Trading statistics at the end of today's session (September 24) showed that foreign investors had a sudden net selling session on the HoSE with a net selling volume of 141.15 million shares, the total net selling value was VND2,431.23 billion.

The focus of foreign investors' net selling was on VIB shares of Vietnam International Commercial Joint Stock Bank. This code was net sold a total of more than 148 million units, with a net selling value of VND2,664 billion. This transaction was conducted by negotiation.

Negotiated transactions at VIB in session 9/24 (Source: VDSC).

With more than 2.97 billion VIB shares in circulation, the number of shares that foreign investors net sold today accounts for 4.97% of VIB's equity.

While the foreign selling volume was 148 million VIB shares, there was no foreign buying volume, accordingly, the buying transaction was made by domestic investors.

Closing today's session, VIB shares increased by 3.2% to VND19,100. The matching order at this code reached more than 19 million units. The negotiated price of VIB is significantly lower than the price VIB matched on the market (the negotiated price is at VND18,000).

Previously, the extraordinary general meeting of shareholders of VIB held on June 11 approved the adjustment of the maximum foreign ownership ratio from 20.5% to 4.99%. This content received 74.28% of votes in favor and 25.7% of votes against. This resolution takes effect from July 1.

According to VIB, the Law on Credit Institutions 2024 takes effect on July 1 with many new regulations, leading to the need for banks to amend their charters before July 1 to ensure compliance with the law's requirements.

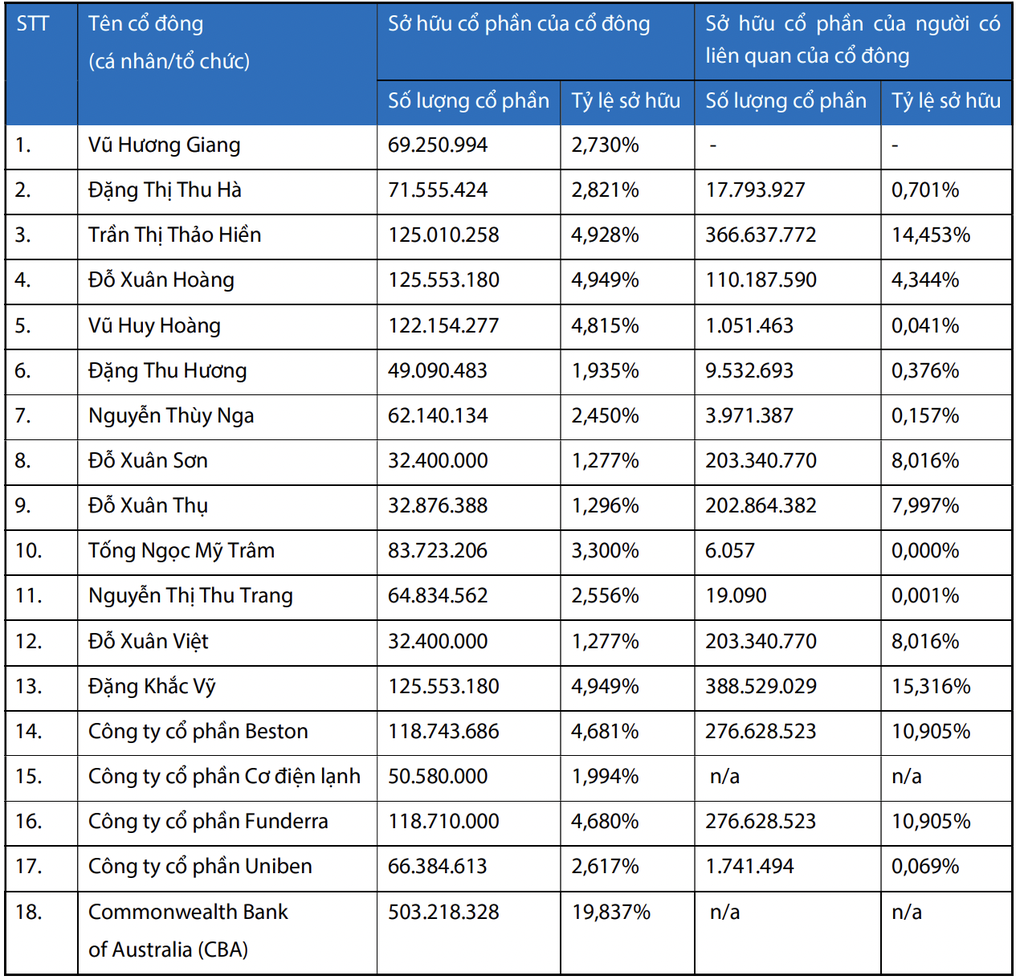

List of shareholders holding more than 1% of VIB's capital at the end of June (Source: VIB).

According to the list of 18 shareholders holding 1% of VIB's charter capital announced by the bank on August 5, strategic shareholder Commonwealth Bank of Australia (CBA) is VIB's largest shareholder as of June 28. CBA owns 503.2 million VIB shares, equivalent to a 19.84% ownership ratio.

Other shareholders own less than 5% of VIB's capital, of which Uniben owns 2.62%; Funderra owns 4.68%; Beston owns 4.68%.

With the high volume of shares sold today, it is likely that the seller is CBA.

CBA became a strategic shareholder of VIB in 2010 when it spent about VND4,000 billion to buy back 15% of VIB shares and increased it to 20% after just one year.

Source: https://dantri.com.vn/kinh-doanh/khoi-ngoai-ban-rong-dot-bien-gan-2700-ty-dong-co-phieu-vib-20240924221123246.htm

Comment (0)