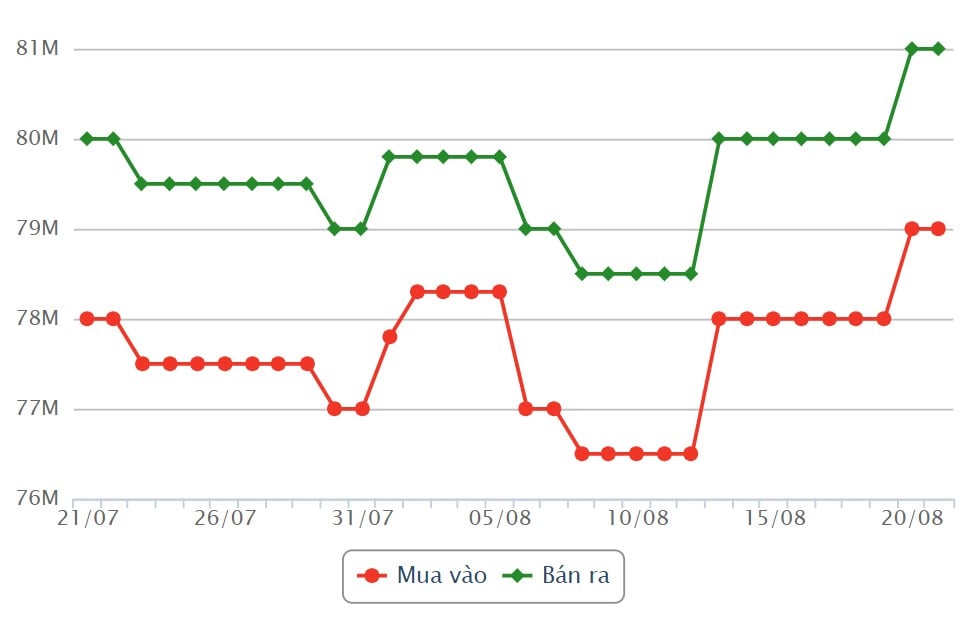

SJC gold bar price

As of 9:00 a.m., the price of SJC gold bars was listed by DOJI Group at 79 - 81 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold prices at DOJI remained unchanged in both buying and selling directions.

The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 79-81 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, the gold price at Saigon Jewelry Company SJC remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

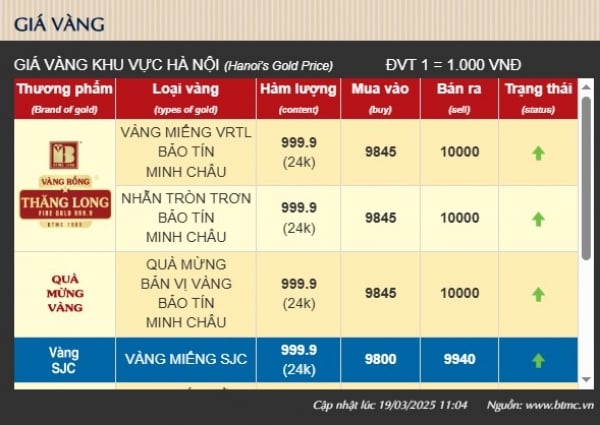

9999 gold ring price

This morning, the price of 9999 Hung Thinh Vuong round gold ring at DOJI was listed at 77.10-78.35 million VND/tael (buy - sell); an increase of 150,000 VND/tael for both buying and selling compared to the beginning of the previous trading session.

Saigon Jewelry Company listed the price of gold rings at 77.1-78.4 million VND/tael (buy - sell); an increase of 300,000 VND/tael for buying and 200,000 VND/tael for selling compared to the beginning of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 77.08-78.38 million VND/tael (buy - sell); an increase of 150,000 VND/tael for both buying and selling compared to the beginning of the previous trading session.

In recent sessions, the price of gold rings has often fluctuated in the same direction as the world market. Investors can refer to the world market and expert opinions before making investment decisions.

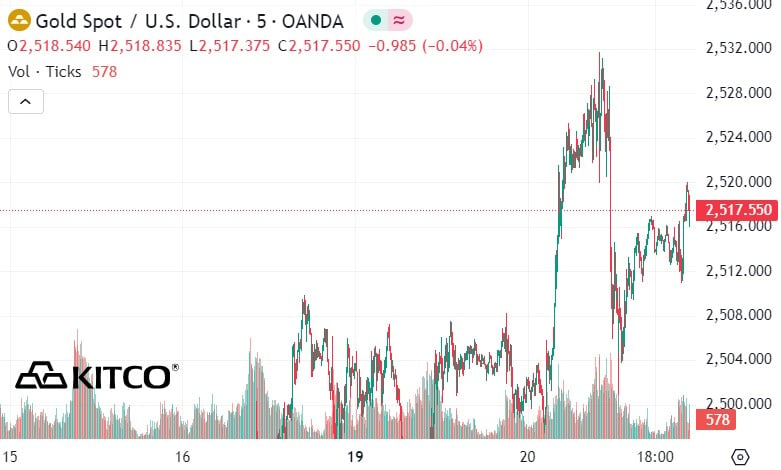

World gold price

As of 9:30 a.m., the world gold price listed on Kitco was at 2,517 USD/ounce, up 13 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased in the context of the USD index decreasing. Recorded at 9:00 a.m. on August 21, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 101.282 points (down 0.02%).

Experts and media channels say many factors are supporting gold prices.

Aakash Doshi - Head of North American Commodities at Citi Research commented: "The main reason for the increase in gold prices is financial investment demand, especially from ETF funds. Investor confidence in general has also improved as they expect the US Federal Reserve (FED) to cut interest rates at its September meeting."

Mr. Doshi predicts that gold prices could jump to $2,600 an ounce by the end of this year and $3,000 an ounce by the middle of next year.

Ms. Sabrin Chowdhury - head of commodity analysis at BMI Consulting Company (Singapore) said that 2024 is the year when gold will peak as a safe haven channel.

“Gold prices are growing strongly because of uncertainty… and uncertainty is at its peak,” she said.

Another factor pushing gold prices higher is the increasing likelihood of a Fed rate cut in September, according to CNBC. The Fed's July meeting reinforced investors' belief that a rate cut next month is "possible."

When the Fed starts cutting interest rates, possibly next month, gold could hit $2,700 an ounce, Ms. Chowdhury argues.

Other analysts have a similarly optimistic view. Low interest rates reduce the opportunity cost of buying gold.

In another notable move, yesterday, reserves at SPDR Gold Trust - the world's largest gold ETF - also reached a 7-month high, with 859 tons.

Source: https://laodong.vn/tien-te-dau-tu/gia-vang-hom-nay-218-huong-toi-ky-luc-moi-1382605.ldo

Comment (0)