND.

The codes that were sold strongly were MSN 1,077 billion VND, VIX 178 billion VND, VHM 135 billion VND, GEX 118 billion VND, VNM 72 billion VND,... On the contrary, the codes that were mainly bought were VSC 46 billion VND, HSG 33 billion VND, MWG 30 billion VND, TPB 18 billion VND, DBD 18 billion VND,... .

Source

Comment (0)